How to File Your NSSF Returns Online

KEY POINTS

Every employer with one or more employees must promptly register with NSSF as a contributing employer and promptly deduct and remit contributions on time.

KEY TAKEAWAYS

Late payments of mandatory NSSF contributions attracts a penalty at the rate of 5 percent of the total contributions for each month or part of the month remitted late.

The deadline for employers to file their National Social Security Fund (NSSF) returns is the 9th day of each month, and for someone who doesn’t know the exact procedure, it can become quite challenging.

Nevertheless, every employer with one or more employees must promptly register with NSSF as a contributing employer and promptly deduct and remit contributions on time.

According to the National Social Security Fund (NSSF) Act, late payments of mandatory contributions shall attract a penalty at the rate of 5 percent of the total contributions for each month or part of the month remitted late

It is, therefore, in the best interest of your business to maintain proper and up-to-date records of employees’ earnings and particulars for easy filing of returns before the deadline.

Lucky for you, this post simplifies the procedure for filing your returns online. However, to follow this procedure, you must register with the NSSF e-service to be able to log in.

Note: These steps apply to both new NSSF and old NSSF rates. See NSSF new rates Calculator

Here’s the process:

1. Getting Started: Create a Payroll Excel Sheet

Create a payroll of your employees using Microsoft Excel and ensure that the file is correctly formatted according to the NSSF template.

Template Guidelines

- No formulas in the cells

- No Special Characters, e.g. /, “, – etc.

- Nothing should appear after the last record, e.g., Totals, Complied by

- Columns A to F should be in text format, the rest, general format (Gross Pay and Voluntary)

- No blank rows

- No hidden rows or columns

- File must have one sheet only

- Payroll Number is optional

- Include leading zeros and trailing ‘X’ where applicable for NSSF number

- NSSF number should be a minimum of 9 characters and a maximum of 10 characters

Worth noting is that the format doesn’t have NSSF contribution amounts. It works with the employees’ Gross Salaries. It also includes NSSF Membership Number, KRA PIN, and voluntary amounts.

2. Log in to the NSSF e-Service Portal

Navigate to the https://eservice.nssfkenya.co.ke/launch/. The link will pop up with the eService Main Menu.

Fig: Main Menu

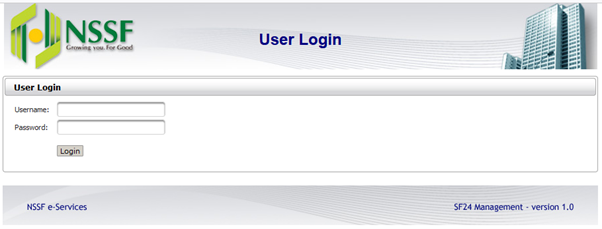

Click on ‘Submission and Payments.’ A login screen will pop up

Fig: Login Screen

Log in with your details by entering your username and password.

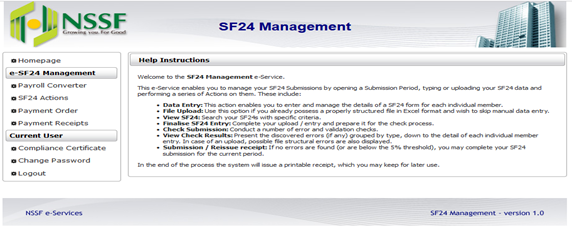

After successful login, the system will prompt with the SF24 Management screen. The Home Page is located on the left

Fig: SF24 Management Screen

Fig: SF24 Management Screen

Begin by clicking on ‘Payroll Converter.’ The system will display Payroll Submission Screen:

Fig: Payroll Converter

Fig: Payroll Converter

3. Create a Payroll Period

Click on ‘Create Payroll Period’ to create a Payroll Period. Proceed:-

- Enter the Payroll period, i.e., 99/9999

- From the ‘Payroll Type,’ select ‘Regular Employees’

- On ‘Contribution Type,’ select the contribution type to be paid. Use the guidelines below

| Rates | Employer contribution | Employee contribution | Total |

| Tier 1 | 360 | 360 | 720 |

| Tier 1 & 2 | 1080 | 1080 | 2160 |

| Old rates | 200 | 200 | 400 |

NOTE: The NSSF rates are explained below. However, once the NSSF Act is unlocked, these will change.

