Equity Bank’s Profits After Tax Up By 79% To Ksh 26.9 Billion

KEY POINTS

Equity Bank's profits were up by 79 percent to 26.9 billion shillings. This was growth from 15 billion shillings at the same time in 2020 helped by rising interest income and falling provisions for bad loans.

Equity Group has posted impressive financial results for the third quarter of 2021 despite the ongoing Covid-19 pandemic that has hit hard on various businesses within and without Kenya. The bank says it will remain resilient as the year snails on.

Equity Bank’s profits were up by 79 percent to 26.9 billion shillings. This was growth from 15 billion shillings at the same time in 2020 helped by rising interest income and falling provisions for bad loans.

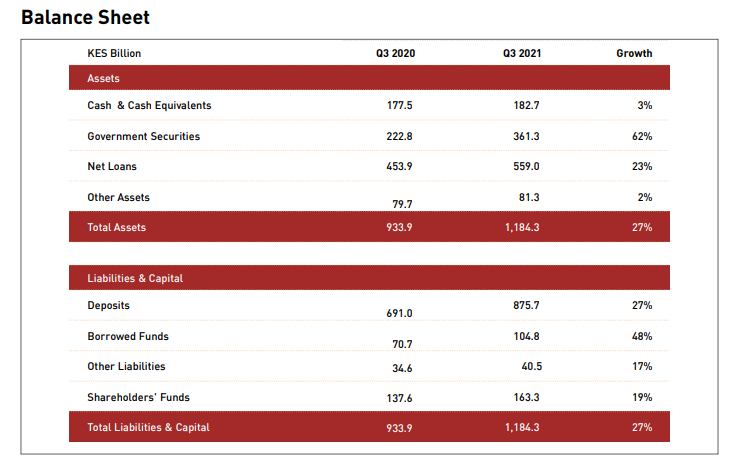

At the same time, the total assets for Equity Group are now at 1.18 trillion shillings. The lender plans to grow the assets to 3 trillion shillings in the next 5 years.

“Our largest subsidiary, Kenya, has the highest return on Assets and hence able to lift the Group as we continue to support the subsidiaries on this front,” said Equity.

Deposits for the bank grew by 27 percent to 875.7 billion shillings while the loan book rose by 23 percent to 559 billion shillings. At the same time, total income grew by 25 percent to 79.9 billion shillings. The Net interest income grew 23 percent to 48.5 billion shillings.

“Out of the KES 171bn offered in loans, we see minimal changes that will pose a risk to the current provision we have made for the loan book,” said the bank in a statement on Monday morning.

Equity also operates in Tanzania, Rwanda, Burundi, South Sudan, the Democratic Republic of Congo, and Uganda, and has a representative office in Ethiopia with CEO Dr. James Mwangi saying that the “bulk of this growth has come from our subsidiaries.”

Equity says together with its partners has invested USD 513 million in Social Investment Programs in education, health, enterprise development, food and agriculture, social protection and energy, and environment.

“Social capital is as good as financial capital, and Equity Group is a creation of its values and ethos. Our social impact programs are a reflection of our Shared Prosperity Model, creating value within the economy and impacting communities on a daily basis,” said the lender in a statement.

At the same time, the bank says that it has trained 2.24 million farmers, enabling them to transform into agribusiness. “Agriculture is central not only to us but has formed a large part of the ongoing global conversation centered around climate change.”

Read More: Equity Ranked Among The World’s 1,000 Biggest Banks

About Soko Directory Team

Soko Directory is a Financial and Markets digital portal that tracks brands, listed firms on the NSE, SMEs and trend setters in the markets eco-system.Find us on Facebook: facebook.com/SokoDirectory and on Twitter: twitter.com/SokoDirectory

- January 2026 (217)

- February 2026 (122)

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (230)

- December 2025 (219)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)