Credit constraints continue to hurt Kenya’s House price growth – KBA

House prices in Kenya for the third quarter of 2017 registered their first annual decline in the last three years attributed to a slowdown in credit expansion.

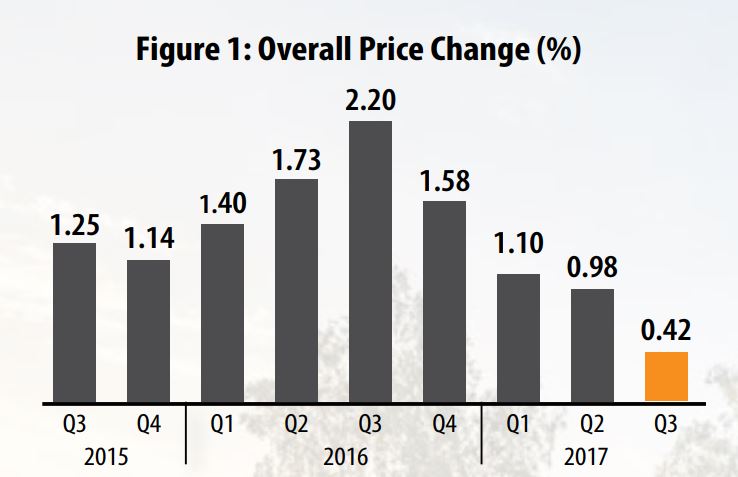

The latest Housing Price Index released by the Kenya Bankers Association (KBA) shows that there was a 0.42 percent increase – in overall house prices between July, August, and September.

This was a reduction compared to 0.98 percent growth in 2017 second quarter and the lowest price increment posted since the third quarter of 2015.

“This is an indication that there is no- relief for the declining trend in the rate of house prices increase since the third quarter of 2015,” the report reads in part, “With the generally depressed demand in the economy and the slowdown in credit expansion, households relying on the credit market towards home acquisition have been adversely effected.”

For the last year, housing prices have been on a declining curve with an increase in prices dropping from a high of 2.20 percent as at the third quarter of 2016 and falling to 1.58 percent in the fourth quarter of the same year.

This declining trend piqued in the first quarter of this year (between January and March) with prices increase falling to 1.10 per cent, then dropping further to 0.98 percent in the April-June period of this year, and then sliding further to the current rate of 0.42 percent.

According to the KBA Director of Research and Policy Jared Osoro, the trend on growth in house prices mirrors that of credit growth to the private sector.

“With the generally depressed demand in the economy and the slowdown in credit expansion, households relying on the credit market towards home acquisition have been adversely affected,” Osoro said, “This has consequently influenced the house prices trend.”

In addition, the survey noted that the sluggish demand environment has provided little incentive for increased supply of housing units, a situation that is compounded by the constrained supply of financing.

On the demand side, potential home buyers seem to be holding back on decisions to invest in homeownership while on the supply side, investors in the real estate could also be on a wait and see mode.

Read:

- Nairobi’s property market remains subdued due to political uncertainty

- House Prices Soften on the Back of Demand and Supply Slowdown – KBA

During the period under review, apartments accounted for 82.66 percent of the total number of units sold in Q3 of 2017 with maisonettes and bungalows accounting for 10.70 percent and 6.64 percent respectively.

Across all the market segments (lower, middle and upper), prices of apartments registered the highest rise compared to prices of bungalows and maisonettes, with the rise in prices in the latter two segments being more or less muted, the survey noted.

“The rise in the price of apartments compared to bungalows and maisonettes signals an element of the search for affordability by potential home buyers are given the lower cost of construction per unit on the developer’s’ side and therefore relatively low offer process,” said Osoro. “As a consequence, market activity appears to be skewed towards the lower end compared to the middle and the upper market segment.

The survey further noted that the house price drivers in the quarter remained largely unchanged compared the previous quarters with the size of the house as captured by plinth area of the house, number of bedrooms, presence of backyard, master ensuite and gym area being among the core drivers of house prices during the quarter.

“During the quarter, the type of the house was core in influencing the house prices during the quarter,” the survey reads in part. “This speaks to the difference in the interests of the various potential home buyers which would be informed by the income levels as well as the family size.”

About Soko Directory Team

Soko Directory is a Financial and Markets digital portal that tracks brands, listed firms on the NSE, SMEs and trend setters in the markets eco-system.Find us on Facebook: facebook.com/SokoDirectory and on Twitter: twitter.com/SokoDirectory

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (119)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)