Foreign Outflows And Weak Indices Signal Fragile Investor Confidence At The NSE

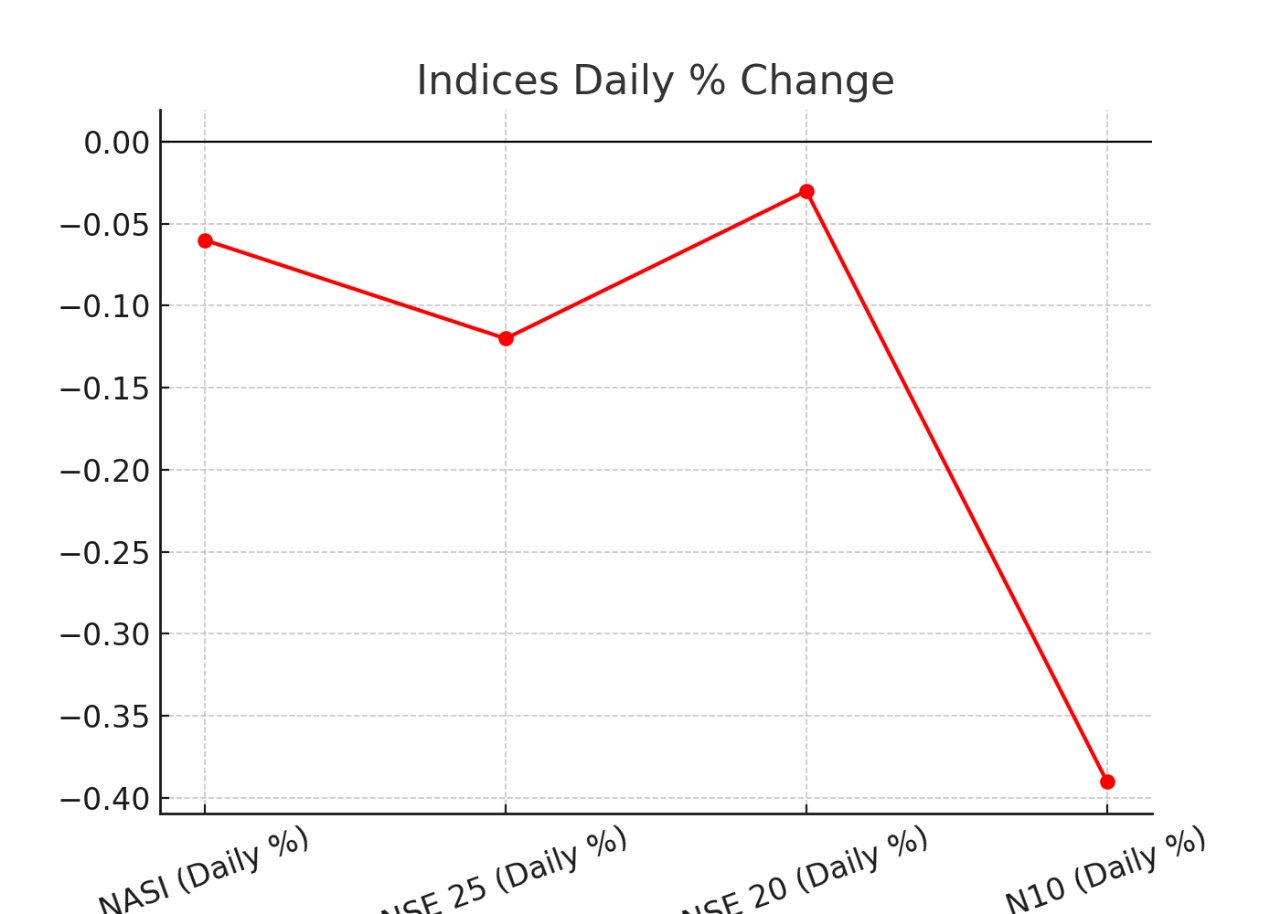

The Nairobi Securities Exchange ended the day under pressure as the NASI and NSE 25 both slipped 0.1%, while the NSE 20 remained flat and the N10 eased 0.4%. These small but broad-based dips highlight fragile sentiment across the board, with blue chips struggling to attract meaningful momentum.

Turnover fell 41.1% to USD 2.6m (KES 337.5m), underlining reduced appetite from investors. Local investors, however, stepped up, driving 62.1% of total activity compared to 41.5% the previous session. This shift shows rising domestic conviction even as foreign investors pulled back, raising concerns over capital flight.

Read Also: Why the NSE Must Diversify Beyond A Few Firms

Foreign investors registered net outflows of USD 590.8k, led by heavy selling on the Absa Gold ETF. Equity Group was the lone bright spot, attracting inflows. This bearish stance reflects global risk-off sentiment and highlights how quickly international investors can swing Kenyan markets.

On individual counters, KCB Group dominated turnover at 27.7%, its price rising 0.9% to KES 54.25 on strong local buying. Absa Gold ETF advanced 1.4% to KES 4,490.00, while Equity Group edged up 0.5% to KES 54.25. These moves confirm financial counters remain attractive amid volatility.

Read Also: New NSE Rules To Make It Easier For Small Investors To Trade – What It Means For You

Limuru Tea surged 10% to KES 374.75, cementing its place as the day’s top gainer, driven by speculative interest in thinly traded stocks. In contrast, Home Afrika plunged 9.8% to KES 1.01, cementing its position as the day’s biggest loser. Umeme also shed 8.6% to KES 7.62, hitting lows last seen in January 2023.

Market stability was reflected in EABL (KES 211.75), Safaricom (KES 28.70), and DTB (KES 104.74), all of which closed unchanged. Their flat performance underscores their defensive character, with investors holding steady despite foreign-driven outflows in other segments.

Overall, the session was a cautionary tale: foreign exits clipped turnover, local investors filled the gap, and select financial counters outperformed while smaller caps suffered. The story is clear—Kenya’s equity market remains resilient but exposed to the whims of global sentiment.

Read Also: Invinsense Powers End-to-End Security & Compliance For Lean Fintech Teams

About Soko Directory Team

Soko Directory is a Financial and Markets digital portal that tracks brands, listed firms on the NSE, SMEs and trend setters in the markets eco-system.Find us on Facebook: facebook.com/SokoDirectory and on Twitter: twitter.com/SokoDirectory

- January 2026 (220)

- February 2026 (243)

- March 2026 (72)

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (230)

- December 2025 (219)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)