- Click on ‘Open’ to continue

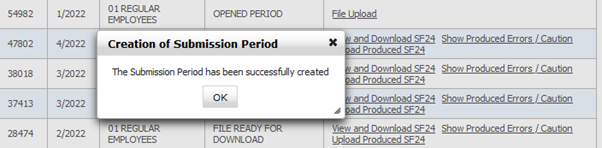

Fig: Payroll Period Creation

4. Upload Your SF24 File

Fig: File Upload

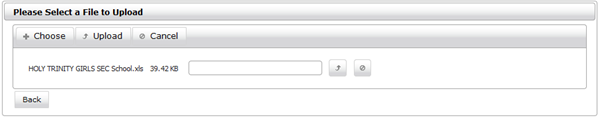

Click on ‘Ok’ to open the period. On the Action column, the system prompts ‘File Upload.’ Click on file Upload and ‘Choose’ to the location where you have saved the SF24.

Fig: SF24 Upload

Highlight the file and open it. Click on ‘Upload’ or ![]() to attach the file. After a successful file attachment, wait until the system responds with the message as displayed below.

to attach the file. After a successful file attachment, wait until the system responds with the message as displayed below.

Fig : SF24 Upload/Attachment completion

After the message has been displayed, click on ‘Back’ to continue

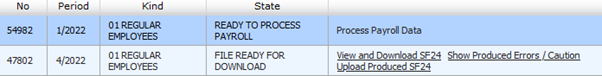

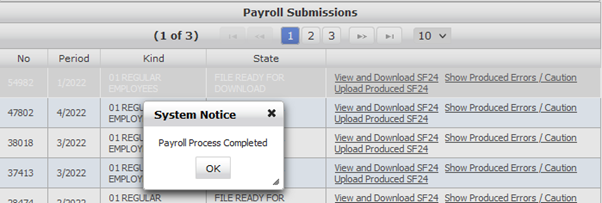

5. Process Payroll Data

The system will respond with ‘Process Payroll Data’ on the Action column.

Click on the link to process the data. The system will process the data, and the message ‘Payroll Processing has been initiated. You will be notified about its progress using the link Payroll Processing Progress Update’.

Fig: Payroll Processing Progress Update

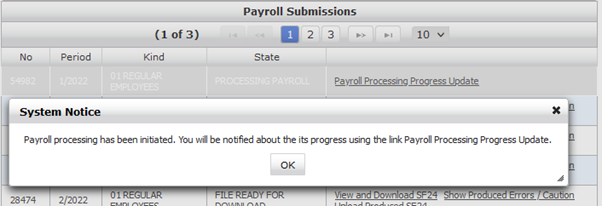

Click on ‘Ok.’ Click on ‘Payroll Processing Progress Update’ for the system to prompt the next action.

Fig: Payroll Processing Completion

The system will prompt ‘Payroll Process Completed,’ clicking on ‘Ok,’ the system will prompt three crucial links ‘View and Download SF24’, ‘Show Produced Errors / Caution’ and ‘Upload Produced SF24’.

6. View and Download SF24

Will display Member, Employer, and Total Contributions at the upper part of the Screen, and below will have details of all the employees who are being paid for. Kindly make sure that all the employees have their Surnames indicated where the Surname is missing; the record is in Error.

Fig: View and Download SF24

Show Produced Errors / Caution

Will display Errors found in the return and also give cautions on the Surname if it does not match the Surname as per the records held by the Fund

Upload Produced SF24

Click on this link to initiate a Submission.

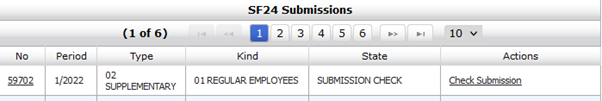

7. SF24 Submission

The system will automatically create a submission period, and the Action Column will have ‘Check Submission.’

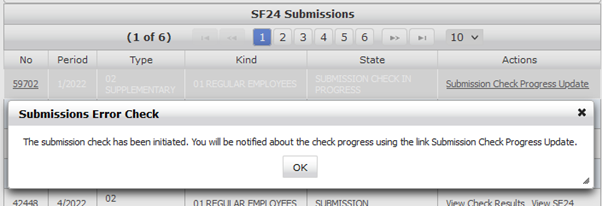

Fig: Check Submission

Click on ‘Check Submission’ to commence processing

Fig: Submission Check Progress Update

The system will prompt with the above message. Click on ‘Ok’ and also click on ‘Submission Check Progress Update’ to refresh the process.

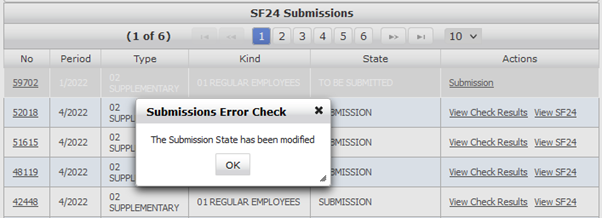

Fig: SF24 Submission

After data validation, the system will prompt ‘The Submission State has been modified,’ and the Action column will change to ‘Submission.’ Click on ‘Submission’ to submit the SF24.

