MMFs Are Not Investments — Stop Lying To Yourself. They Are The Best Way To Save

There has been endless debate in offices, WhatsApp groups, and Twitter spaces about whether Money Market Funds (MMFs) are investments. Let’s be clear: the best way to cut through the noise is to separate saving from investing. Too many Kenyans confuse the two, and that’s why they mismanage their money. If you put KSh 100,000 into a product, do you want safety and accessibility, or do you want growth with risk? That is the real question.

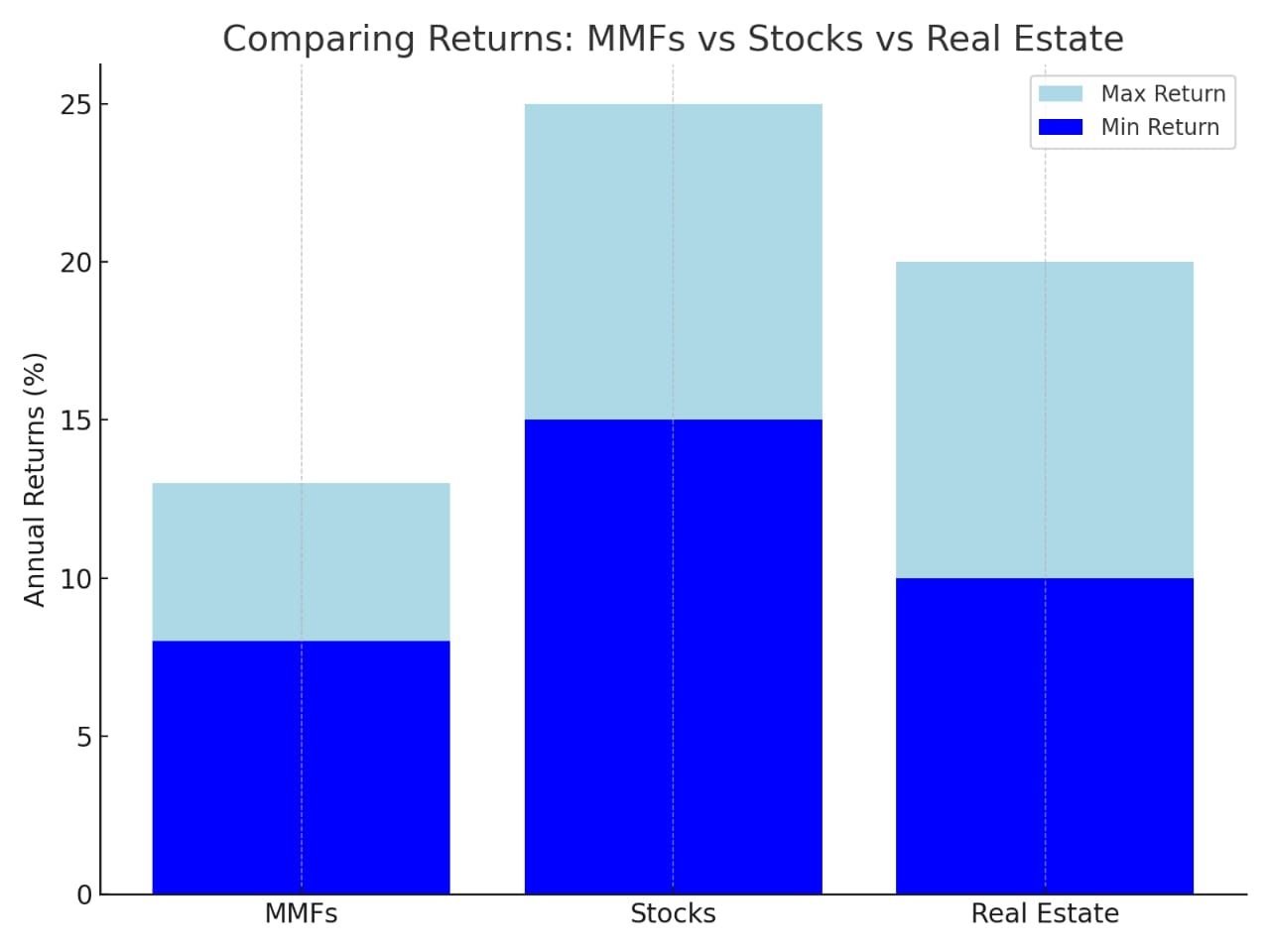

Saving is about safety. You put aside money in a low-risk environment where your capital is protected. Think of it as a financial parking lot — your KSh 50,000 will still be KSh 50,000 next month, next year, and five years from now, with a little “thank you” interest on top. Because the risk is low, the returns are also low, often 3–8% annually. That is the price of peace of mind and liquidity — having your cash when you need it.

