Standard Chartered Kenya: Cracks Beneath the Shine

Standard Chartered Bank Kenya has long been considered a pillar of stability within the Nairobi Securities Exchange. For years, it has maintained a reputation for strong governance, steady dividends, and relative calm in an otherwise turbulent market. Yet the recent profit warning projects a more fragile reality.

The bank’s announcement that FY 2025 profits after tax will drop by over 25% compared to FY 2024 shook investors who have relied on its consistency. The numbers point not only to weaker earnings but also to legal challenges that continue to drain resources. This dual threat exposes vulnerabilities beneath its polished corporate image.

A bank that has built its story around reliability now faces the uncomfortable question of sustainability. With earnings under pressure, the focus naturally shifts to dividends. Standard Chartered has historically rewarded shareholders generously, often ranking among the top dividend-paying counters. That tradition is now under direct threat.

Dividends have served as the glue holding investor confidence together, particularly for foreign funds that value yield more than price appreciation. If payouts are slashed, as current projections suggest, the bank could risk alienating its core investor base. A potential cut would echo across the NSE, shaking income investors.

Read Also: Standard Chartered Bank’s Net Profit Surges to Ksh 20 Billion On Strong Income Growth

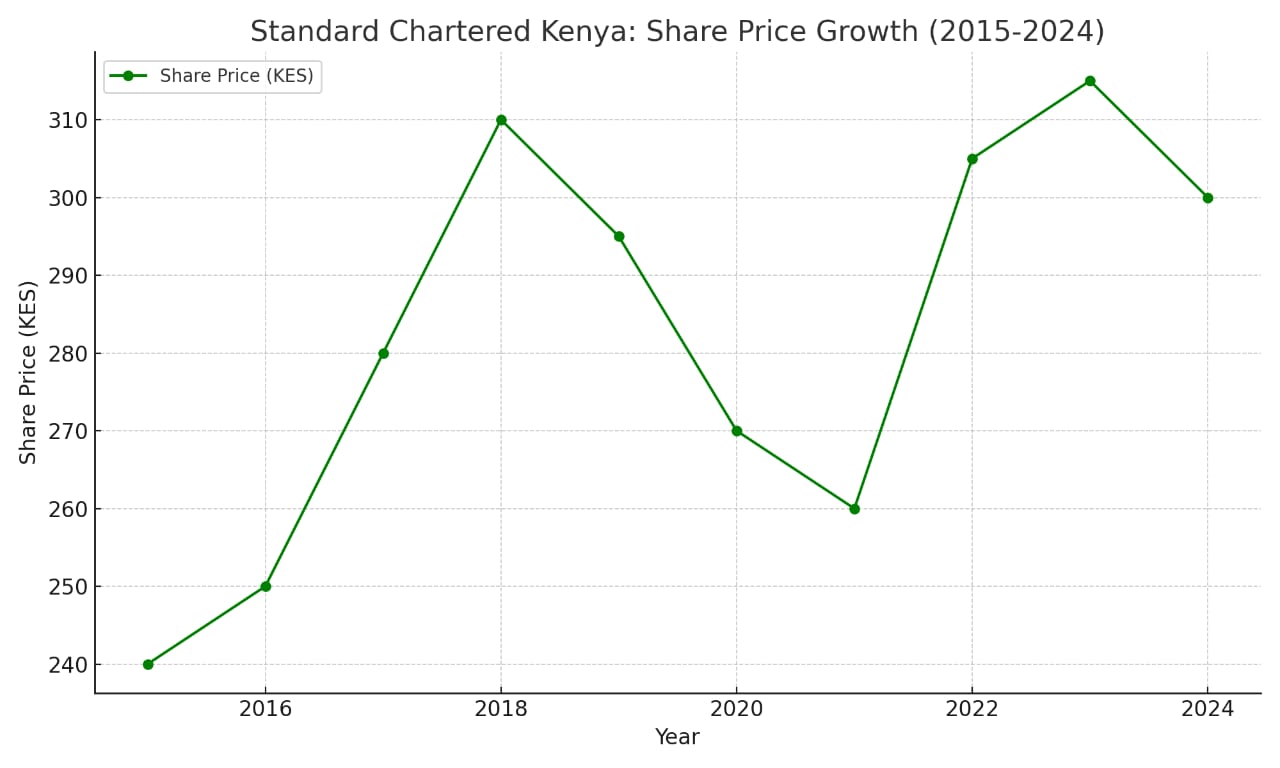

The irony lies in the share price itself. Even amid the profit warning, the counter has remained stubbornly above the KSh 300 mark. This resilience raises questions about investor psychology. Are markets pricing in a quick turnaround, or are they clinging to history rather than confronting present realities?

