Central Bank Rate Expected to be Retained at 10 pc ahead of MPC Meeting

Fixed Income:

Secondary market turnover is expected to be remain underwhelming, with trading activity expected to pick up after the primary auction next week.

The expectation for the auction, which closes tomorrow, stands at 13% – 13.50% for the FXD3/2007/15 and 13.75%-14.35% for the FXD1/2008/20.

The Monetary Policy Committee (MPC) is marked to meet on 28th November 2016, with markets expecting the Central Bank Rate (CBR) to be retained at 10%.

Liquidity in the market improved, with Central Bank of Kenya (CBK) opting out of the market on 18/11/2016.

Corporate News:

Kenya Airways (NSE: KQ) formally opened six modern docking bays at Jomo Kenyatta International Airport (JKIA), on Friday. The national airline, which transports goods in 20 countries, had recently sold its large capacity Boeing 777-300, which directly impacted the firm’s cargo earnings- down to KES 3.7Bn. The new docking bays are expected to reduce inefficiency and under utilisation witnessed over the past five years, as a result of the airline using a single exit channel. The counter has recently registered a significant increase in activity following supportive market sentiment, from a low of KES 3.40 in September (+91.18%); as a result of the appointment of Micheal Joseph as the board’s Chairman and the better-than expected 1H17 financial results. We expect this news to further propel the Kenya Airways counter, which closed trading at KES 6.75 (YTD: +32.65%) on Friday.

Atlas African Industries Listed (NSE: ADSS) was forced to cancel trading on the London Stock Exchange AIM market, as a result of not appointing a replacement nominated adviser (nomad). The company’s shares trading on AIM were cancelled with effect from 18 November, following the exit of

- their initial nomad on 17 October and the AIM’s admission policy that a replacement must be found within a one month period. The loss-making logistics firm is looking to invest in Africa-focused businesses, operating in the consumer sector, following a sale agreement on East African Packaging Holdings Limited (which includes the Chancho Project); as a result of Ethiopian tax authorities seizing KES 240Mn. The sale will book the company an immediate KES 25.4Mn loss from the KES 500Mn investment, raised in February 2016.

Trading Expectation:

Foreign participation was lower in Friday’s trading session, with foreigners contributing 42% to the market participation. East African Breweries Limited (NSE: EABL) was the day’s highest mover, with locals coming in to buy into the counter. The Kenya Commercial Bank Limited (NSE: KCB) counter had the highest foreign participation, while Diamond Trust Bank Kenya Limited (NSE: DTK) counter noted a marked interest in the counter – with locals buying into the counter during Friday’s session. We expect the market to be relatively tame due to the lack of market moving corporate news for the day.

Market Events

- Total Kenya Ltd 1H16 Financial Results, 23rd November 2016.

- Unga Ltd Books Closure, 01st December 2016. (First& Final Div: KES 1.00)

- Umeme Ltd Books Closure, 02nd December 2016. (Interim Div: UGX 11.00)

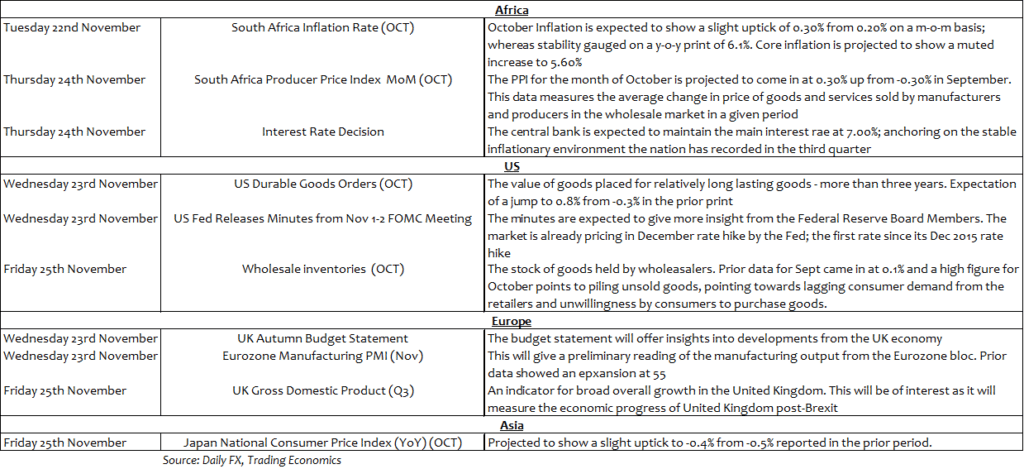

Economic Calendar

About Soko Directory Team

Soko Directory is a Financial and Markets digital portal that tracks brands, listed firms on the NSE, SMEs and trend setters in the markets eco-system.Find us on Facebook: facebook.com/SokoDirectory and on Twitter: twitter.com/SokoDirectory

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (166)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)