Money Market Liquidity Ups As Interbank Rate Dips

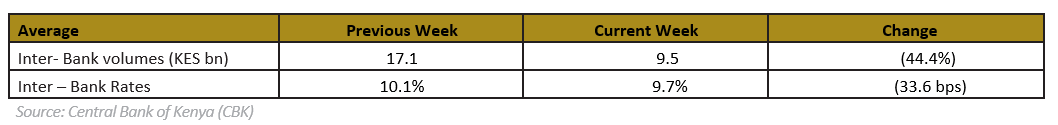

Money market liquidity improved during the week with the average interbank rate decreasing by 33.6 bps to 9.7 percent, from 10.1 percent recorded the previous week attributable to government payments that offset tax remittances.

The decline is the highest in almost six months. However, daily traded volumes averaged 9.5 billion shillings, a 44.4 percent decrease from 17.1 billion from the previous week.

The table below summarizes the market liquidity indicators:

Related Content: The Devastating Impact of Delayed Payments: A Looming Threat to SMEs In Kenya

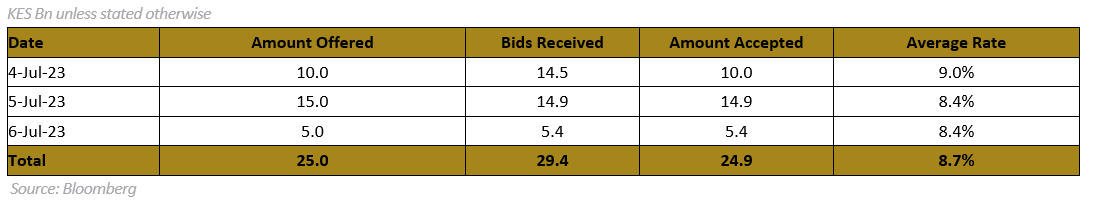

The Central Bank intended to mop a total of 24.9 billion shillings through 5-day, 6-day, and 7-day Term Auction Deposit in order to balance liquidity in the money market.

The regulator received bids worth 29.4 billion shillings and accepted 24.9 billion shillings worth of bids at the average rate of 8.7 percent as shown below;

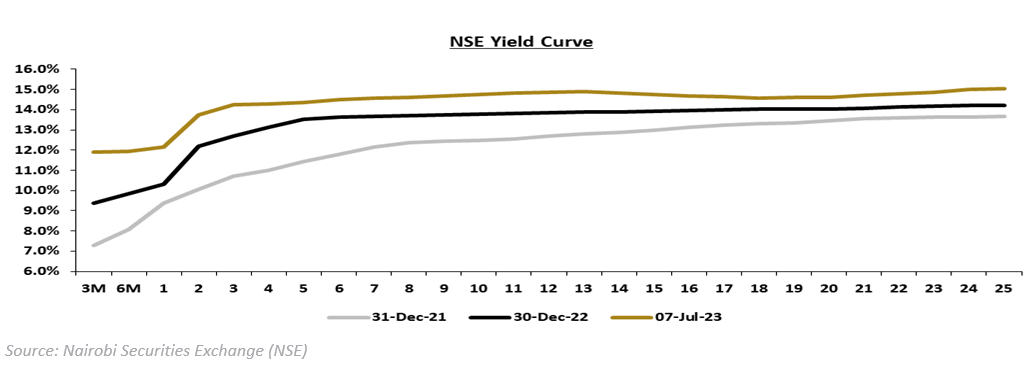

Yields on short-term and medium-term securities continue to rise faster than yields on long-term securities, reflecting short-term expectations of the country’s interest rate environment and the government’s heightened appetite for borrowing.

However, some upward movement was witnessed on the furthest tail of the yield curve. Specifically for Treasury Bills, the yields on the 364-day, 182-day and 91-day papers continued to rise to 12.250% (+9.3bps), 12.199% (25.2 bps) and 12.014% (+11.0bps), w/w respectively.

Related Content: Pesapal And Sokohela Partner To Launch New Credit Product For SMEs In Kenya

See below the performance of the yields on the government papers;

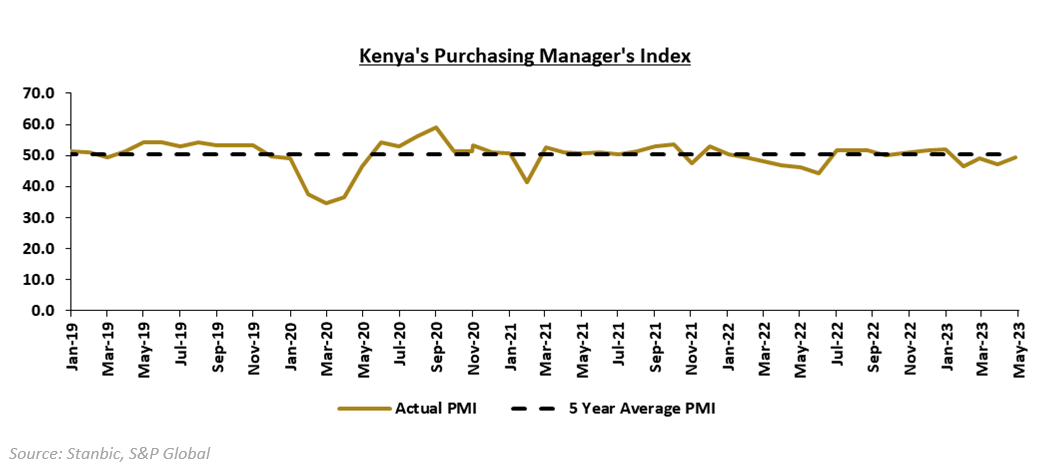

In other news, according to the most recent Purchasing Managers’ Index (PMI) data, Kenya’s private sector business conditions remained in the contraction zone in the month of June 2023 due to a faster increase in input prices which consequently led to an increase in output prices and a decline in new orders.

The scenario underlines the weakening of the Kenyan Shilling and elevated inflationary pressures with the rate still above the CBK target ceiling of 7.5%. The headline figure fell to 47.8, from 49.4 in May, signaling a sharper deterioration, albeit softer than the February and April deterioration.

Related Content: Kenya Private Sector Activity Dipped In June

See below a chart showing the evolution of Kenya’s PMI;

Related Content: Equity Turnover Ups 171%, Safaricom Sweeps The Counters

About Soko Directory Team

Soko Directory is a Financial and Markets digital portal that tracks brands, listed firms on the NSE, SMEs and trend setters in the markets eco-system.Find us on Facebook: facebook.com/SokoDirectory and on Twitter: twitter.com/SokoDirectory

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (226)

- August 2025 (211)

- September 2025 (270)

- October 2025 (162)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)