Investing, on the other hand, is a completely different animal. It’s long-term, it’s risky, and it can reward you handsomely or punish you harshly. If you put KSh 200,000 into stocks, property, or a business, you may double it in five years, or you may lose half in a single bad year. Investments bring capital growth through dividends, rents, or capital gains, but they also carry the risk of capital losses. With investing, your KSh 200,000 today might be KSh 350,000 tomorrow, or KSh 120,000 if things go south.

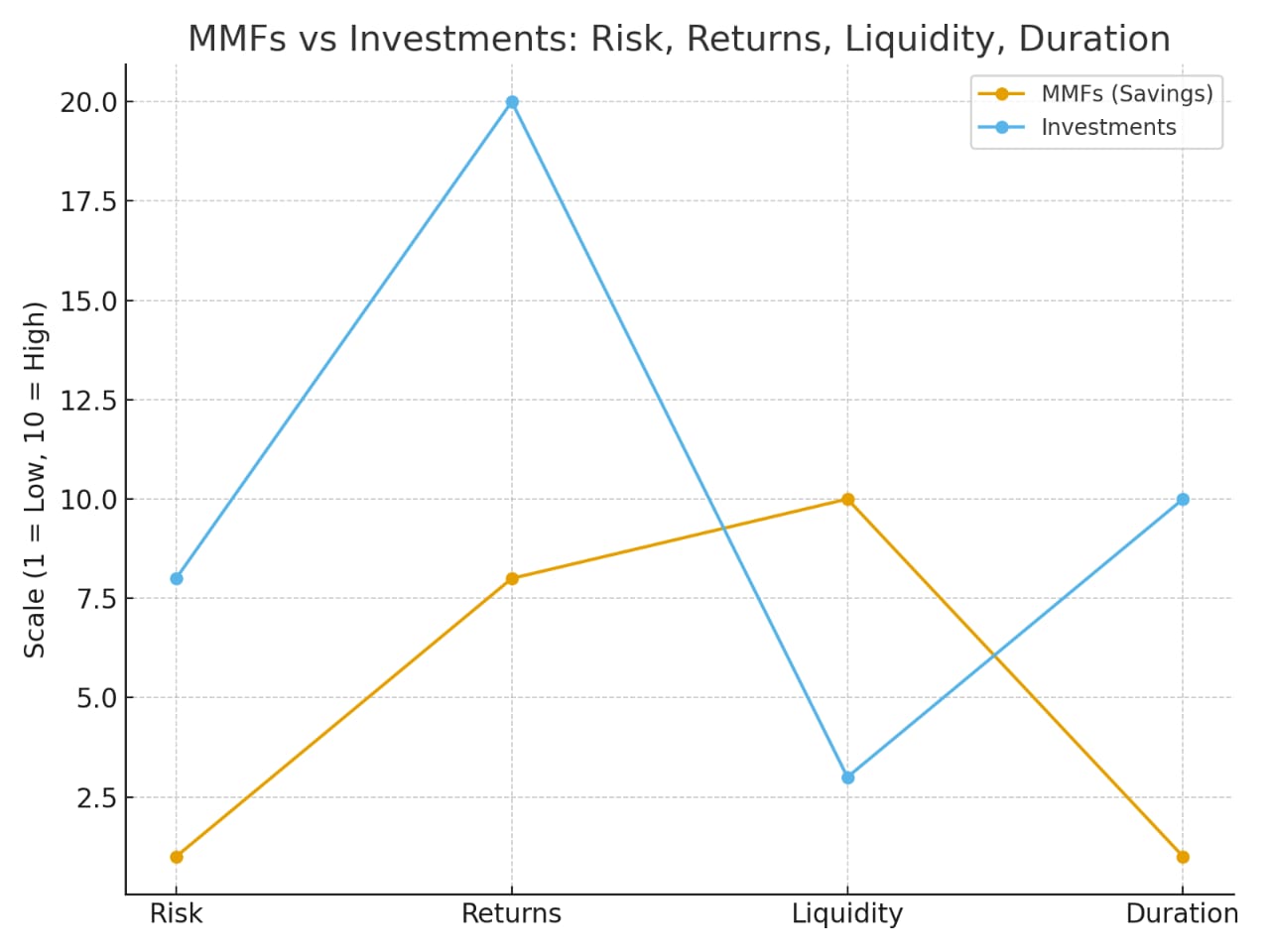

This is why definitions matter. Savings are short-term, safe, and liquid. Investment is long-term, risky, and volatile. When you hear people throwing around the words interchangeably, remember that they are mixing apples and oranges. A 7% MMF yield and a 20% stock market return are not the same species. They serve different purposes in your financial life. Liquidity, duration, and risk are the true dividing lines.

So where do MMFs stand? Strictly speaking, MMFs fall under the savings category. Why? Because most MMFs place your money in government securities, treasury bills, and bank deposits — the safest assets available. In Kenya, MMFs currently yield between 8% and 13% per year, depending on the fund. Compare that with the 3–5% interest you get from a normal savings account, and MMFs look more attractive. But let’s not lie to ourselves: this is still saving, not investing.

Now, there are exceptions. Special funds that venture into corporate bonds, equities, or commercial paper introduce real risk. In those cases, capital is no longer guaranteed. Your KSh 100,000 can shrink. At that point, you are no longer saving, you are investing. But the ordinary MMF that your bank or insurance company sells you? That is a savings product dressed up in investment clothes. It’s stable, predictable, and safe, but don’t expect miracles.

People love to complain that MMFs are “too low.” But what did you expect? If you earn 9% per year, that’s KSh 9,000 on every KSh 100,000 you’ve put in. Compare that with inflation, currently hovering around 6–7%. That means your money is keeping pace with rising prices. If you wanted 30% returns, then you must accept the risk of losing it all. That’s how the financial world works — no free lunch, no shortcuts.

