Why the Nairobi Securities Exchange Is Africa’s Most Underrated Investment Opportunity in 2025

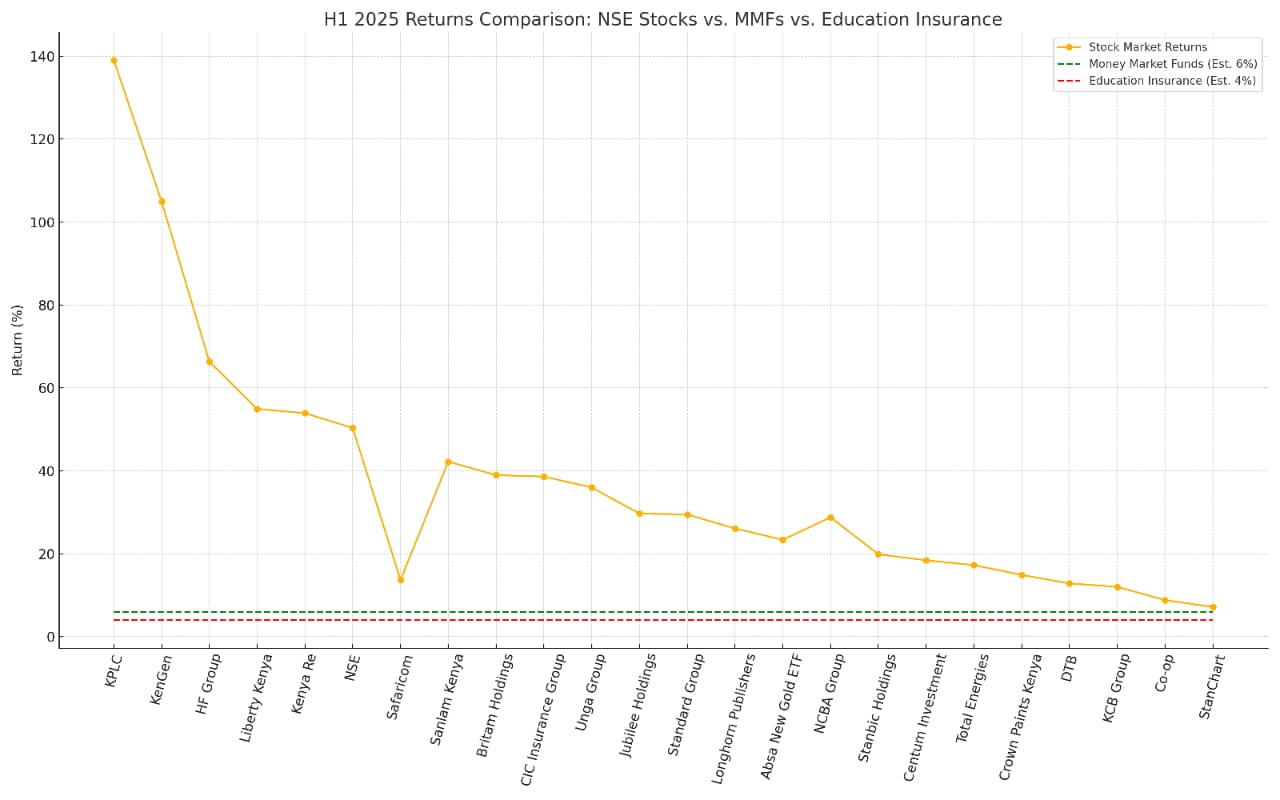

When people think about investing, the first thoughts are often of real estate, fixed deposits, money market funds, or insurance-linked savings plans. Stocks, especially in developing markets like Kenya, rarely top the list. Yet, the returns shown on the Nairobi Securities Exchange (NSE) in the first half of 2025 present a compelling case, not just for seasoned investors but also for ordinary Kenyans who want to grow their wealth sustainably and transparently.