A closer look at market behavior suggests that foreign investor flows may be playing a role. Standard Chartered’s global brand carries weight, and institutional investors often hold long-term positions despite short-term turbulence. This global cushion could explain the surprising resilience above KSh 300.

Yet the Kenyan retail investor reads the story differently. For many, the profit warning signals a time to reassess. The rise of alternative dividend stocks, from NCBA to Co-operative Bank, creates competition for income-seeking capital. If Stanchart’s yield drops below par, its status as a dividend darling could fade.

Legal settlements add another layer of complexity. Court cases and their financial toll create an image of a bank weighed down by legacy issues. The cost of compliance and legal exposure is not merely a line item—it chips away at trust and positions the bank as reactive rather than proactive.

The broader banking sector paints a contrasting picture. Rivals like Equity and KCB have been more aggressive in retail expansion, digital banking, and regional growth. Stanchart’s focus has been conservative, prioritizing stability over innovation. But in an era of fintech disruption, conservatism risks stagnation.

Share price data from the last decade reflects this tension. Stanchart has enjoyed periods of impressive growth, peaking above KSh 310, but its trajectory has been inconsistent. Dividend yields have similarly oscillated, reflecting underlying volatility in performance rather than steady upward momentum.

The debate now is whether the bank is undergoing a temporary stumble or facing structural decline. Optimists argue that its deep pockets, multinational backing, and disciplined management will cushion the storm. Pessimists warn that its cautious approach leaves it ill-equipped for a hyper-competitive market.

Investors are thus forced into a balancing act: reward history or react to present weakness. A dividend slash would represent more than reduced income—it would be symbolic, a break from tradition that could redefine the counter’s identity. It would signal that even Stanchart cannot escape market forces.

Regulators are also watching. Profit warnings from tier-one banks ripple across the financial system. Pension funds, insurance companies, and foreign investors with heavy exposure to the counter may have to adjust their portfolios, impacting liquidity and confidence in the broader NSE.

At the same time, the resilience of the counter above KSh 300 suggests there is still faith in the brand. Faith, however, is not infinite. Sustained underperformance will eventually erode goodwill. Markets may be patient, but they are not blind.

A key question is whether management will use this moment as a turning point. Will Stanchart invest in digital transformation and regional expansion, or double down on its traditional conservative strategy? The answer will shape not only its profits but its identity in the next decade.

The dividend graph over the last ten years shows both strength and fragility. Yields once comfortably above 8% have slid, reflecting pressure on profitability. Meanwhile, the share price graph demonstrates volatility masked by occasional rallies. Together, they tell a story of a bank caught between legacy and renewal.

For shareholders, the debate is not simply about numbers but about philosophy. Do they continue to back a bank that prizes safety, or shift to peers willing to take risks for growth? The NSE itself is watching closely, as Stanchart’s movements set tone for market confidence.

In a broader Kenyan context, the story reflects the country’s economic contradictions. Legacy institutions face pressure from agile, tech-driven competitors, while investors cling to symbols of stability in uncertain times. Stanchart embodies both the promise and the peril of this moment.

As the profit warning sinks in, debate will rage among analysts, investors, and regulators. But one truth remains clear: Standard Chartered Kenya can no longer rely on history alone. Its next moves will determine whether it emerges as a resilient survivor or fades into cautious irrelevance.

The KSh 300 question remains a riddle. Is the share price a show of confidence or a mirage waiting to break? The coming financial year will answer that question with brutal clarity. Investors, regulators, and the market at large are watching closely, for this is no longer just about a bank—it is about trust.

Read Also: Standard Chartered, Prudential Sign Bancassurance Partnership Targeting Affluent Customers

About Steve Biko Wafula

Steve Biko is the CEO OF Soko Directory and the founder of Hidalgo Group of Companies. Steve is currently developing his career in law, finance, entrepreneurship and digital consultancy; and has been implementing consultancy assignments for client organizations comprising of trainings besides capacity building in entrepreneurial matters.He can be reached on: +254 20 510 1124 or Email: info@sokodirectory.com

- January 2026 (220)

- February 2026 (243)

- March 2026 (82)

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (230)

- December 2025 (219)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)