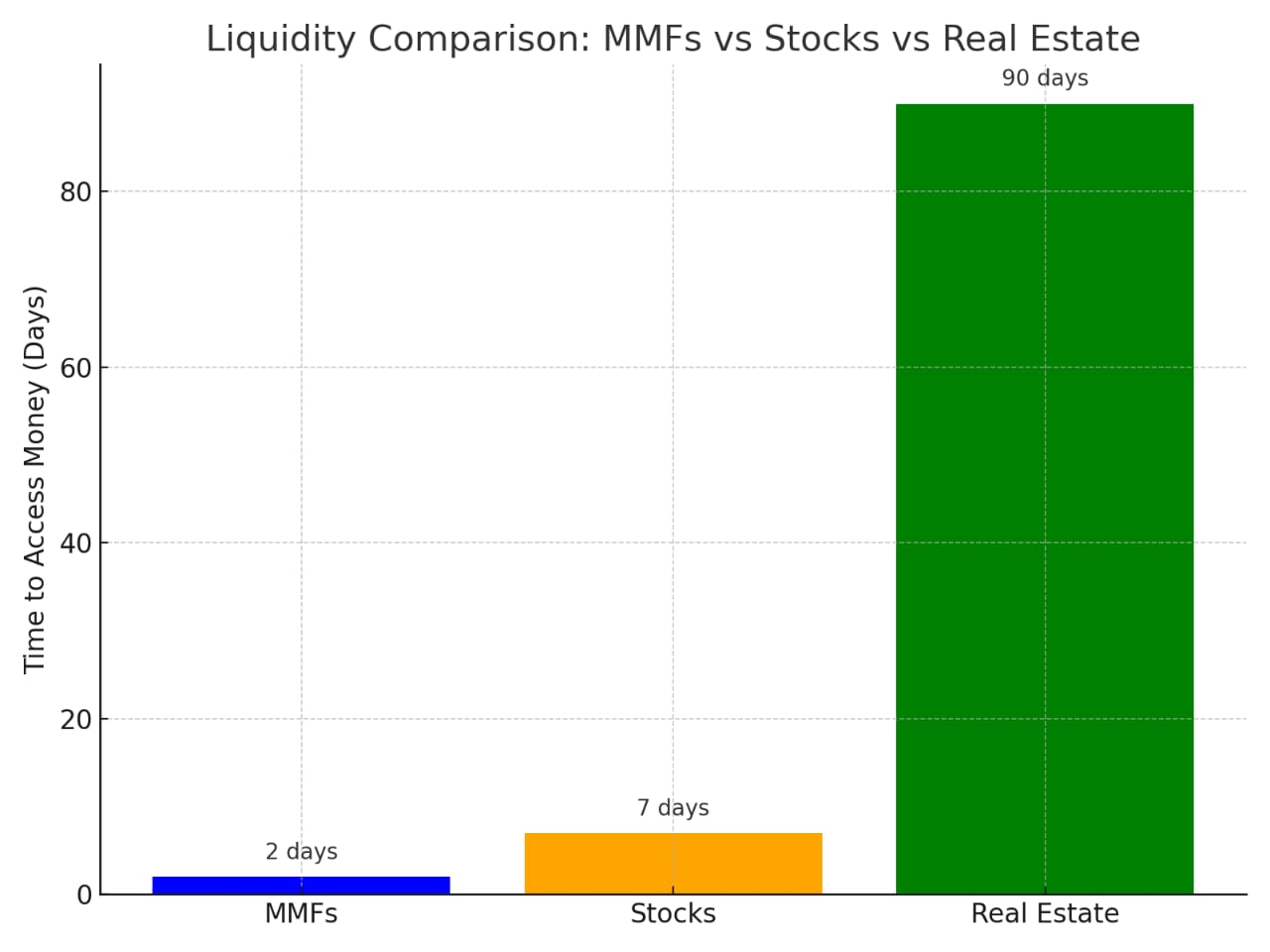

The real beauty of MMFs lies in liquidity. Imagine you’ve parked KSh 200,000 in an MMF, and an emergency strikes tomorrow. Most funds let you withdraw in 2–4 days. Some, like Ziidi MMF linked to M-PESA, let you access your money instantly. That convenience is priceless. Yes, maybe you’re getting “just” 8% instead of 12% elsewhere, but the ability to pull out your cash when needed is worth far more than chasing a few extra shillings in return.

If you want true growth, then stop crying about MMFs and start exploring actual investments: equities, land, real estate, agribusiness, or even your own company. The Nairobi Securities Exchange has had stocks like Safaricom and Equity Bank deliver over 15% annualized returns over the last decade. But along the way, prices crash, sometimes by 30–40% in a year. Can you stomach that? If not, then stay in the comfort of your MMF and accept your 9%.

This is not about competition between products. It is about alignment with your financial goals. Use MMFs as your short-term money home — your emergency fund, your parking spot for school fees, your bridge while you wait for a deal to close. Use investments for wealth-building over 5, 10, or 20 years. The problem is when people expect one product to serve all purposes. That is financial laziness disguised as ambition.

So here is the hard truth: MMFs are savings products. Stop calling them investments. Stop demanding stock market-level returns from treasury-bill-level risk. If you want to grow wealthy, you need both: the calm reliability of MMFs for short-term money and the wild volatility of investments for long-term growth. The secret is knowing which bucket your money belongs in. Only then will you stop being frustrated and start being financially wise.

Read Also: CMMF And Zimele Best Performing Money Market Funds In Kenya

About Steve Biko Wafula

Steve Biko is the CEO OF Soko Directory and the founder of Hidalgo Group of Companies. Steve is currently developing his career in law, finance, entrepreneurship and digital consultancy; and has been implementing consultancy assignments for client organizations comprising of trainings besides capacity building in entrepreneurial matters.He can be reached on: +254 20 510 1124 or Email: info@sokodirectory.com

- January 2026 (220)

- February 2026 (243)

- March 2026 (75)

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (230)

- December 2025 (219)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)