Eleven Counties Risk Missing Out Ksh 11.1B Budget Cash

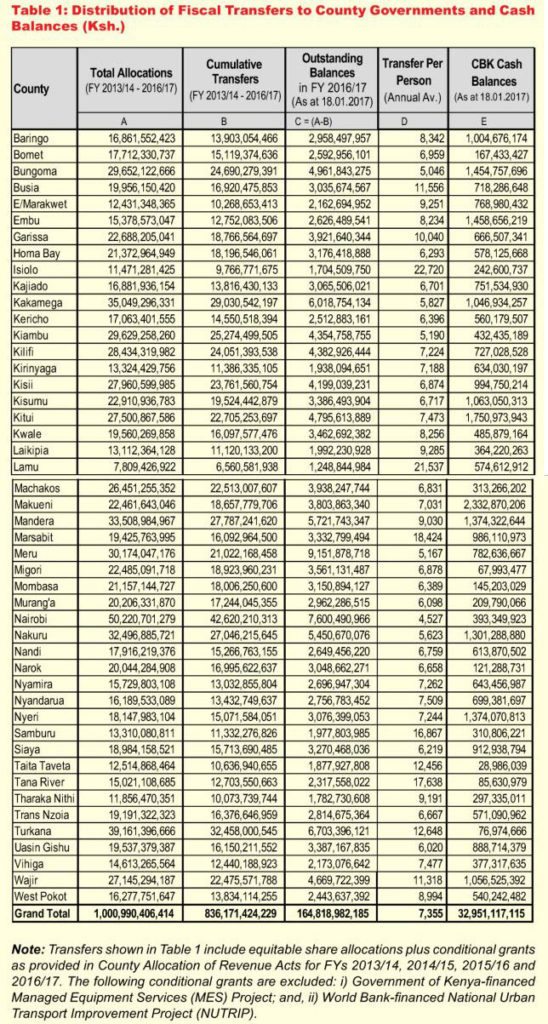

The National Treasury has disbursed Ksh 836 billion as at 18 January, 2017 to the County Governments.

“With regard to FY 2016/17, 46.9 percent of equitable share transfers has been disbursed. The only outstanding amounts in respect of the equitable share due to County Governments in the first half of FY 2016/17 is Ksh 11.1 billion,” said Dr. Kamau Thugge, PS, National Treasury in a public statement on the status of Fiscal Transfers to County Governments.

However,Treasury faults 11 Counties for failing to meet their financial obligations linked to low budget absorption capacity, escalation of the wage bill and shortfalls in own source revenue collections leading to budget deficits.

“In view of the fact that the National Treasury has largely been on schedule with disbursements, County Governments do not have justifiable reasons to default on their commitments, which include timely payment of salaries and fulfilment of other contractual obligations,” said Thugge.

According to the public notice, as at 18 January, 2017, County Governments had collectively accumulated cash balances in various Central Bank of Kenya accounts amounting to Ksh 33 billion, equivalent to 11.8 percent of their equitable share allocation in the current fiscal year.

“Some 11 counties have unspent reserves above Ksh 1 billion each, while the average balance per county exceeds Ksh 700 million. Evidence suggests that the iel cash balances could be much higher if deposits irregularly held in commercial bank accounts are taken into account,” notes Treasury.

Counties that have unspent reserves include: Baringo (, Bungoma (Ksh 1.45B) Embu (Ksh1.46B), Kakamega (Ksh 1.05B), Kisumu (Ksh1.06B), Kitui (Ksh1.75 B), Makueni (Ksh 2.3B), Mandera (Ksh1.37B), Nakuru (Ksh 1.3B), Nyeri (Ksh1.37 B) and Wajir (Ksh1.06 B).

Thugge states that with the prevailing drought situation in the country, county governments are able to deal with it.

“With proper planning and prudent financial management, County Governments should be able to deal with contingencies such as the ongoing drought situation as required under the Public Finance Management Act, 2012 by setting aside 2 percent of their revenues for purposes of the Emergency Fund.”

However, governors of the affected counties described as “erroneous” and “misleading” to the statement by National Treasury Principal Secretary Kamau Thugge.

Treasury states that the amount the remains to be disbursed, they will prioritise those with least balances in their Central Bank of Kenya accounts.

The objectives of the the Public Finance Management Act is to ensure that—

a) Public finances are managed at both the national and the county levels of government in accordance with the principles set out in the Constitution; and,

b) Public officers who are given responsibility for managing the finances are accountable to the public for the management of those finances through Parliament and County Assemblies.

In line with the constitution and the PFM Act 2012, a contingency provision of KSh 5.0 billion was provided for in the FY 2016/17 budget to cater for unforeseen expenditures. The Equalization Fund was allocated KSh 6.0 billion to cater for critical development expenditure in water, roads, health, and energy in marginalized areas to improve services in those areas to the standards in other areas. Together with the accumulated deposits of KSh 6.4 billion, brings the total available resources in the Equalization Fund to KSh 12.4 billion.

For this Fiscal Year, the Government has borrowed Kshs 164.0 bn domestically against a target of Kshs 132.5 bn.

“However,It is in the process of revising its domestic borrowing target upwards to Kshs 294.6 bn, which will take the pro-rated borrowing target to 170.0 bn, meaning that the government will fall slightly behind its borrowing target, especially in a tight money market liquidity condition such as we are now experiencing,” according to insights from Cytonn Investments.

The government has only borrowed Kshs 45.8 bn from the foreign market against its foreign borrowing target of Kshs 462.3 bn, and the Kenya Revenue Authority (KRA) having already missed its first quarter of 2016/17 fiscal year revenue collection target by 18.4 percent.

“This creates uncertainty in the interest rate environment as the government might have to plug in the deficit likely to arise from the lag in revenue collection and foreign borrowing from the domestic market, a move which may exert upward pressure on interest rates,” adds the Analysts.

The country’s budget deficit has risen by 9.6 per cent of gross domestic product, from 7.2 per cent in the 2015/16 financial year, to currently stand at $5.16 billion till end of June 2016.

Read: Kenya Sets FY2016/17 Budget Deficit to 9.3 percent Starting July

Further, the government has re-opened a 15-year bond with an effective tenor of 5.4 years, to raise Kshs 30.0bn for budgetary support.

“Given that a 5-year bond is currently trading at a yield of 13.4 per cent in the secondary market, and there is skewed liquidity currently being witnessed in the market, we expect investors to bid for the bond at yields above the secondary market yield, at a bidding range of 13.6 percent – 14.5 percent,” according to Cytonn Investments.

About David Indeje

David Indeje is a writer and editor, with interests on how technology is changing journalism, government, Health, and Gender Development stories are his passion. Follow on Twitter @David_IndejeDavid can be reached on: (020) 528 0222 / Email: info@sokodirectory.com

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (226)

- August 2025 (211)

- September 2025 (270)

- October 2025 (258)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)