Kigali’s Rental Yields Higher than Key Cities in Sub-Saharan Africa – Cytonn Report

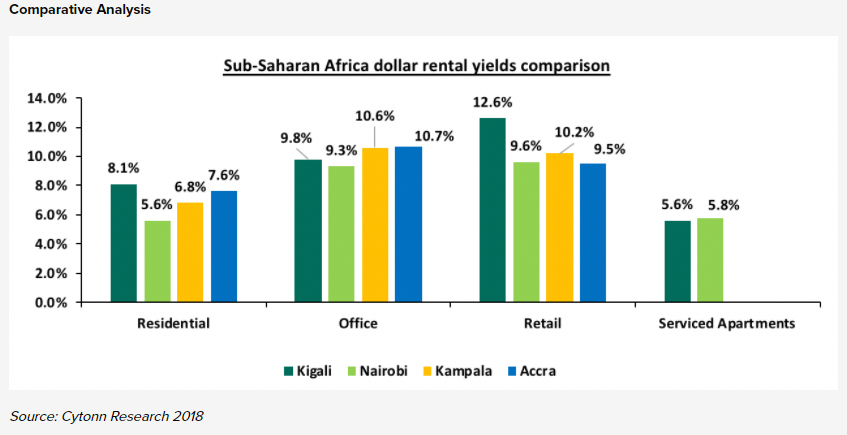

Kigali, Rwanda has higher dollarized rental yields than any other key cities in the residential and retail sector in Sub-Saharan Africa at an average rental yield of 8.1 percent and 12.6 percent respectively.

This means that Kigali outperforms Nairobi market in Residential, retail, and office with rental yields of 8.1 percent,12.6 percent, and 9.8 percent respectively, compared to Nairobi with 5.6 percent, 9.6 percent, and 9.3 percent respectively.

The Kigali market, according to the Cytonn Investments weekly report, is however nascent and small as the City has a population of 1.3mn against Accra’s 2.4mn, Nairobi’s 4.1mn and Kampala’s 1.5mn people according to the country’s respective statistical bureaus.

Rwanda is one of the fast-growing countries in Africa at a GDP growth rate estimated at 6.2 percent in 2017 compared to an Africa average growth of 2.4 percent and a sub-Saharan Africa average of 3.2 percent.

The country was ranked the 41st in the world and second-best country in Africa to do business after Mauritius which ranked 25thglobally and best in Africa according to World Bank Ease of Doing Business 2018 report.

There are a number of factors that drive the real estate sector in Kigali and they include the following:

- Government Incentives –These include the government investment in infrastructural expansion and modernization of urban and rural infrastructure, which involves the construction of roads and provision of utilities such as water and electricity in development sites,

- Political Stability – political stability with well-functioning institutions, rule of law and zero tolerance to corruption,

- Housing Deficit – The affordable housing demand in Kigali for 2012-2022 is estimated at 186,163 Dwelling Units (DU) with an average demand of 16,923 affordable Dwelling Units per year according to Planet Consortium 2012 Housing for the City of Kigali report, hence increasing investment activities by the government and developers with the aim of meeting the demand,

- Economic Growth – Rwanda’s real GDP growth recorded an estimated growth of 6.2 percent in 2017 from 5.9 percent in 2016, an indicator of macroeconomic stability that is conducive to growth. Rwanda was also ranked the 41st and second-best country in Africa to do business in after Mauritius which ranked 25th and best in Africa according to World Bank Ease of Doing Business 2018 report,

- Demographics – Rwanda has a population of approximately 12.4 Million people and growing at a rate of 2.4 percent compared to the global average of 1.2 percent.

The urban population stands at 30.7 percent of the total population and urbanization rate of 4.9 percent p.a. hence creating increased demand for real estate developments, and

- Master Plan– Strict Implementation of zoning regulations guided by the Kigali master plan introduced in 2013, which outlines the conditions and plans for development in Kigali. This is a visionary project which will see planned development in the area and control urban sprawl in future.

Despite the above factors driving real estate in Rwanda, the sector continues to face major challenges that have discouraged potential investors from investing in the real estate sector in Rwanda. These include;

- High Construction Cost– The construction cost in Rwanda is high since it imports most of the construction materials. However, the country is trying to bridge the gap, with companies such as Cimerwa, Rwanda’s sole cement producer and S&H Industries that produces stone-coated tiles (Hippo brand),

- High Cost of Financing– Funding real estate developments has resulted in excessive debt financing, with a debt interest rate ranging from 17 – 19 percent per annum on the Rwandan Franc. The market also does not embrace presales but rather prefer to buy after completion of the project or sometimes during the construction. In addition, Development Bank of Rwanda is the only main lender providing development loans, and

- Low Purchasing Power– The high mortgage rates makes it hard for Rwandese to borrow to finance the purchase of houses given the low levels of income, with approximately 66 percent of the population, earning less than USD. 243 per month. Currently, the value of the mortgage to GDP stands at 3.6 percent against Sub Saharan Africa average of 5.0 percent.

About Soko Directory Team

Soko Directory is a Financial and Markets digital portal that tracks brands, listed firms on the NSE, SMEs and trend setters in the markets eco-system.Find us on Facebook: facebook.com/SokoDirectory and on Twitter: twitter.com/SokoDirectory

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (228)

- December 2025 (59)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)