Business 101: Why You Should Keep Records For Business Transactions

As an accountant, I have come across many business owners who do not understand why they need to keep all their business records and keep them properly.

This is mainly a problem with most startups and a few businesses which have been around for a while but have not managed to get it right yet. Unless you are an accountant, auditor, or have experience with running a business, no one teaches you about proper record keeping until you have to file your tax returns or get audited.

Most startups do not have proper financial records and though they improve as they grow, the information in the first years can be crucial as it documents the basis of your company.

Record keeping is not only important when preparing your financial statements and filing your tax returns, but it is also required by the revenue authority that you keep your records. In Kenya, a lack of proper record keeping attracts penalties to a business or individual.

The Tax Procedure Act states that a business should keep its records for five years from the end of the reporting period. An investigation by the authorities may require records beyond the five-year period where there is gross or willful neglect, evasion or fraud by the taxpayer.

For a small startup, facing budget constraints, the business can have their records on Excel, or scan, and keep documents as soft copies and upgrade as the business grows.

For medium and large scale business, an ERP system would be ideal to ensure all documents are saved and recorded properly. There are different types of ERP systems that can be used. An accountant should be able to advise you on the best ERP system, depending on your company’s needs and budget.

Here are some of the documents that a business should ensure they keep

- Sale invoices/contracts

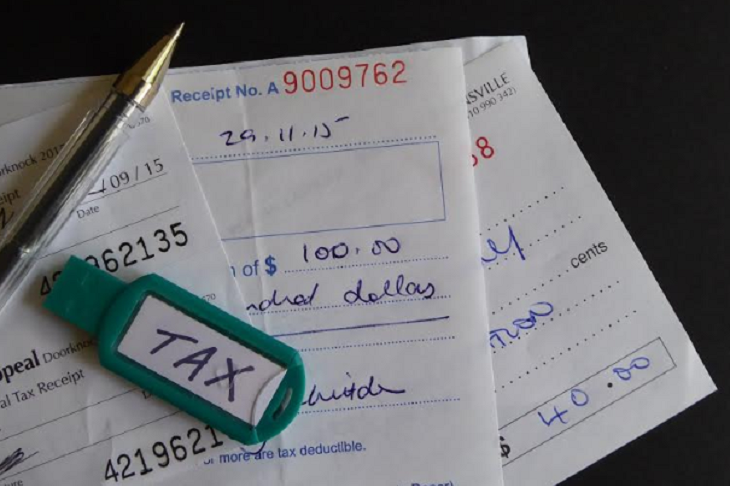

- Invoices/Receipts or any expense related to the business including purchase of assets

- Contracts and Agreements, e.g., Lease agreements, legal contracts, employee contracts

- Business registration records, e.g., registration certificate, pin certificate, MEMARTS, business permit

- Payroll records

- Bank statements (Include loan statements, cheque counterfoil or any other documentation from the bank)

- Previous Tax Returns (Thanks to Itax these records are now accessible on the web)

A business should keep all records relating to its operations, and thanks to the internet, this has been made easier and efficient. There are several benefits as to why a company should keep all its records. With the main reason being the preparation of financial statements, the other benefits include;

- Ensures that the financial statements are accurate as the documents are the source and which are used for verification.

- Records help you monitor the progress of your business.

- Record-keeping helps make work easier during the preparation and actual audit work.

- Used in the preparation of tax returns – Tax returns should be supported by actual documents. The burden of proof is on you to support all figures in your tax return and especially an amount that reduces your tax liability.

- To be compliant as required by law.

- For companies dealing with goods, record-keeping can help in times of conflict with the customer. For example, if the customer agreed to a contract or to pay a certain amount for certain goods and later tries to dispute.

- When dealing with suppliers’ record-keeping is important to match goods ordered versus goods delivered and the prices.

- Budgeting – Record keeping will help you budget for your next financial period.

- Help in acquiring business deals – Some clients, e.g. the government, might require certain documentation concerning your business for them to onboard as a supplier.

- Proper record-keeping comes in handy when acquiring a loan or during valuation to sell your business.

In conclusion proper record keeping can seem like a daunting task and even destruct you from your core work but once in a while (depending on your business transactions), create time to do some filing and write on your receipts/invoices the purpose of each, if not descriptive enough, as with time you might forget or outsource a bookkeeper/accountant to keep the records for you.

This will make work easier for you and even save you a couple of bucks. I cannot emphasize enough the importance of keeping your records while running your business. So, while we are at it, why don’t you go and work on that pile of receipts? Happy filing J

This article has been written by Alice Chege, a Finance Consultant at Zenuha, an independent advisory firm that offers outsourced Finance & Accounting services to entrepreneurs, small to medium-sized businesses, foundations, corporations, and high net worth individuals.

Contact Alice via consulting@zenuha.com.

About Soko Directory Team

Soko Directory is a Financial and Markets digital portal that tracks brands, listed firms on the NSE, SMEs and trend setters in the markets eco-system.Find us on Facebook: facebook.com/SokoDirectory and on Twitter: twitter.com/SokoDirectory

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (226)

- August 2025 (211)

- September 2025 (47)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)