Kenya’s Economic Trajectory In 2024: A Comprehensive Investment And Policy Analysis

KEY POINTS

The Central Bank is likely to maintain a tight monetary policy to control inflation and support the Kenyan shilling. While short-term interest rates are expected to remain high, a stabilization is anticipated in the medium term, particularly post-June 2024, following the redemption of the 10-year Eurobond.

GDP Growth: A Balanced Path Ahead

In 2024, Kenya’s GDP is expected to grow by 5.0%-5.4%, propelled by a resurgence in business activities, a thriving agricultural sector, and a vibrant services sector, particularly in IT and tourism. Despite these promising indicators, this growth trajectory faces challenges from stringent monetary policies, debt risk, inflationary pressures, and currency devaluation.

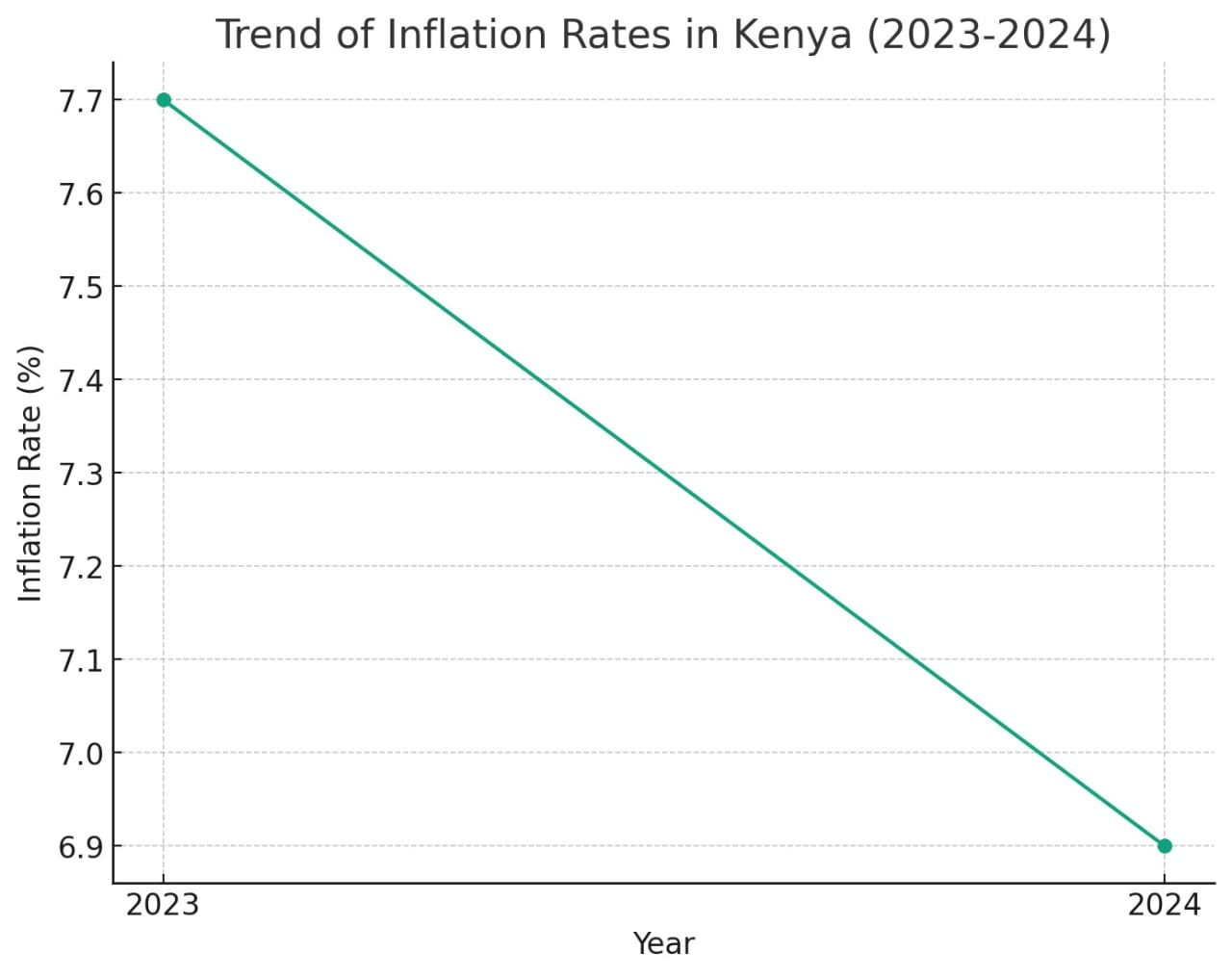

Inflation: A Return to Stability

Inflation forecasts for 2024 are moderately optimistic, with expectations of an average rate of 6.9%, aligning with the government’s target range. This anticipated decrease from the 7.7% rate of 2023 is attributed to agricultural improvements and the effects of stringent monetary policies. However, concerns over high electricity and fuel costs, along with the Kenyan shilling’s depreciation, suggest ongoing inflationary challenges.

Read Also: Dear Entrepreneur, Here Are the Top 5 Long Term Investment Opportunities Right Now

This graph shows the trend in inflation rates from 2023 to 2024. The declining line from 7.7% in 2023 to a projected 6.9% in 2024 indicates a downward trend in inflation, aligning with the economic outlook presented in the analysis.

Currency Concerns: Navigating Depreciation:

The Kenyan Shilling is projected to face a decline, trading between Kshs 183.2 and Kshs 189.6, with a potential depreciation of 16.4% against the USD. This is primarily due to Kenya’s status as a net importer and increasing debt servicing demands, which strain forex reserves, especially with the looming maturity of the 2014 Eurobond issue in June 2024.

