Banking On Africa: Unlocking Capital And Partnerships For Sustainable Growth

A new white paper by the United Bank for Africa (UBA) has called for a fundamental shift in how Africa funds its growth, one that redefines the continent’s development narrative from one of dependency to one of self-determination.

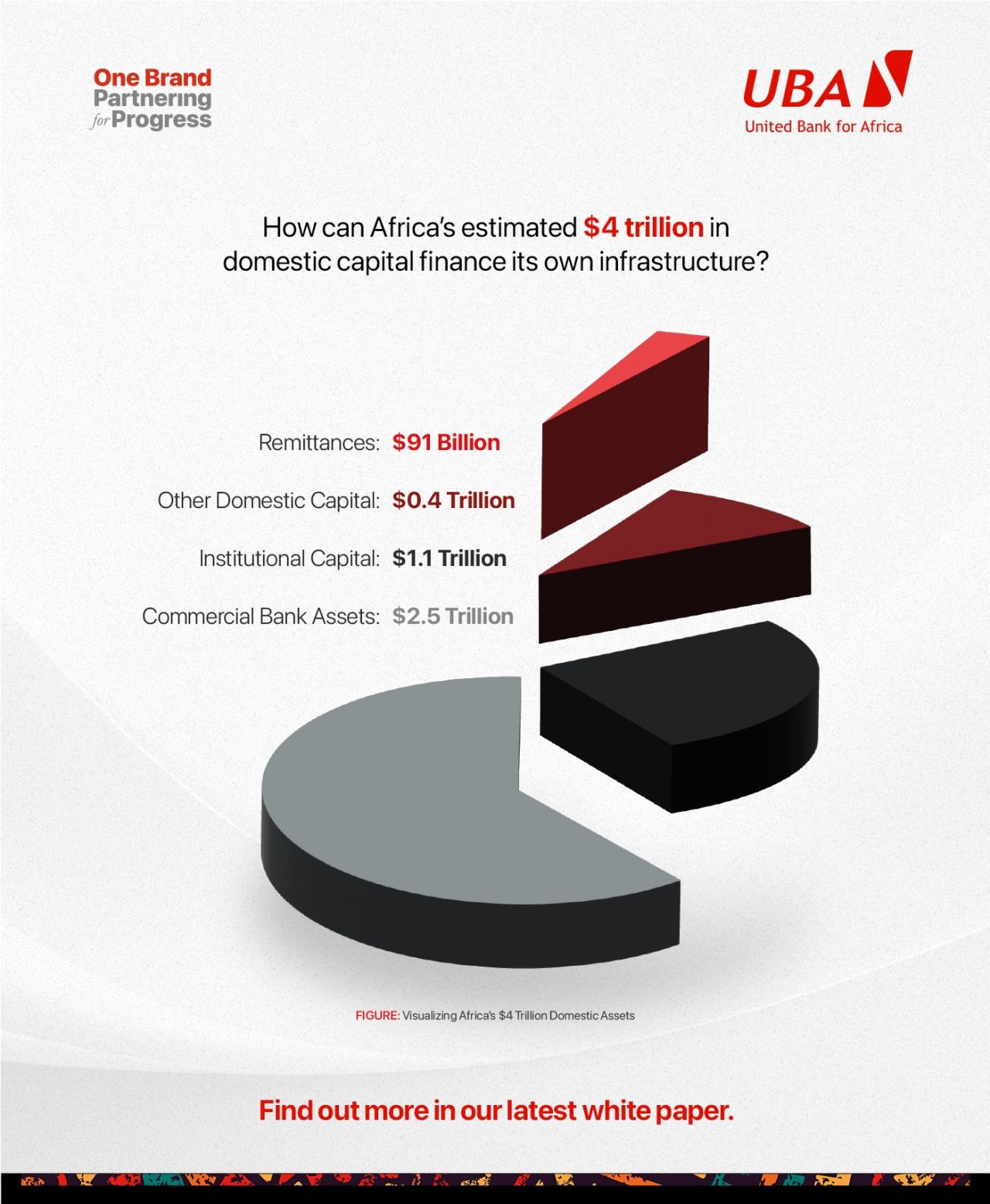

Titled “Banking on Africa: Unlocking Capital and Partnerships for Sustainable Growth,” the report reveals that Africa holds an estimated $4 trillion in domestic financial assets, yet less than 15 percent of this capital is directed toward productive infrastructure—the very foundation of economic expansion.

