Is CMA The Savior Or The Butcher Of Markets In Kenya?

KEY POINTS

Kenya seems to be a graveyard for once-thriving giants in businesses. Take Kenya Airways, for instance, its peak share used to be at 58 shillings. As we speak, it is oscillating at 3.5 shillings and always sinking in massive losses.

Of late, there has been noise about various investments in various fields, especially markets, and whether the regulator, Capital Markets Authority (CMA) is playing its role in ensuring that there is leveled ground and adherence to the law.

The latest discussion and heated debate that touches on CMA has been that that concerns Cytonn Investments. Many have conducted an online mob justice against the brand and on what it offers. Surprisingly, the regulator seems to have joined those baying for the blood of Cytonn.

CMA came out and made a statement that made matters worse while placing Cytonn as an illegal entity. As a regulator, the press statement that was issued without a right of reply from Cytonn was misleading, castigating with no roots to anchor whatever was being raised.

The recent happenings that have dominated both online and offline beg the question: is CMA doing its job properly? Is CMA the last line of defense for markets or the butcher of the same? What are some of the glaring areas that CMA seems to have failed?

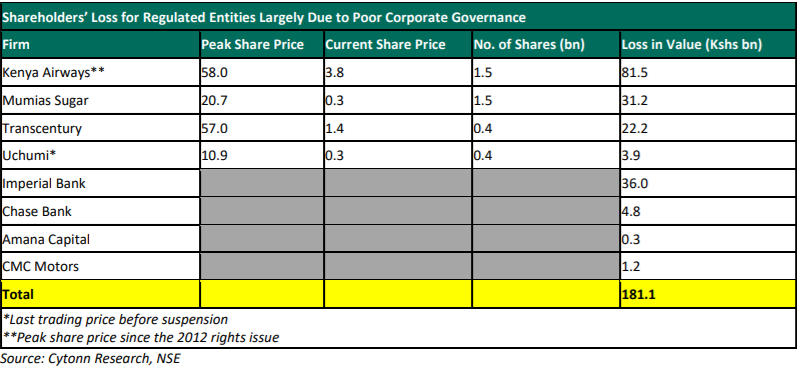

In recent years, there have been too many losses in regulated markets. Investors have lost over 180 billion shillings from CMA-regulated products. Every time this matter is brought up, the regulator coils within and leaves the investors to wade the storm on their own.

Kenya seems to be a graveyard for once-thriving giants in businesses. Take Kenya Airways, for instance, its peak share used to be at 58 shillings. As we speak, it is oscillating at 3.5 shillings and always sinking in massive losses. Look at Mumias Sugar Company, from a peak share price of 20.7 shillings to just 3 cents. Mumias Sugar is currently a shell. Where was CMA?

The story is the same for Transcentury and Uchumi Supermarket. Transcentury is currently trading at 1.4 shillings from a peak of 57 shillings. Uchumi Supermarket, on the other hand, is as good as dead. Trading at 3 cents from a peak of 10.9 shillings is not something to smile about.

For Kenyan banks, there is the Central Bank of Kenya and the Kenya Bankers Association for regulation and service delivery. But CMA seems to have taken up the responsibility of protecting the Kenyan banks at the expense of its core business; the markets.

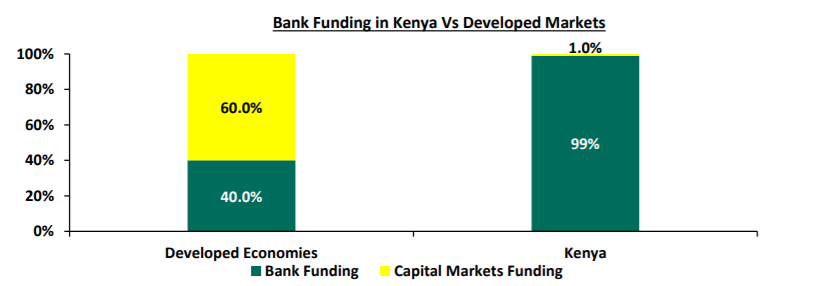

Any keen eye on the markets will tell you that CMA is stifling capital markets for the benefit of banking markets. In well-developed markets, banks account for only 40 percent of business funding, with the balance coming from capital markets. But in Kenya, banks provide 99 percent of the funding with only 1 percent from capital markets, as illustrated below. CMA is focused on protecting the banking sector while castigating the “small players” who should actually be the “main players.”

Sadly, the regulator seems to have become the player; one with a vested interest in the same thing he is supposed to regulate. There is no way someone can be a referee and a player at the same time. Even the holy book says that one cannot serve two masters at the same time.

It does not require rocket science for the regulator and other stakeholders to realize that the oversight of Capital Markets funds, such as Money Market Funds, should not be a preserve of the banking sector, since the banking sector is in competition with capital markets. In this case, the banks are left to call the shots, and being “giants”, they have every potential to kill the competitors.

The truth is that the oversight is done by Trustees and there is a requirement that a trustee must be a bank. We need to open up Fund Managers approved by CMA to reflect the face of Kenya and not a preserve of the elite.

For the markets to have a new awakening and a shift, Fund Managers should be allowed to form sector funds, such as technology, financial services, and real estate funds so that Capital Markets fund these sectors rather than just relying on the banking sector. Relying on banks makes them “economic slaves” who can’t breathe just becomes banks are the “bosses.”

Why should a scheme be forced to have only one bank? What happens if that bank goes under? We know how volatile the banking sector is in Kenya. Stakeholders and regulators should allow collective investment schemes to have several custodian banks to make it easy for investors to invest at minimal costs. Currently, Funds are allowed only one custodian bank, which means an investor say at Equity Bank who wants to invest 1,000 in a fund hosted by KCB will incur a 100 bob transaction fee to invest in the Fund hosted at KCB. This is already 10 percent of the amount being invested. It will take the investor a whole 1 year just to recoup their fees. Yet if funds could open several accounts, they can open as many as possible cater for their investors.

There is a need for better disclosures of portfolio contents. In developed markets, money market funds disclose where they are invested. This enables investors to know the risks they carry. In Kenya CMA, despite several requests from money market fund investors, has refused to require disclosure. This endangers investors. For example, in Genghis Money Market Fund investors were not able to withdraw because most of their money was invested at Chase Bank. And then Amana Money Market Fund were not able to withdraw because their money was invested in Nakumatt commercial paper. Investment should not be a secret. People should know where their money is going.

There is also the need to reform the governance of CMA to include representation from professional bodies so that the agency is more effective and also infuses management with industry experience. Currently, it is staffed with career bureaucrats with no market experience, hence very unresponsive. This should be given priority.

Read More: Cytonn CEO Tells CMA To Stop Destabilizing Markets

About Soko Directory Team

Soko Directory is a Financial and Markets digital portal that tracks brands, listed firms on the NSE, SMEs and trend setters in the markets eco-system.Find us on Facebook: facebook.com/SokoDirectory and on Twitter: twitter.com/SokoDirectory

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (226)

- August 2025 (211)

- September 2025 (270)

- October 2025 (40)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)