State Of The Economy:Number of Jobs Lost in the Banking Sector in Kenya

Commercial banks in the Kenya continue to experience a difficult operating environment after the enactment of the Banking (Amendment) Act 2015, which saw the interest rates capped on both loan pricing and deposit pricing, reducing interest margins significantly.

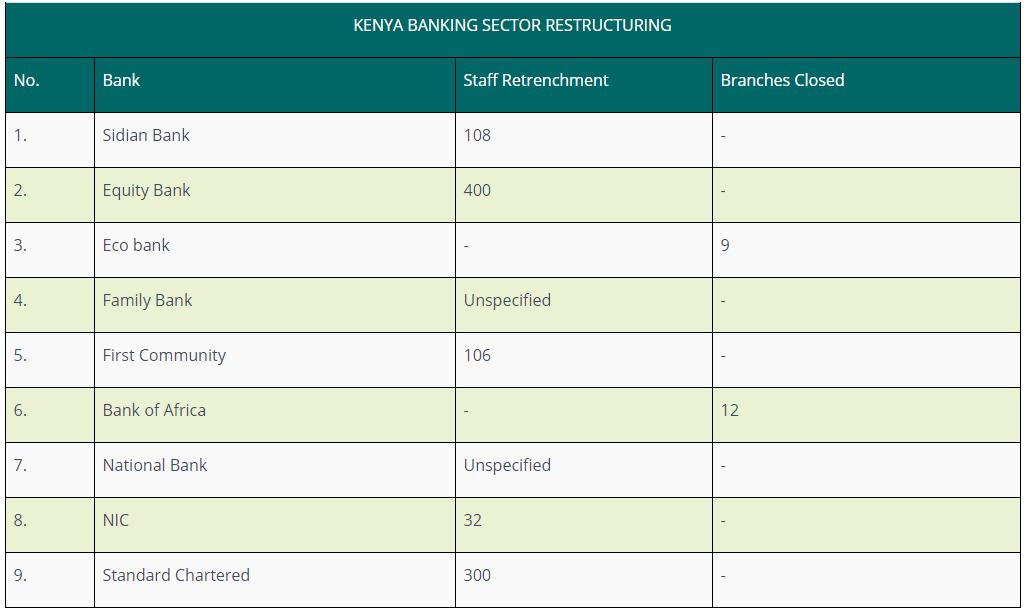

In the recent past, several commercial banks have announced plans to cut on costs by laying off employees and shutting down some branches and adopt alternative banking channels, which are cheaper and more efficient for them to remain afloat.

The latest lender to close down some branches and lay off part of her staff was Bank of Africa which has indicated a planned closure of 12 branches to reduce from 42 to 30 in a bid to increase efficiency through alternative banking channels.

Of the 40 operating banks in Kenya, 9 have already announced restructuring plans, equating to 22.5 percent of the entire sector. This is a worrying statistic, and given the expected continuation of consolidation in the banking sector, the trend is likely to continue going forward as the banks optimize on digital banking platforms and reduce staff costs in a bid for efficiency.

Sidian Ban has laid off 108 employees, Equity Bank 400, Family Bank has sent home unspecified number of staff, First Community Bank 106, National Bank laid off an unspecified number, NIC Bank 32 while standard Chartered 300. Bank of Africa has closed down 12 branches while Ecobank has closed down 9 branches.

See the image below:

Image and informatio gotten from Cytonn Investments Report

About Juma

Juma is an enthusiastic journalist who believes that journalism has power to change the world either negatively or positively depending on how one uses it.(020) 528 0222 or Email: info@sokodirectory.com

- January 2026 (217)

- February 2026 (115)

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (230)

- December 2025 (219)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)