“This is not a scarcity of capital, but an opportunity for more effective allocation,” said Oliver Alawuba, UBA Group Managing Director. “Africa’s transformation will be built on African capital, partnerships, and innovation working together.”

From Aid to Investment: A New Growth Paradigm

UBA’s paper highlights a new paradigm rooted in investment-centered partnerships rather than aid-heavy models. It calls for African institutions to integrate domestic and international capital strategies, blending commercial viability with social impact through “solution-oriented finance.”

This reframing, the report argues, could unlock a powerful multiplier effect—reducing reliance on external funding, enhancing sovereignty, and attracting global partners into African-led financing mechanisms.

Infrastructure as the Engine of Integration

The paper emphasizes that the path to inclusive growth lies in mobilizing domestic institutional capital for infrastructure development.

It cites successful national models:

Nigeria’s InfraCredit which has facilitated over $278 million in infrastructure bonds tailored for pension fund investment.

Kenya’s Pension Funds Investment Consortium (KEPFIC), pooling 24 schemes to raise $113 million for infrastructure projects, has with oversubscription rate of 157 percent.

Ghana’s Infrastructure Investment Fund (GIIF), co-financing with banks and DFIs to leverage $325 million in equity across a $3.6 billion project portfolio.

Such initiatives, UBA notes, demonstrate how institutional investors can channel long-term capital into energy, transport, and digital infrastructure—sectors vital for regional competitiveness.

AfCFTA: Powering Trade and Connectivity

Central to UBA’s vision is the African Continental Free Trade Area (AfCFTA), described as “the architectural blueprint for integration.” The bank projects intra-African trade to grow by over 12 percent in 2025, reaching $220 billion, driven by new market access for SMEs and more resilient supply chains.

The report further highlights the Pan-African Payment and Settlement System (PAPSS)—the digital backbone of AfCFTA, as a transformative tool. By enabling instant payments in local currencies and saving the continent $5 billion annually in transaction costs, PAPSS promises to accelerate trade velocity and financial inclusion.

Sustainability and Green Finance

The paper calls on African banks and governments to align infrastructure growth with sustainability principles, advocating for green bonds and blended finance mechanisms that attract both domestic and global investors. It urges the creation of “appropriate investment vehicles” that balance environmental responsibility with commercial returns, ensuring that Africa’s infrastructure boom does not come at the planet’s expense.

A Collaborative Roadmap for Action

UBA’s proposed roadmap identifies five areas for reform:

Scaling blended finance to de-risk private investment.

Pooling regional capital for large-scale projects.

Developing green and infrastructure bonds for pension funds.

Harmonizing regulations to ease cross-border investment.

Leveraging digital infrastructure for transparency and efficiency.

Africa’s Global Bank, Africa’s Vision

Operating in 20 African countries and global financial centers, including New York, London, Paris, and Dubai, UBA positions itself as a bridge between African opportunity and global capital. Through initiatives like its $6 billion AfCFTA partnership and collaboration with the African Development Bank, UBA is demonstrating how financial institutions can turn policy blueprints into bankable realities.

“Africa doesn’t lack capital—it lacks coordination,” the report concludes. “By unlocking even a fraction of its own financial resources, the continent can finance the roads, power grids, and digital highways that will define the next century of African prosperity.”

Read Also: UBA Kenya Empowers SMEs to Trade Faster, Safer, And Smarter Across Borders

About Soko Directory Team

Soko Directory is a Financial and Markets digital portal that tracks brands, listed firms on the NSE, SMEs and trend setters in the markets eco-system.Find us on Facebook: facebook.com/SokoDirectory and on Twitter: twitter.com/SokoDirectory

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (230)

- December 2025 (162)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)