Equity Officially Licensed To Operate Life Insurance

KEY POINTS

- The license will enable ELAK to provide life insurance solutions to an underserved market and contribute towards the vision of Equity Group to transform lives and expand opportunities for wealth creation

KEY TAKEAWAYS

- A life insurance license has been issued to Equity Life Assurance (Kenya) Ltd which is fully owned by Equity Group Insurance Holdings Limited (EGIHL), a subsidiary of Equity Group.

A life insurance license has been issued today to Equity Life Assurance (Kenya) Ltd (‘ELAK’) which is fully owned by Equity Group Insurance Holdings Limited (EGIHL), a subsidiary of Equity Group.

The license will enable ELAK to provide life insurance solutions to an underserved market and contribute towards the vision of Equity Group to transform lives and expand opportunities for wealth creation.

Ms. Angela Okinda, the Managing Director and Principal Officer of ELAK said, “ELAK will contribute to the trusted Equity brand by providing inclusive, affordable, innovative and accessible insurance products to a majority of Kenyans who are not utilizing insurance solutions to secure much-needed protection of their lives, health and wealth, or secure their financial futures through savings solutions.”

Dr. James Mwangi, Equity Group CEO and Managing Director said, “The ELAK license comes at a very critical time when the economy is recovering from the impact of the COVID-19 pandemic. Our inspiration is to offer insurance to all categories of consumers and make insurance accessible, affordable, and inclusive in line with our purpose of transforming lives, giving dignity, and expanding opportunities for wealth creation.”

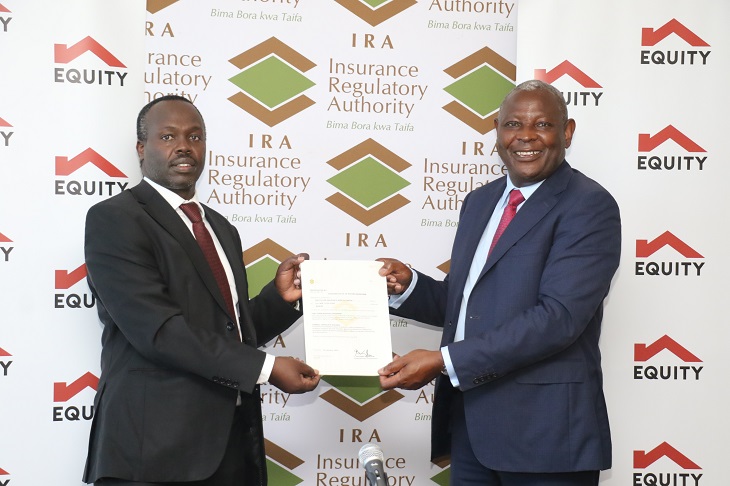

While handing over the ELAK license, Commissioner of Insurance, Insurance Regulatory Authority Godfrey Kiptum said, ” As the regulator, we are delighted to see Equity Group adapt to the changing demands of the market and respond to the needs and aspirations of the customers. The insurance business in Kenya is still heavily driven by the general business class and with the entry of Equity Life Assurance (Kenya) Limited into the sector, this is likely to enhance the value and distribution of life insurance in the country.”

The insurance industry in Kenya is characterized by low penetration levels, currently estimated at 2.4% This has been attributed to a number of factors including poor or limited product portfolio, low or no awareness of available insurance products, low-income levels among the key consuming public, perceived low rate of returns for life insurance policies, cumbersome claim settlement procedures, lack of trust of insurance players, negative perception of providers/intermediaries and expensive premiums among others.

Also speaking at the event, Insurance Regulatory Authority Chairman Hon. Abdirahin Haithar Abdi, MGH said, “The insurance business relies heavily on trust and Equity has a well-defined history and support from the public which is a key aspect for success in the sector. We congratulate Equity Group for joining the insurance sector as the newest player. Additionally, Kenya is ranked number 3 or 4 with regards to insurance penetration in Africa, and many investors have taken an interest in the sector. We are happy to see a local player coming in to contribute to our growth.”

COVID-19 has been the greatest setback to many households in their pursuit of economic independence. Equity Life (ELAK) is pledging to invest heavily in consumer education to equip Kenyans with the knowledge to make the right decisions regarding insurance for themselves and their businesses and to embrace insurance as a key component to reliably grow their wealth, health, and livelihoods by protecting it.

Dr. Mwangi further added, “ELAK will optimize on Equity Group’s serial innovation culture to launch inventive and substantial solutions that meet the needs of Kenyans. We will co-create products with Kenyans so that our offerings will be relevant and applicable to their daily lives. Further, we will ensure that the insurance solutions are easily accessible using technology on, thus giving Kenyans the freedom to access, pay and receive the insurance solution of their choice.”

About Soko Directory Team

Soko Directory is a Financial and Markets digital portal that tracks brands, listed firms on the NSE, SMEs and trend setters in the markets eco-system.Find us on Facebook: facebook.com/SokoDirectory and on Twitter: twitter.com/SokoDirectory

- January 2026 (217)

- February 2026 (118)

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (230)

- December 2025 (219)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)