Fig: Unpaid Submission

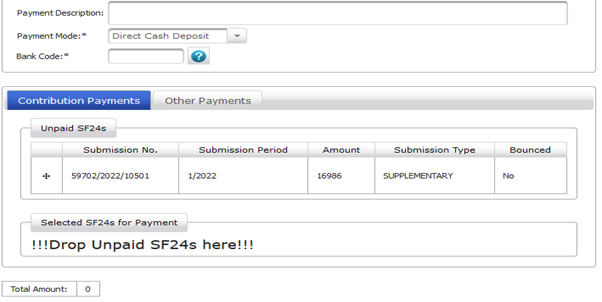

8. Payment Order

After successful submission, proceed to ‘Payment Order’; the submission will appear in the Contributions Payments section as Unpaid submission

Fig: Selected Submission for Payment

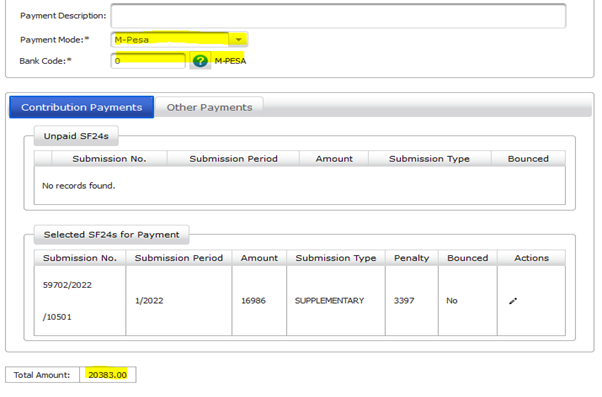

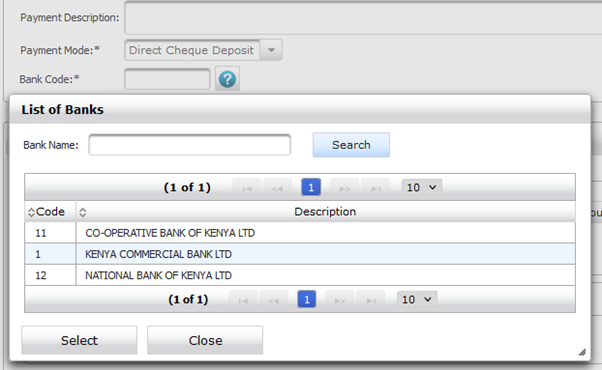

Select Payment Mode from the drop-down; the available payment modes include:-

- Cheque

- Bankers Cheque

- Real Time Gross Settlement (RTHS)

- Electronic Funds Transfer (EFT)

- Cash subject to a maximum of Kshs.5.000/-

- M-PESA PayBill 333300 account number is the generated UPN

Enter the Bank Code; if known otherwise, click on ![]() to search for the Bank Code.

to search for the Bank Code.

Fig: Search Bank Code

Highlight the desired bank and click on ‘Select,’ and the search auto closes

Place the computer cursor on the Asterix characters from the Unpaid Submission section and drag it to ‘!!!Drop Unpaid SF24s Here!!!’

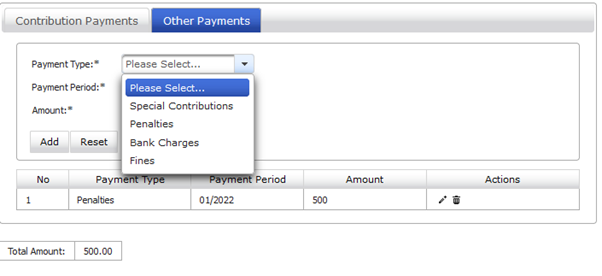

Optionally there could be more than one Submission, or there could be other payments; click on ‘Other Payments’

Fig: Other Payments

Total Amount will have the total amounts to be paid

9. Payment Receipts

Click on ‘Payment Receipts‘ on the left-hand menu.

Fig: Employer Payment Receipt

- Select ‘Start date’ and ‘End date,’ click on the ‘Search’ button

- The available Receipts will be displayed. To print the desired receipt, click on the , and the Receipt will be shown below

- Click on the ‘Print’ to print the receipt.

About Soko Directory Team

Soko Directory is a Financial and Markets digital portal that tracks brands, listed firms on the NSE, SMEs and trend setters in the markets eco-system.Find us on Facebook: facebook.com/SokoDirectory and on Twitter: twitter.com/SokoDirectory

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (104)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)