High Profile Scandals Creating Overnight Millionaires in Kenya as Taxpayers Suffer

KEY POINTS

Kenya registered high-profile government scandals including misappropriation of borrowed funds, which has created overnight millionaires. This has cost the taxpayers about 30 percent of the national budget — translating into 2 billion shillings (USD 18.34 million) per day.

A new edition of the Global Wealth Report by the Swiss investment bank, Credit Suisse has revealed that despite being weighed down by debts, Kenya keeps churning out millionaires.

The report noted that every adult in the country has a debt load of 523 US dollars making it the most indebted country in East Africa.

The report further stated that Kenya registered high-profile government scandals including misappropriation of borrowed funds, which has created overnight millionaires. This has cost the taxpayers about 30 percent of the national budget — translating into 2 billion shillings (USD 18.34 million) per day.

In 2020, the number of Kenyans with a net worth of at least USD 30 million, including their primary residence, stood at 90. The number was a decline from the 2019 figures where these individuals were 106. The drop was attributed to the COVID-19 pandemic, noted a Knight Frank Wealth report.

After Nigeria, South Africa, and Egypt, Kenya follows in countries with the highest number of wealthy people in the African continent.

ALSO READ: KQ Drops Flights to JF Kennedy as Customer Numbers Fall

Data from the Credit Suisse report indicates that despite being overwhelmed by debts estimated at over 7 trillion shillings (USD 64.22 billion), Kenya is the richest in the region with total wealth estimated at USD 338 billion (both financial and non-financial wealth) as of last year.

Putting these numbers in perspective translates into wealth per adult of USD 12,313 (approximately 1.4 million shillings) and an average wealth per adult of USD 3,683 (approximately 405,130 shillings).

Following Kenya is Rwanda with a wealth per adult standing at USD 4,188; Tanzania, USD 3,647; Uganda, USD 1,994; Democratic Republic of Congo, USD 1,240; and Burundi with USD 728.

According to the researchers at Credit Suisse, Kenya’s wealth rose significantly over the past decade hitting a high of 560 billion US dollars in 2020 from a low of 24 billion US dollars in 2000.

Compared to Kenya, every adult in Tanzania carries a debt load of USD 137, followed by Rwanda with USD 135, Uganda with USD 107, Burundi with USD 37, and the Democratic Republic of Congo at 36 US dollars.

DR Congo has an estimated 39.74 million adults, followed by Tanzania (27.74 million), Kenya (27.47 million), Uganda (19.83 million), Rwanda (6.58 million), and Burundi (5.38 million).

The whole African continent had an estimated wealth per adult of USD 7,922 in 2020, with debt per adult at USD 552 in the same period.

The total wealth barely changed in the continent, with exchange rate appreciation accounting for the slight change in wealth in the continent.

ALSO READ: M-Pesa Hits 50 Million Monthly Active Customers

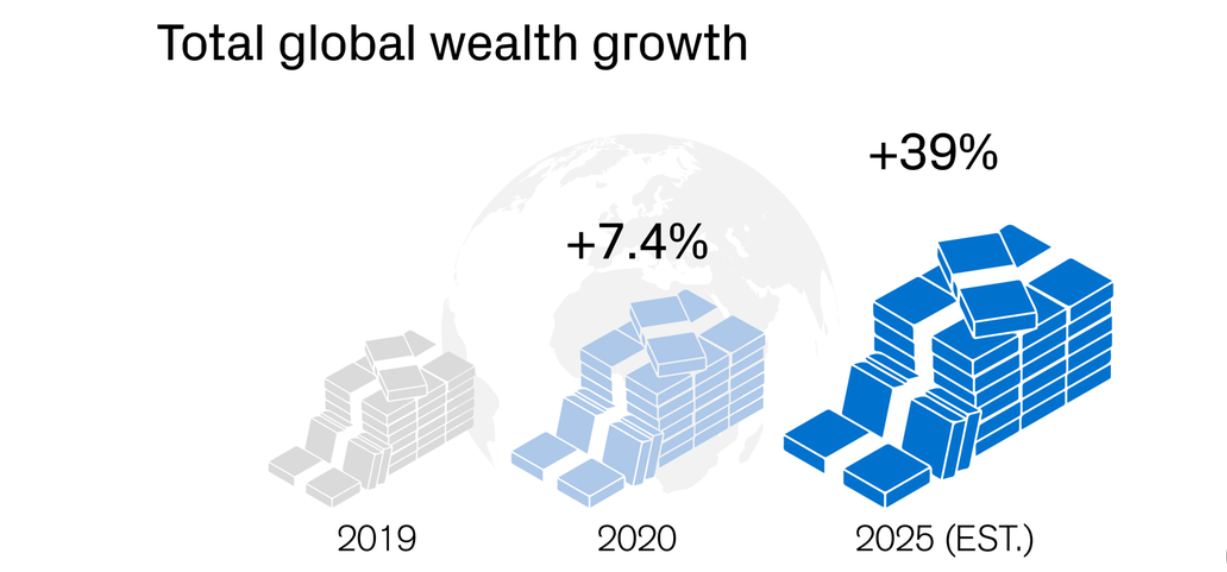

Meanwhile, the total global wealth rose by 7.4 percent in 2020 and the wealth per adult grew by 6 percent to USD 79,952. The countries most affected by the pandemic did not fare badly in terms of wealth creation.

“Wealth creation in 2020 was largely immune to the challenges facing the world due to the actions taken by governments and central banks to mitigate the economic impact of Covid-19,” said the report.

About Soko Directory Team

Soko Directory is a Financial and Markets digital portal that tracks brands, listed firms on the NSE, SMEs and trend setters in the markets eco-system.Find us on Facebook: facebook.com/SokoDirectory and on Twitter: twitter.com/SokoDirectory

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (183)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)