The Mumias Sugar Resurrection Saga: Who Were The Bidders?

KEY POINTS

New Mumias Sugar/ Devki Group had a total bid of 59.2 billion shillings while West Kenya Sugar placed a bid of 33.3 billion shillings. KE Internation had a total bid of 25.9 billion shillings while Kruman Finance placed a bid of 14.1 billion shillings.

KEY TAKEAWAYS

At its peak, Mumias controlled 60% of the local sugar market, had thousands of employees, and over 50,000 registered out-growers who supplied it with sugarcane.

Just how was the lowest bid, which will invest the least money into Mumias, leaving farmers and other debtors unpaid while taking a decade to pay KCB back was chosen?

Mumias Sugar Company was one of the economic giants and pillars of Western Kenya and the country at large. This was the “signature tune” of sugar manufacturing in the country and was a mark of pride, economic empowerment, and a sense of ownership.

The company provided employment opportunities for thousands of Kenyans who worked in the main factory, in the farms, and as drivers. At the same time, thousands of farmers from the region earned their livelihood and built the future of their farming through sugarcane farming. At its peak, Mumias controlled 60% of the local sugar market, had thousands of employees, and over 50,000 registered out growers who supplied it with sugarcane.

When the company collapsed, people lost their jobs. Farmers’ lives were shuttered with a lot of them left hopeless, and there are even numerous reports of those who committed suicide as a result. Their source of livelihood was gone, probably forever without even paying them their dues.

Today, when you drive through Mumias, past a small market called Shibale, you will witness the true meaning of devastation and economic meltdown after the collapse of Mumias Sugar Company. The place is no longer joy but signs of pain and frustration.

Read More: More Job Losses As Mumias Sugar Company Fires All Employees

Therefore, when news broke out that Mumias Sugar Company was to be handed over to other able investors to revive it, pay farmers, other loans, and give people back their jobs, people saw the white smoke of hope. They knew that at long last, their prayers had been answered and they looked forward to the day that miracle will finally materialize.

Being a public entity that was running on the taxes of hardworking Kenyans, bids had to be made. Already there is a controversy surrounding the bidding process and how the investor who won the bidding was selected. As the controversy surrounding the bidding continues, the true people who placed the bid have remained behind the scenes. So, who were the bidders for the Mumias Sugar Company?

The Bidders

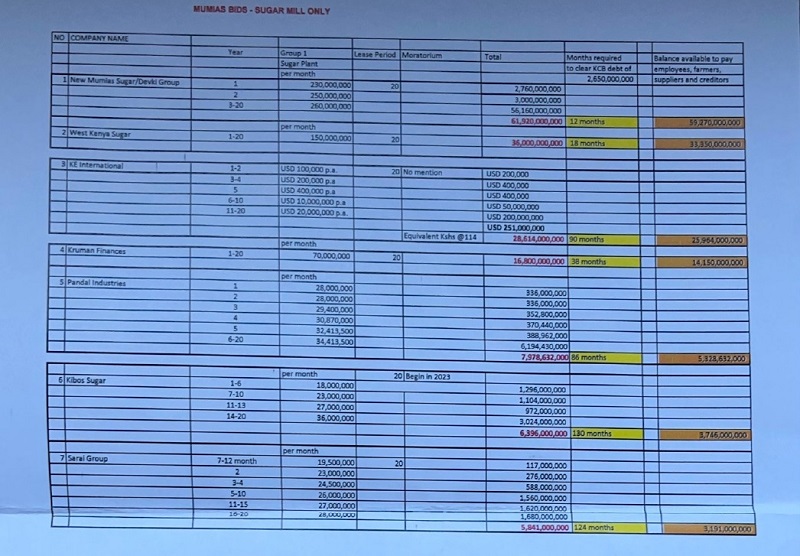

New Mumias Sugar/ Devki Group had a total bid of 59.2 billion shillings while West Kenya Sugar placed a bid of 33.3 billion shillings. KE International had a total bid of 25.9 billion shillings while Kruman Finance placed a bid of 14.1 billion shillings.

