High Court Thwarts KRA’s Plan to Impose New Fuel and Beer Taxes

KEY POINTS

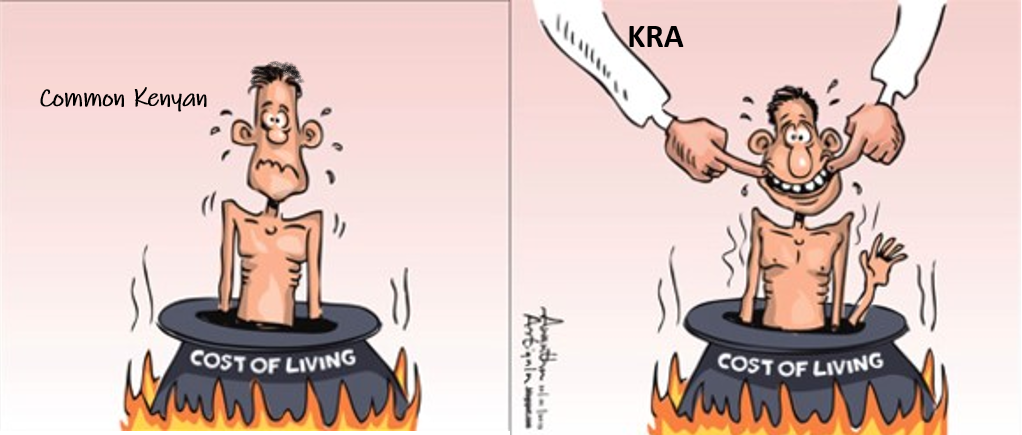

The cost of living is rising and KRA’s implementation of new taxes will only worsen an already dilapidated state. As such, it should highly consider pausing the annual inflation adjustment tax that affects excisable goods.

Kenya’s High Court has stopped the Kenya Revenue Authority (KRA) from imposing new taxes on goods including fuel and beer.

KRA had planned to increase exercise duty on these products and 29 others such as bottled water and juice from October 1. Other items that are set to attract higher taxation are cigarettes, bottled water, and motorcycles (boda boda).

The ruling issued by Justice James Makau followed a determination of suit opposing the taxes, which, according to him, may be successful.

One Isaiah Odando and Wilson Yata filed a petition to stop the impending decision by the taxman to increase excise duty on the products by 4.97 percent in line with average annual inflation. The two argued that the decision will put more pressure on the cost of living.

KRA, it’d seem are determined to net more revenue by whichever means necessary without regard for the common Mwananchi.

A few days ago, High Court halted KRA from collecting 21 billion shillings through a minimum tax – and equivalent of one percent of a business’s total sales revenue regardless of profits or losses.

ALSO READ: Sugar Prices Up By 30 Shillings: Where Should Kenyans Run To?

This barbaric and capitalistic move is all seemingly aimed at ensuring our “good president”, the one and only Uhuru Kenyatta, completes his legacy projects in areas such as healthcare, and affordable housing – something we have nothing to write home about.

The High Court’s order is a blow to the government, which apparently, is desperately trying to make it seem like it is servicing the soaring public debt and the gaping fiscal deficit.

“If the interim order is not granted, the petitioners and Kenyans will stand prejudiced. There will be a danger to Kenyans in the further increase of fuel prices if KRA adjusts the excise duty rates on October 1 as proposed, although the decision is pending approval by the Cabinet Secretary National Treasury,” said the judge in the ruling.

The judge noted that the petitioners expressed concern and demonstrated that the case is a matter of public interest and that their constitutional rights are under threat of being breached through the tax increases.

The judge noted that the Attorney-General’s lawyer Mitchelle Omuom was yet to receive instructions on how to oppose the case.

Meanwhile, KRA opposed the order and temporarily froze the taxes terming the application premature because the proposed levy is yet to be authorized by the Treasury Cabinet Secretary.

The court was also told that the decision to increase the taxes does not end with the KRA, since it will seek for approval in parliament before implementing the new rates.

If the new rates take effect, manufacturers will pass on the additional cost of the commodities they produce to consumers in what will further stoke public outrage over the high cost of living.

Consumers will have to part with 5.77 shillings more for a liter of beer and spirits prices will rise for a whopping 13.20 shillings!

Petrol will increase by 1.09 shillings a liter, elevating the excise duty to 23.04 shillings whereas kerosene and diesel will increase by 0.566 shillings per liter.

The adjustment is in line with the law that demands that excise duty be revised upwards in tandem with the cost of living measure or the average rate of inflation in the 12 months through June.

Well, the government’s recent economic decisions, are angering Kenyans who are still reeling from the effects of the COVID-19 pandemic.

The cost of living is rising and KRA’s implementation of new taxes will only worsen an already dilapidated state. As such, it should highly consider pausing the annual inflation adjustment tax that affects excisable goods.

About Soko Directory Team

Soko Directory is a Financial and Markets digital portal that tracks brands, listed firms on the NSE, SMEs and trend setters in the markets eco-system.Find us on Facebook: facebook.com/SokoDirectory and on Twitter: twitter.com/SokoDirectory

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (226)

- August 2025 (211)

- September 2025 (270)

- October 2025 (162)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)