Kenya Has The Highest Fuel Price Per Liter Across Africa

KEY POINTS

The total amount of taxes and levies that are imposed on fuel in Kenya is significant. In fact, it is estimated that taxes and levies account for about 40% of the retail price of fuel. This high level of taxation has a significant impact on the cost of living in Kenya and makes it difficult for businesses to operate.

The price of fuel in Kenya has been on the rise in recent years, and it is now one of the most expensive in Africa. In March 2023, the price of a liter of petrol in Kenya was $1.38, which is more than double the price in some other African countries.

This high price of fuel is a major burden on Kenyans, who are already struggling with the high cost of living.

Comparative Analysis:

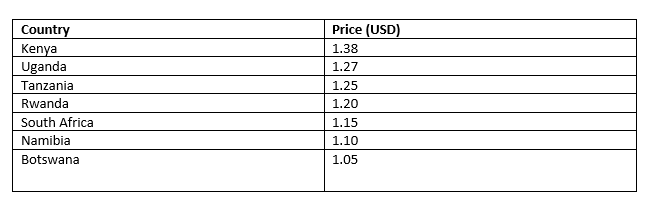

In order to understand why fuel prices are so high in Kenya, it is important to compare them to the prices in other African countries. The following table shows the price of a liter of petrol in a selection of African countries in March 2023:

Related Content: Super Petrol Up By Ksh 3, Diesel By Ksh 6, And The Hustlers Say “Amen”

As you can see, the price of petrol in Kenya is significantly higher than the price in most other African countries. This is due to a number of factors, including the high cost of crude oil, the high taxes and levies on fuel, and the weak Kenyan shilling.

Why is Kenya’s fuel the most expensive in Africa yet it is not a landlocked country? Here is why;

Levies and Taxes:

One of the main reasons why fuel prices are so high in Kenya is the high level of taxes and levies that are imposed on fuel. The Kenyan government taxes fuel at a rate of 33%, which is one of the highest rates in the world. In addition, there are a number of other levies that are imposed on fuel, such as the road maintenance levy and the railway development levy. These levies add an additional 10% to the cost of fuel. But what are these taxes and levies?

The following are the taxes and levies that are put on fuel in Kenya, making it the highest rate in the world.

- Excise duty: This is a tax that is levied on the sale of fuel. The excise duty on petrol is 12.95 shillings per liter, while the excise duty on diesel is 11.37 shillings per liter.

- Value-added tax (VAT): This is a tax that is levied on the sale of goods and services. The VAT on fuel is 8%.

- Road maintenance levy: This is a levy that is used to fund the maintenance of roads. The road maintenance levy on petrol is 18 shillings per liter, while the road maintenance levy on diesel is 15 shillings per liter.

- Petroleum development levy: This is a levy that is used to fund the development of the petroleum sector. The petroleum development levy on petrol is 5.40 shillings per liter, while the petroleum development levy on diesel is 2.20 shillings per liter.

- Railway development levy: This is a levy that is used to fund the development of the railway sector. The railway development levy on petrol is 0.40 shillings per liter, while the railway development levy on diesel is 0.20 shillings per liter.

- Anti-adulteration levy: This is a levy that is used to fund the fight against fuel adulteration. The anti-adulteration levy on petrol is 0.10 shillings per liter, while the anti-adulteration levy on diesel is 0.05 shillings per liter.

- Merchant shipping levy: This is a levy that is used to fund the development of the merchant shipping sector. The merchant shipping levy on petrol is 0.05 shillings per liter, while the merchant shipping levy on diesel is 0.02 shillings per liter.

In addition to these taxes and levies, there are also a number of other charges that are associated with the sale of fuel, such as the cost of transporting fuel to Kenya and the cost of refining fuel. These charges can add an additional 5% to the cost of fuel.

The total amount of taxes and levies that are imposed on fuel in Kenya is significant. In fact, it is estimated that taxes and levies account for about 40% of the retail price of fuel. This high level of taxation has a significant impact on the cost of living in Kenya and makes it difficult for businesses to operate.

Weak Kenyan Shilling:

Another factor that contributes to the high price of fuel in Kenya is the weak Kenyan shilling. The shilling has lost about 20% of its value against the US dollar in the past year, which has made imported goods, including fuel, more expensive.