Let’s talk returns. If you had invested KES 100,000 in Kenya Power and Lighting Company (KPLC) on the first trading day of January 2025, your investment would be worth approximately KES 239,100 today. That’s a 139.1% return in just six months. It’s not a hypothetical scenario — it’s real data, and it’s happening on Kenyan soil. The same story applies to KenGen, the power generation giant, which returned 104.9% over the same period. These aren’t tech unicorns or speculative crypto coins. These are essential service providers, household names, often criticized in public discourse, yet delivering investor returns that would make Wall Street analysts nod in approval.

Why are these returns so high? In KPLC’s case, the turnaround has been fuelled by operational reforms, renewed government support, and investor optimism around improved efficiencies and financial restructuring. For KenGen, the market responded to their expansion into geothermal and wind energy, monetization of carbon credits, and growing demand for green energy. Their fundamentals improved, investor confidence soared, and the share price followed.

Now look at HF Group, up 66.3%. Traditionally known for mortgage financing, HF has been repositioning itself as a digital-first bank, tapping into the growing demand for affordable housing and fintech services. That transformation, though still ongoing, has been rewarded by the market. Liberty Kenya, another strong performer, saw a 54.9% increase, reflecting the insurance sector’s growing relevance post-COVID and improved actuarial structures.

Read Also: The NSE Saw A Mixed Market With Foreign Net Outflows Taking Centre Stage

Then there’s Kenya Re, posting a 53.9% gain. The reinsurance business is complex, but its profitability is often underestimated. As primary insurers grow, they offload risk to reinsurers. And with climate change driving up insurance claims globally, well-run reinsurers are now sitting on solid portfolios. That’s the opportunity Kenya Re represents — and the market has picked up on it.

The Nairobi Securities Exchange itself — the institution that houses all these firms — returned 50.3%. This performance is important, not just symbolically. It reflects confidence in the system itself, growing participation, stronger regulatory frameworks, and innovations like Real Estate Investment Trusts (REITs), derivatives, and cross-listing opportunities. It signals that the market is maturing and that local investors are starting to believe in their economy.

Even companies like Safaricom, often viewed as already saturated in growth, managed a 13.7% increase. While modest compared to KPLC, remember that Safaricom is Kenya’s largest company by market capitalization. It’s already massive. Any movement in its price represents billions in underlying shifts. Their expansion into Ethiopia, coupled with consistent M-Pesa innovations, continues to deliver strong long-term prospects.

Sanlam Kenya’s 46.6% return is another example of how financial services are turning into high-growth plays. Strategic partnerships with banks for bancassurance, digital onboarding, and improved claims management are behind this rise. Similarly, Britam Holdings posted a 39% gain on the back of a strategic shift toward asset management and tech-driven insurance distribution.

CIC Insurance grew by 38%, and that’s largely a function of how effectively they’ve tapped into microinsurance and underserved markets, especially boda boda riders and rural farmers. This is social impact investing that yields double-digit returns. Unga Group’s 36.7% return reminds us that food and agribusiness are not just essential for survival — they’re critical investment verticals. With food inflation rising, companies involved in staple processing have become inflation hedges.

Jubilee Holdings rose 29.7%, continuing its tradition of conservative but stable growth. With its reach across East Africa and a diversified portfolio, Jubilee remains one of the most solid insurance bets for any long-term investor. Standard Group, traditionally a media underdog, returned 29.5% following restructuring and new revenue models from digital platforms and e-commerce advertising.

Even niche sectors are paying off. Longhorn Publishers returned 26.1%, showing the staying power of content and curriculum providers in the age of government-driven education. The Absa New Gold ETF posted 23.5%, attracting risk-averse investors who want to hedge against inflation and currency swings. Gold has always been a safety net, and this ETF provides local exposure to that global trend.

Banks like NCBA Group (23.4%) and Stanbic Holdings (19.9%) show that core banking — when executed with innovation and retail focus — still delivers. NCBA’s Loop app continues to attract youth, while Stanbic’s regional presence insulates it from domestic shocks. Centum Investments, long considered sluggish, returned 18.4%, largely driven by a shift away from real estate toward venture capital and private equity. It’s a recovery story in motion.

