The Barclays Bank of Kenya’s Investment Journey: The Best Time to Bet on Their Shares

Kenya’s Banking Sector

There has been a lot of talk about the banking sector in Kenya. With all the talk, consumers and investors have often been left in a limbo of where they should turn to either to invest or keep their money.

Some say that with a population of slightly above 50 million, and with more than 40 banks, Kenya is overbanked. Some, however, feel that Kenya is not overbanked but lacks the strategies that can help her harness all the potential that lies in the banking sector.

The coming of the interest rate capping law was seen as a move to help Kenyans have access to affordable loans from Kenyan banks. Before the coming into force of the law, the interest rates had gone through the roof to as high as 20 percent in some banks.

The law, however, seems to have failed to deliver on its primary objective as Kenyan banks increasingly keep off from lending to most Kenyans whom they consider ‘risky.’

Majority of the banks prefer lending to the government and investing in Treasury Bonds than lending to Kenyans and the SME sector has received the most heat.

Investing in the Banking Sector

The closest most Kenyans come to interacting with a bank is either when they want to deposit cash, withdraw cash or ask for a loan.

What most Kenyans don’t know is that there are amazing investment opportunities that lie in Kenya’s banking sector. For instance, there are banks that have savings accounts that have great rates annually. Chase Bank, for instance, had the Origin Savings account that gave one a return of up to 13.1 percent annually.

A savings account with better returns is perfect for someone with long-term investment goals and one whose money is not tailored towards urgent spending on either business or project.

Barclays Bank of Kenya has an amazing product known as Zidisha Bonus Account that gives one up to 70 percent rate annually of the Central Bank of Kenya rate (CBR) and a bonus on 0.25 percent annually on the savings.

If you have some money somewhere that you do not necessarily need to use, instead of letting it lie somewhere in a deposit account, you may think of moving it to a savings account.

Just the same way you shop for a good shop that will give you better prices for quality products, it is also prudent to ‘shop’ for a better bank that has good returns. I would whisper to you to try out Barclays Bank of Kenya on this one.

Investing in Banking Shares

Most Kenyans are often reluctant in investing in shares in various companies for two major reasons:

- Inadequate information on how and where to invest when it comes to shares

- The fear of the unknown for most fear of the losses even before they try it out.

In the recent past, most companies that trade at the Nairobi Securities Exchange have been issuing profit warnings and running into losses, something that has always scared away those interested in investing in shares.

Question: how many banks trading in shares have you heard issuing profit warnings? One? Two? None? Almost none. The fact that most Kenyans looking to invest in shares don’t know is that banks rarely make losses in Kenya and, therefore, the perfect venture to place your money as an investment.

Allow me to use Barclays Bank of Kenya because they were open enough to allow me to use their information. Something to learn, always be ready to work or invest in a company that is open to information.

So far, Barclays Bank of Kenya has issued 5,431,536,000.00 worth of shares with a market capitalization of 61,647,933,600. Now the best way to invest in shares of any company is to have a look at their profit history. Has the company been making profits? This should always be your first question.

For the year 2017, Barclays Bank of Kenya recorded 6.93 billion shillings in profits after tax. This was, however, a slight drop from 7.3 billion shillings in profits in 2016. The lender closed the year with a loan book of 168.4 billion shillings, similar to 2016 with the customer deposits increasing by 4.4 percent to 186 billion shillings.

During the first quarter of 2018, the lender registered a profit of 1.8 billion shillings, an increase from 1.7 billion shillings at the same time in 2017 with an investment in the Treasury Bills increasing by 52 percent to 67 billion shillings.

What is the share price of Barclays Bank of Kenya?

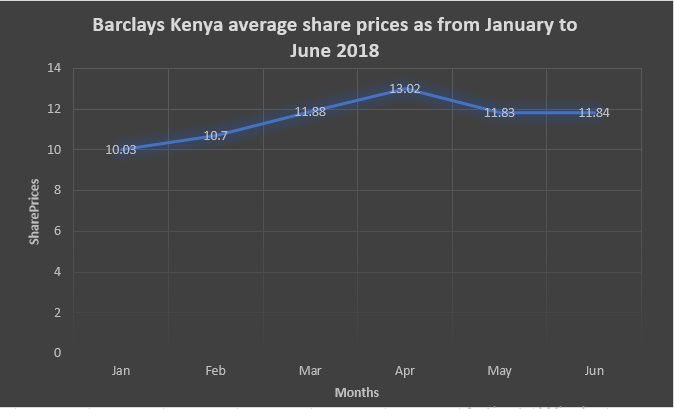

The next thing you should look at before investing in any shares of any company is the share price. How consistent is the average share price? Has it been increasing? Has it been reducing? When was it at its lowest? When was it at its highest?

Between the month of January 2018 and June 2018, the average share price of Barclays Bank has been relatively stable. In January, the average was at 10.03 shillings per share, increased to 10.7 shillings per share in February.

The lowest average share price for the lender this year was at 10.03 shillings per share in January while the highest stood at 13.02 shillings per share in April.

The image below shows the average share price for Barclays Bank of Kenya between January 2018 and June 2018:

About Soko Directory Team

Soko Directory is a Financial and Markets digital portal that tracks brands, listed firms on the NSE, SMEs and trend setters in the markets eco-system.Find us on Facebook: facebook.com/SokoDirectory and on Twitter: twitter.com/SokoDirectory

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (65)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)