Impact on Kenyans:

The high price of fuel has a significant impact on Kenyans. It makes it more expensive to transport goods and people, which drives up the cost of living. It also makes it more expensive to operate businesses, which can lead to job losses.

What Can Be Done to Make Fuel Affordable in Kenya?

There are a number of things that can be done to make fuel more affordable in Kenya. One option would be to reduce the taxes and levies that are imposed on fuel. This would lower the cost of fuel and make it more affordable for Kenyans. Another option would be to devalue the Kenyan shilling. This would make imported goods, including fuel, cheaper. However, this would also make Kenyan exports more expensive, which could lead to job losses.

Ultimately, the best way to make fuel more affordable in Kenya is to find a balance between reducing taxes and levies and maintaining a strong currency. This will require careful planning and coordination by the Kenyan government.

The high price of fuel in Kenya is a major burden on Kenyans. It is important to understand the factors that contribute to the high price of fuel in order to find ways to make it more affordable.

Related Content: Why Is Fuel So Expensive In Kenya Despite Global Prices Reducing?

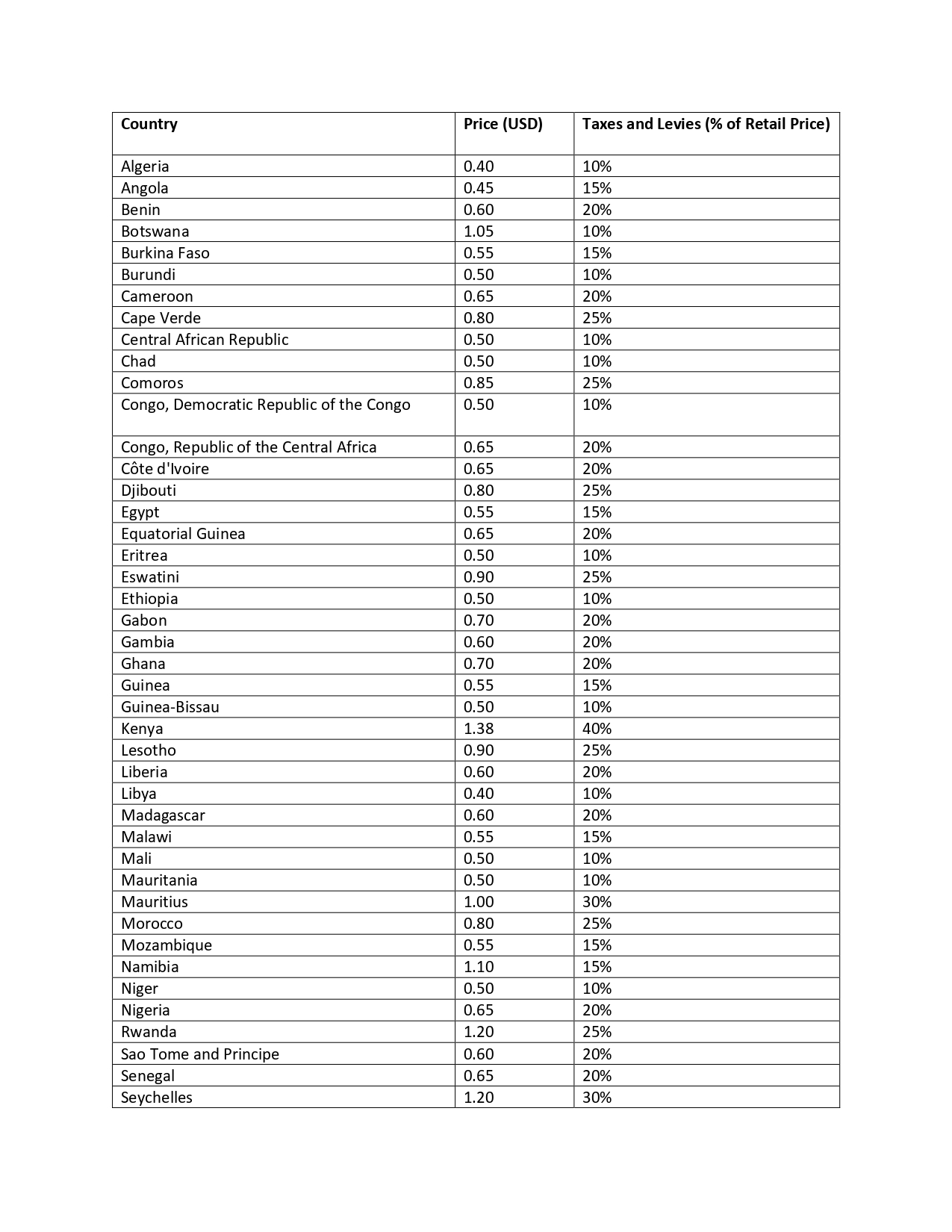

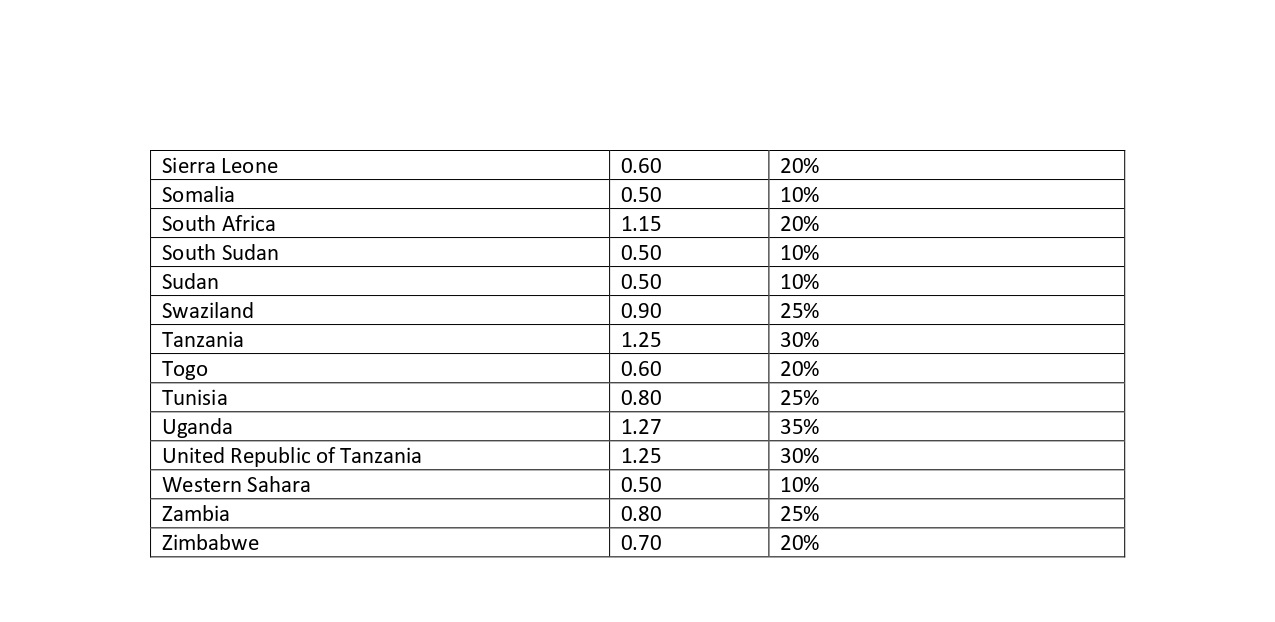

The table below shows a comparative analysis between Kenya and the rest of Africa. From the table, it is clear that Kenya has the most expensive in Africa and the top 5 in the world. This is where we need to have an honest conversation about reducing the taxes, levies, and charges so that we can reduce the cost of living and spur manufacturing.

As you can see, the price of fuel varies significantly from country to country in Africa. This is due to a number of factors, including the cost of crude oil, the level of taxes and levies on fuel, and the strength of the local currency. But this shows that Kenya has the highest taxes, levies, and charges. It is the most expensive in Africa.

Related Content: Fuel Prices to Go Up In The Coming Months, Here Is Why

About Steve Biko Wafula

Steve Biko is the CEO OF Soko Directory and the founder of Hidalgo Group of Companies. Steve is currently developing his career in law, finance, entrepreneurship and digital consultancy; and has been implementing consultancy assignments for client organizations comprising of trainings besides capacity building in entrepreneurial matters.He can be reached on: +254 20 510 1124 or Email: info@sokodirectory.com

- January 2026 (93)

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (230)

- December 2025 (219)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)