Total Energies, with a 17.3% gain, is proof that energy still matters. Despite the green shift, petroleum-based businesses with retail distribution networks remain cash cows. Crown Paints, up 14.9%, reflects real estate-linked consumption even in a depressed construction market. Their East African expansion is paying off.

DTB (12.8%), KCB Group (12.0%), and Co-op Bank (8.8%) represent stable financial institutions with large customer bases and consistent dividend histories. They may not deliver the headline-grabbing returns, but they anchor any balanced portfolio. StanChart, with a 7.1% return, closes the list — and still beats many money market funds and insurance-linked savings schemes.

Let’s put this in perspective. The average money market fund in Kenya delivers 8–10% annually. That’s 4–5% semiannually. Educational insurance savings plans — the ones sold in malls and supermarkets — return an average of 4% annually after fees. Not a single one of the listed stocks returned less than 7% in the same six-month period. Some delivered 20x that.

And this isn’t just about capital gains. Most of these stocks also offer dividends. Safaricom, Jubilee, KCB, NCBA, and Co-op are known for their regular payouts. When you factor in a 5–10% dividend yield on top of the capital gains we’ve discussed, total returns become almost unbeatable. For instance, KCB’s 12% price gain plus a 6% dividend yields an 18% return, without complex structures or lock-in periods.

There’s also liquidity. Shares can be bought and sold with relative ease. Compare that to insurance policies that penalize early withdrawals or money markets that require notice periods. Stocks offer control, transparency, and the chance to participate in corporate governance via AGMs and voting rights.

Critics often argue that the stock market is volatile. Yes, it is. But volatility isn’t risk — it’s movement. It’s that movement that creates opportunity. Risk is not understanding what you’re buying. And that’s where investor education comes in. With growing access to apps, research platforms, and financial literacy programs, any Kenyan with a smartphone can now become an informed investor.

This matters for the economy, too. When more citizens own shares, more capital stays within the country. Companies raise funds without overreliance on debt. Expansion becomes possible. Jobs are created. Taxes are paid. Wealth circulates. A vibrant stock market isn’t just good for investors — it’s good for GDP growth and national resilience.

It also changes culture. It promotes long-term thinking, disciplined saving, and a deeper understanding of macroeconomics. When you hold shares, you start caring about inflation, interest rates, fiscal policy, and corporate earnings. This makes the electorate smarter and the market more resilient.

There’s a mindset shift needed. Stocks aren’t just for the elite or the lucky. They are for every boda boda rider who saves KES 500 a week. Every teacher is looking to grow a retirement fund. Every young person is trying to build a future. Platforms like Hisa, AIB DigiTrader, Faida, and Genghis Capital are already lowering the barriers.

Governments and institutions need to help. Introduce tax incentives for new investors. Encourage SACCOs and pension schemes to increase equity exposure. Launch “beginner” portfolios that mirror the top-performing NSE firms. And yes, teach investing in schools — because our children deserve to understand the tools that will shape their financial futures.

In the end, investing in the stock market is not about chasing hype. It’s about recognizing value. And if the numbers from the first half of 2025 are anything to go by, there’s a lot of value to be found on the NSE. You just have to look — and be bold enough to act.

Read Also: The NSE Saw A Mixed Market With Foreign Net Outflows Taking Centre Stage

About Steve Biko Wafula

Steve Biko is the CEO OF Soko Directory and the founder of Hidalgo Group of Companies. Steve is currently developing his career in law, finance, entrepreneurship and digital consultancy; and has been implementing consultancy assignments for client organizations comprising of trainings besides capacity building in entrepreneurial matters.He can be reached on: +254 20 510 1124 or Email: info@sokodirectory.com

- January 2026 (220)

- February 2026 (243)

- March 2026 (62)

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (230)

- December 2025 (219)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)