Men are the Most Active Users of Mobile Money in Kenya – Report

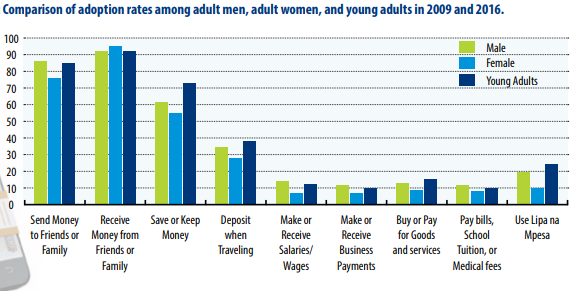

Gender and age have proven to be meaningful factors in terms of whether Kenyans use mobile money and to what ends. On the whole, men remain the most active users.

According to The 2016 FinAccess Household Survey data, 76 percent of men (approximately 18.1 million men nationwide) claimed access to a mobile money account. Their overall percentage grew two-fold over the last seven years, from 2009 to 2016.

Like most subscribers, the most common use was for sending mobile money between friends and family (90 percent), followed by saving (61 percent). Men were also most likely to use mobile money for everyday economic opportunities and conveniences, with 10 percent to 15 percent of them using mobile money for managing business needs such as giving or receiving wages (13 percent), or sending or receiving business payments (11 percent).

Today, over 70 percent of Kenyans have registered a mobile money account. The large majority of them use it for sending and receiving remittances, while many others use it for personal and business needs such as borrowing money from friends or paying wages.

Much of why, or how often, Kenyans utilize mobile money varies across demographic categories and social and economic contexts, according to both gender and age.

According to a report by FSD dubbed, ‘The Gender and Age Dimensions of Mobile Money Adoption in Kenya’, men and women of different age levels use their phones for varying reasons.

Statistically, their levels of adoption and usage vary considerably too. Up until now, studies concerning mobile money and financial inclusion have focused largely on aggregate adoption rates and usage trends. Few have shed light on the ways in which women, men and young adults (men and women ages 18-25), use mobile money differently.

Women, on the other hand, showed comparatively lower adaption rates. As of 2016, 68 percent of surveyed women (approximately 16.1 million females nationwide) claimed access to mobile money accounts.

While women were nearly as likely to use mobile money to transfer sums between friends and family, they were half as likely to use it for managing business finances, whether in giving or receiving wages (7 percent) or in making or receiving business payments (6 percent). Yet, women did demonstrate certain counter trends. Specifically, they were more likely than men to use mobile money accounts on a consistent monthly basis – 43 percent compared to 34 percent.

In addition, women’s overall rate of mobile money adoption since 2007 tripled compared to men’s twofold increase over the same seven-year period, demonstrating a closing gap between gender groups. One demographic category that remains less studied is young adults.

While exhibiting adoption rates similar to women, young adults have proven to be on the whole more likely to experiment with new mobile money-related products. Young consumers are more likely to utilize mobile money bill pay options or cash collection services such as Lipa Na M-Pesa, where their adoption rates were as high as 25 percent.

Mobile money first emerged in Kenya in 2007. Safaricom, the country’s largest telecom operator, launched M-Pesa. It recruited 400 agents, tasked with registering M-Pesa accounts as well as handle deposits and withdrawals.

Agents were also facilitators of non-subscribers wishing to send or deposit money to account holders. By 2009, nearly 27.6 percent of Kenyan adults claimed access to a mobile money account; by 2013, the percentage increased to 62 percent.

Today, mobile money remains vastly popular, with more than 70 percent of the country’s adults claiming use. And while Safaricom was accompanied by competitors, including Airtel Money, Orange Money, and Yu Mobile, M-Pesa remains the most popular mobile money platform, controlling over 80 percent of the market share with approximately 150,000 licensed agents. (CAK 2018).

About Soko Directory Team

Soko Directory is a Financial and Markets digital portal that tracks brands, listed firms on the NSE, SMEs and trend setters in the markets eco-system.Find us on Facebook: facebook.com/SokoDirectory and on Twitter: twitter.com/SokoDirectory

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (226)

- August 2025 (211)

- September 2025 (99)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)