At the same time, Pandal Industries had a total bid of 5.3 billion shillings followed by Kibos Sugar with a total bid of 3.7 billion shillings. Sarai Group had the least bid of 3.1 billion shillings.

The image below shows the breakdown of bids by each bidder:

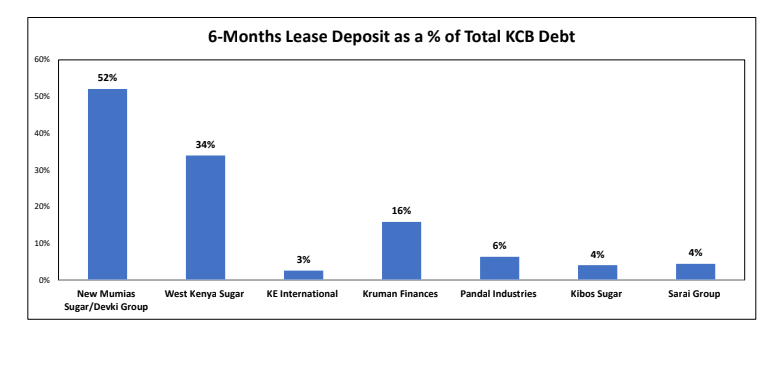

In terms of percentage for the 6-months lease deposit of the total KCB debt owed by Mumias Sugar Company, New Mumias Sugar/Devki Group was to give 52 percent, West Kenya Sugar 34 percent, KE International 3 percent, Kruman Finances 16 percent, Pandal Industries 6 percent while Kibos Sugar and Sarai Group 4 percent each.

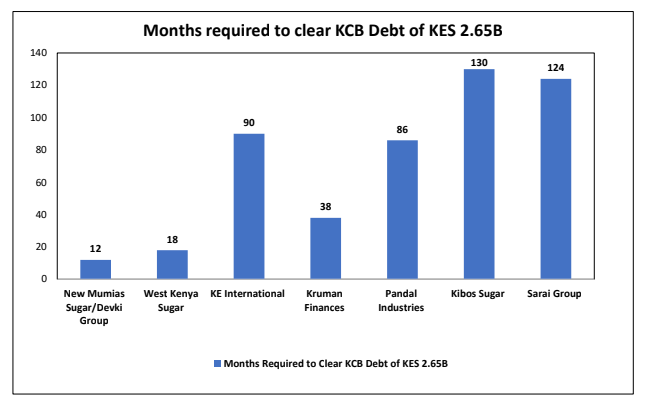

In terms of how long it would take the bidders to clear the debt owed by Mumias Sugar Company to KCB Group, the New Mumias Sugar/Devki Group was to take 12 months, West Kenya was to take 18 months while KE International was to take 90 months. Pandal Industries was to take 38 months, Kibos Sugar 130 days, and Sarai Group 124 months.

In the receivership process it is accepted practice for the receiver to pick a credible bidder who would pay back the creditors in the least amount and would be most likely or able to turn the company back into a functioning profitable company. Thus in the Case of Mumias Sugar Company, the questions that the receiver and KCB should have been asking are:

- Are the bidders credible? Do they have the experience and the capability to revive Mumias and put in the needed investment?

- Which bid will pay back KCB as quickly as possible?

- Which bid will revive the company as quickly as possible?

Of the bidders above, in terms of how long it would have taken to clear the debt and completely liberate Mumias Sugar Company, which one would you have gone for?

The next episode looks at the whole bid-awarding process and why it is questionable. And just how the lowest bid, which will invest the least money into Mumias, leave farmers and other debtors unpaid, while taking a decade to pay KCB back was chosen.

Read More: What Was the Real Reason Behind the Collapse of Mumias Sugar?

About Juma

Juma is an enthusiastic journalist who believes that journalism has power to change the world either negatively or positively depending on how one uses it.(020) 528 0222 or Email: info@sokodirectory.com

- January 2026 (220)

- February 2026 (243)

- March 2026 (75)

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (230)

- December 2025 (219)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)