T-bills Remain Over-subscribed as Interbank Rate Hits 1.9 pc

T-bills remained over-subscribed during the week, with the overall subscription rate coming in at 104.6 percent, a decline from 140.3percent, recorded the previous week.

The decline in subscription is partly attributable to the 5-year and 10-year bond sale that closed during the week.

There was mixed performance, with the 91-day paper recording an increase in subscription rates to 127.6percent, from 121.5percent, recorded the previous week, while the 182-day and 364-day papers recorded declines in subscription to 115.7 percent and 84.3 percent, from 117.1 percent and 170.9 percent, recorded the previous week, respectively.

Cytonn report notes that the yields on the 91-day, 182-day, and 364-day papers declined by 5.3 bps, 10.8 bps and 5.9 bps to 7.0 percent, 8.4 percent, and 9.5 percent, respectively.

The acceptance rate improved to 91.1 percent from 90.9 percent recorded the previous week, with the government accepting 22.9 billion shillings of the 25.1 billion shillings worth of bids received, an indication that bids were largely within ranges the Central Bank of Kenya (CBK) deemed acceptable.

This week, the government issued a 5-year tenor (FXD1/2019/5) and a 10-year tenor (FXD1/2019/10) bond, which recorded an over-subscription of 156.5 percent, mainly attributable to the relatively favorable liquidity conditions.

The yields came in at 11.3 percent and 12.4 percent for the 5-year and 10-year bonds, respectively, in line with our expectations, with the government accepting 53.4 billion shillings out of the 78.3 billion shillings worth of bids received against 50.0 billion shillings on offer, translating to an acceptance rate of 68.2 percent.

READ ALSO T-Bills Over-subscribed During the Week as Interbank Rate Declines

Liquidity

The average interbank rate increased to 1.9 percent from 1.4 percent the previous week, while the average volumes traded in the interbank market declined by 41.6 percent to 10.4 billion shillings, from 17.8 billion shillings the previous week.

The low interbank rate points to improved liquidity conditions, with the rate declining to an 8-year low of 1.2 percent as at 14th February 2019 partly attributed to government payments and net redemption of government securities.

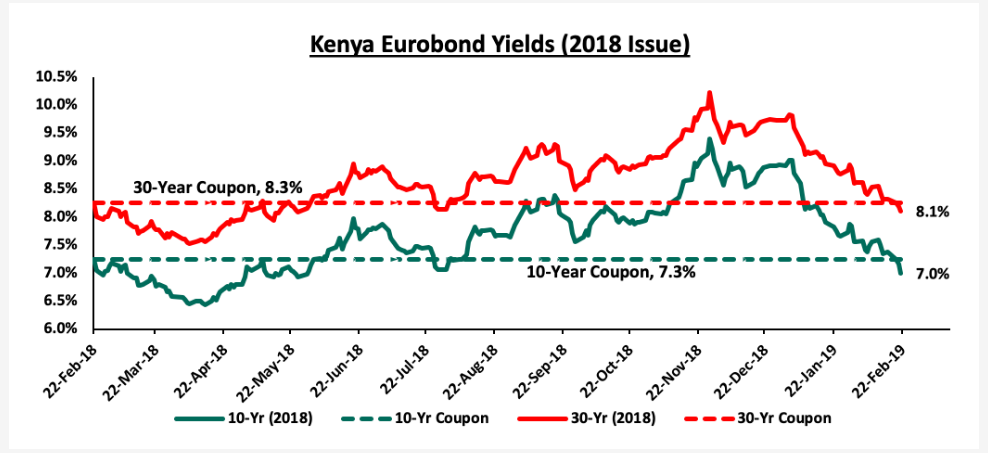

Kenya Eurobonds:

According to Bloomberg, the yields on the 5-year and 10-Year Eurobonds issued in 2014 declined by 0.3 percent points and 0.4 percent points, respectively, to 4.0 percent and 6.2 percent from 4.3 percent and 6.6 percent the previous week.

The continued decline in yields signals improving country risk perception by investors, which is partly attributed to bullish expectations of improved economic growth in 2019 as well as increased Eurobond demand in emerging markets, with a similar trend observed in other Sub-Saharan African Eurobonds, driving the prices up and effectively the yields down. Key to note is that these bonds have 0.3-years and 5.3-years to maturity for the 5-year and 10-year, respectively.

About Soko Directory Team

Soko Directory is a Financial and Markets digital portal that tracks brands, listed firms on the NSE, SMEs and trend setters in the markets eco-system.Find us on Facebook: facebook.com/SokoDirectory and on Twitter: twitter.com/SokoDirectory

- January 2026 (217)

- February 2026 (123)

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (230)

- December 2025 (219)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)