Read Also: Top 10 Investment Opportunities In Nairobi With The Best Returns

Interest Rates: Steady Yet Cautious

The Central Bank is likely to maintain a tight monetary policy to control inflation and support the Kenyan shilling. While short-term interest rates are expected to remain high, a stabilization is anticipated in the medium term, particularly post-June 2024, following the redemption of the 10-year Eurobond.

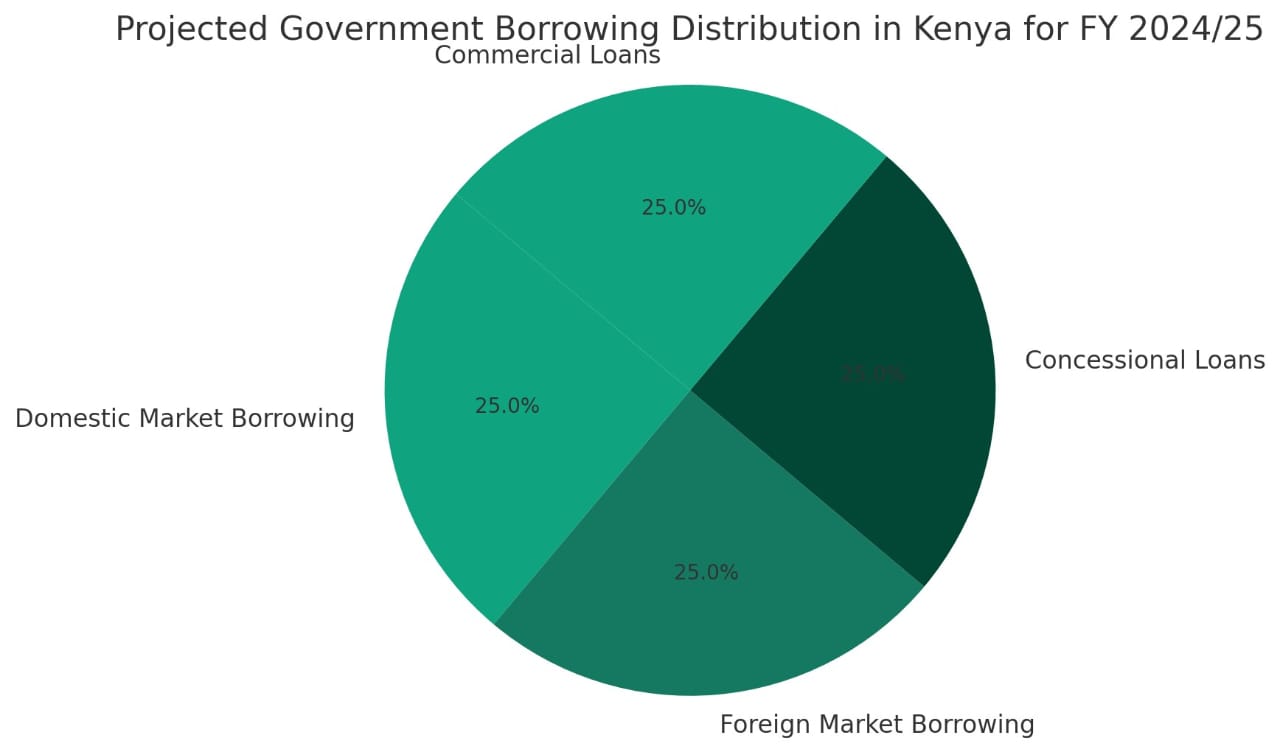

Government Borrowing: An Aggressive Stance

Kenya’s government is expected to intensify borrowing efforts in 2024, seeking Kshs 703.9 bn to address a fiscal deficit equivalent to 3.9% of the GDP. This approach includes seeking concessional loans and commercial financing. Despite upward tax revisions and enhanced revenue collection strategies, these aggressive borrowing plans may weigh heavily on the country’s financial stability.

This chart illustrates the projected distribution of government borrowing in Kenya for the fiscal year 2024/25. Each segment represents an equal share, assuming a balanced division among domestic market borrowing, foreign market borrowing, concessional loans, and commercial loans.

Investor Sentiment: Cautious Optimism Ahead

Investor confidence in 2024 might remain subdued initially due to inflationary pressures and currency challenges. However, a positive shift is anticipated in the medium term as the government addresses its debt obligations and public-private partnerships gain momentum in financing viable projects.

Security: A Stable Outlook

Political stability and effective dispute-resolution strategies are expected to maintain a secure environment in Kenya throughout 2024, presenting a favorable condition for investors and policymakers.

Fixed Income Outlook: A Strategic Approach

Investors are advised to focus on short-term fixed-income instruments in 2024 to mitigate risks associated with the predicted high-interest rates, especially considering the government’s borrowing plans and debt maturities.

Equities Outlook: Cautious Short-Term, Optimistic Long-Term

The Kenyan equities market presents a neutral outlook in the short term but leans bullish in the medium to long term. Factors influencing this include projected GDP growth, an improving business environment, and the performance of the listed sector. However, currency devaluation and investor hesitancy could dampen short-term growth prospects.

It is important to note that this analysis serves as a vital guide for investors, retailers, and policymakers navigating Kenya’s economic landscape in 2024. Balancing opportunities with potential risks will be key to leveraging the country’s economic potential effectively.

Read Also: Green Investment Opportunities For Households And Enterprises In East Africa

About Steve Biko Wafula

Steve Biko is the CEO OF Soko Directory and the founder of Hidalgo Group of Companies. Steve is currently developing his career in law, finance, entrepreneurship and digital consultancy; and has been implementing consultancy assignments for client organizations comprising of trainings besides capacity building in entrepreneurial matters.He can be reached on: +254 20 510 1124 or Email: info@sokodirectory.com

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (230)

- December 2025 (97)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)