The Kenyan Market in Focus: Review of the Week

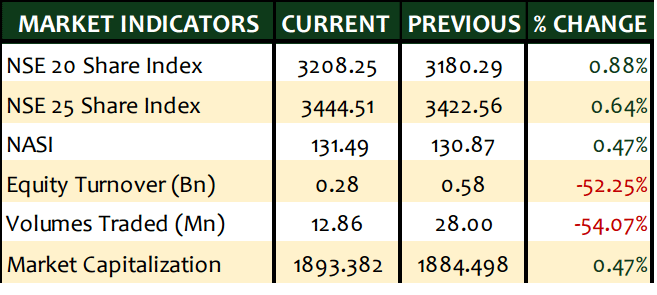

The Kenyan Market activity at the bourse ended the week on a low when compared to its performance last week. The NSE 20 Share index gained 20.38 points during the five days of trading to close the week at 3208.25 points while the NASI declined marginally to end the week at 131.49 points from 134.06 points previously.

The NSE 25 Share index lost 40.91 points in the same period to settle at 3444.51 points from 3485.42 points last Friday. Market capitalization dropped from KES 1,930.575 billion before to KES 1893.382 billion this week, whilst equity turnover declined to KES 4.2 billion from KES 6.7 billion due to a reduction in the volume of shares traded to 170 million shares from 358 million shares.

The returns on government securities have come down by up to a percentage point in two weeks with increased subscription by banks after a new bill capping lending rates was signed into law.

Just two weeks ago, bank holdings of the State securities had fallen but two days after the new law came into effect, the institutions increased their share relative to all other categories of investors ahead of lower lending margins.

Read:

According to the September 2 weekly bulletin of the Central Bank of Kenya, commercial banks held 54.4 per cent of all government securities, up from 54.1 per cent in the previous week. Insurers and pension funds fell to 7.3 and 27.0 per cent from 7.4 and 27.2 per cent respectively in the preceding week.

Currencies

The Kenyan shilling was steady against the dollar on Friday with inflows from the horticulture industry matching subsiding dollar demand from importers.

The Sterling and the Euro lost ground albeit slightly against the shilling owing to the recent UK manufacturing and production data which highlighted the problems that the British economy is facing since the vote to leave the European Union.

The problems for Sterling continued on Wednesday when the NIESR released its latest GDP estimate for the last three months which showed a fall to 0.3%.

Market updates

Liberty Holdings (NSE: CFCI) announced their HY16 results recording a 15.3% dip in Profit after Tax (PAT) to KES 355.4Mn, down from KES 419.8Mn. The drop in profit was as a result of a 41.5% increase in claims from policyholders to KES 2.3 billion. Operating expenses for the period also grew by 14.2% to KES 1.5 billion. Gross premiums increased 11.6% to KES 4.7Bn while income from investment activities grew 56% to KES 1.4Bn. The insurer expects the second half of 2016 to be influenced by an increasingly competitive market place and muted growth prospects. Liberty Holdings Ltd share price lost ground by 21.89% to close at KES 13.20.

Centum Investment Company Ltd (NSE: ICDC), pending shareholder approval in its upcoming Annual General Meeting scheduled for the 29th of September, proposes repurchase of its own shares from public investors. The share repurchase proposal, if approved, would be a major boost to its share price bringing it closer to its Net Asset Value of KES 59.08 (up 23.01% from KES 48.03) recorded in the FY2015/16 period. The stock trading KES 38.50 on Wednesday, the day the annual results were published on the website, has since jumped 13.63% to end the week to perch at KES 43.75. Going forward, we expect renewed accumulation activities around the stock in the run-up to the Annual General Meeting.

Eveready E.A Ltd (NSE: EVRD) issued a profit warning alert as the company anticipates its earnings for the period ended 30th September 2016, to be at least 25% below the profit reported in a similar period last year. The company attributes the profit warning alert to the decrease in revenues caused by a prolonged stock out during the year. Eveready E.A reported a KES 77.7 million net loss in the year ended September 2015. Additionally, the company is seeking to sell off a piece of land in Nakuru. The stock was on a downward trajectory, plummeting by 4.65% to close at KES 2.05 during the 36th week trading session.

The Kenya Institute for Public Policy Research and Analysis (Kippra) requested the Energy Regulatory Commission (ERC) to review the formula it uses to set petroleum prices at the pump, stating that some cost components are unfairly burdening consumers. The government-backed policy body faults the regulator over failure to remove a cost item associated with Kenya’s only refinery despite its closure in September 2013. On the other hand, ERC, maintained to have cut the costs to zero but still maintained the formulae.

Kenya Airways Ltd (NSE: KQ) is set to face shareholders in its upcoming Annual General Meeting scheduled for the 29th of September, with a detailed plan on how they intend to resolve their negative capital position. The airline has already set a new record in wiping out shareholders equity, with the company the company’s net worth receding to a negative KES 35.6 billion from the previous year’s negative KES 5.9 billion. The airline stated that it’s focusing on revenue growth, cutting costs and restructuring its capital base including through asset sales, debt renegotiation and possible capital-raising from shareholders. Going forward, we expect to see speculative trading on the stock as investors continually build up confidence which is currently dependant on the management’s strategies.

About Soko Directory Team

Soko Directory is a Financial and Markets digital portal that tracks brands, listed firms on the NSE, SMEs and trend setters in the markets eco-system.Find us on Facebook: facebook.com/SokoDirectory and on Twitter: twitter.com/SokoDirectory

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (183)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)