KES 264.3 Bn Lost to Corporate Governance Issues

Kenyan investors have incurred Kshs. 264.3 billion losses as a result of isolated corporate governance issues affecting a section of companies, Kenyan investment firm Cytonn Investment said on Monday.

“For a market with over 60 listed companies to have significant issues with at least 8 companies equates to about 13per cent of listed companies with corporate governance issues. That is a worryingly high statistic that should call into question our regulatory frameworks and their effectiveness,” said Shiv Arora, Head of Private Equity Real Estate.

Some of the companies that have led to losses being incurred include: Chase Bank, CMC, Imperial Bank, Uchumi, Mumias, Kenya Airways, National Bank and TransCentury according to the “Kenya Listed Companies Corporate Governance Analysis Report -“What is the role of corporate governance in the recent investor losses?”

Read: Corporate Governance and what it Means to the Economy

Cytonn states that mismanagement of institutions which have large government holding, as well as unsustainable debt levels have led to corporate governance issues and investor losses.

“Poor strategies have led to the demise of companies like Mumias, Uchumi and Kenya Airways, with the capital in these entities shrinking by more than 90 percent, and the companies operating with negative equity positions,” according to the report.

For such public institutions, they call for privatization to ensure an efficient turnaround, which is not dependent of a public bailout.

The Cytonn Corporate Governance Index (CGI) ranked the 50 listed companies on the Nairobi Securities Exchange, with a market capitalization of over Kshs. 1 bn, on 24 corporate governance metrics.

The main areas of analysis were focused on (i) board composition, (ii) audit functions, (iii) CEO tenure and evaluation, (iv) remuneration, and (v) transparency.

In the CGI – Comprehensive Score Ranking, Kenya Commercial Bank Group had the highest score of 95.8 percent, followed by Safaricom and Standard Chartered all with 83.3 percent.

The bottom three companies were: Flame Tree Group Holdings 33.3percent, Limuru Tea 18.8 percent and Kenya orchards 10.4 percent.

Barclays Bank was ranked first on gender diversity with an even gender distribution with 50 per cent. Safaricom and Mumias followed with 44percent and 36.3 percent respectively.

ARM, Limuru Tea , Carbacid Investments, East Africa Portland, Kakuzi, WPP Scan Group, Crown Paints, Car & General and Kenya Orchards all had a zero percent score.

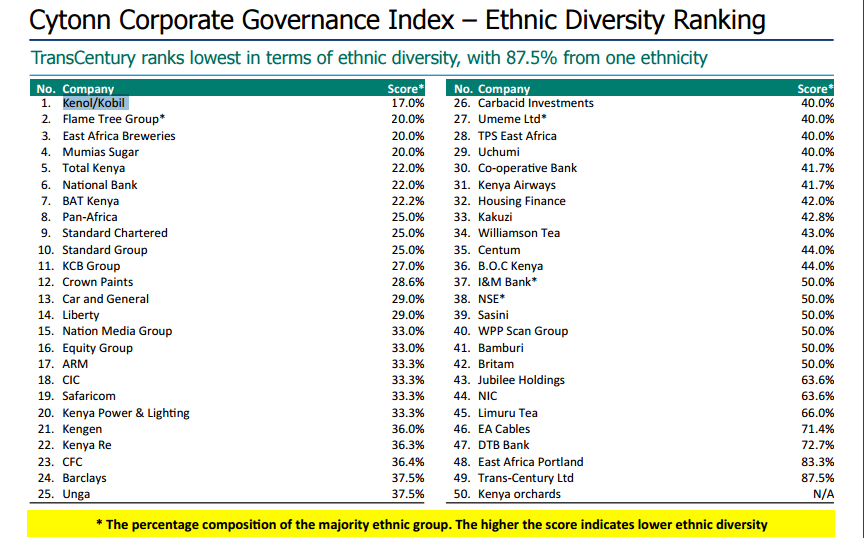

TransCentury was ranked lowest in terms of ethnic diversity, with 87.5 percent from one ethnicity. Kenol Kobil scored the highest in this category with 17 per cent.

From the survey, Shiv Arora stated that good corporate governance was directly correlated to stock price performance.

“Companies with a well-diversified board in terms of gender outperformed those with an undiversified board composition highlighting the importance of gender diversity as a corporate governance ranking metric.”

“The same applies for ethnic diversity where companies that are ethnically diverse also outperformed those that are ethnically biased,” the report states.

About Soko Directory Team

Soko Directory is a Financial and Markets digital portal that tracks brands, listed firms on the NSE, SMEs and trend setters in the markets eco-system.Find us on Facebook: facebook.com/SokoDirectory and on Twitter: twitter.com/SokoDirectory

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (225)

- December 2025 (44)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)