Growth of Africa’s Instant Payment Systems Accelerates Between July 2024 and June 2025

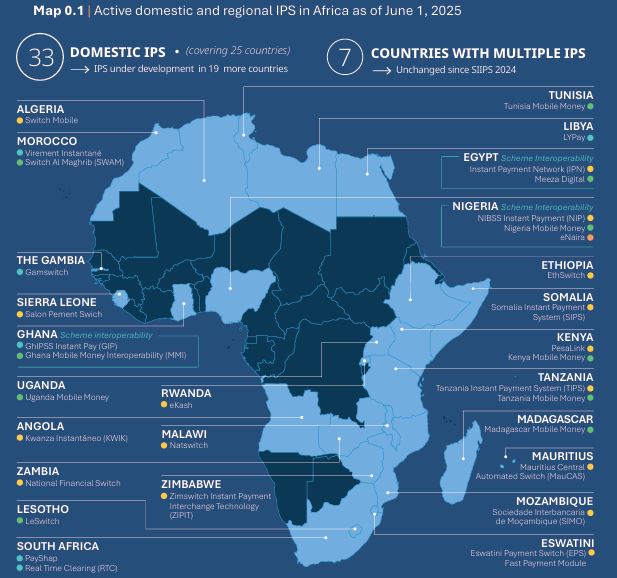

Africa’s journey toward seamless, real-time payments continues to gain momentum. Between July 2024 and June 2025, five new domestic Instant Payment Systems (IPS) went live across the continent, raising the total number of domestic systems to 33 across 25 countries. This is according to the SIIPS 2025 Report.

This marks a significant expansion from the 31 live systems recorded in June 2024. When combined with the three active regional systems, the total number of live IPS platforms across Africa reached 36 as of June 2025.

The continued growth in domestic and regional payment infrastructure highlights Africa’s rapid adoption of digital financial systems designed to enable faster, cheaper, and more secure transactions. Each new IPS represents a step forward in strengthening financial integration and reducing the reliance on cash-based transactions across the continent.

The five new systems launched within this period reflect a diverse mix of technological innovation and cross-sector collaboration. They include Switch Mobile in Algeria, Eswatini Payment Switch (EPS) Fast Payment Module, LYPay in Libya, Salon Pement Swich in Sierra Leone, and the Somalia Instant Payment System (SIPS). These additions demonstrate a continent-wide drive to modernize financial infrastructure and deepen financial inclusion through interoperability between banks and non-bank financial service providers.

In addition to the new launches, there were notable changes in the naming and classification of several systems. Two systems listed in the SIIPS 2025 report were recorded under new names compared with SIIPS 2024.

Morocco’s MarocPay has been renamed Switch Al Maghrib (SWAM), while Taifa Moja in Tanzania is now referred to as Tanzania Mobile Money. These renamings often reflect institutional restructuring, rebranding efforts, or shifts in ownership and operational focus, underscoring the evolving nature of Africa’s payments ecosystem.

Furthermore, two systems underwent reclassification based on the categories of Payment Service Providers (PSPs) they allow to participate. SWAM (Morocco) was reclassified from a cross-domain IPS to a mobile money IPS, signaling a stronger focus on mobile-led transactions and services. Conversely, PesaLink (Kenya)—previously categorized as a bank IPS—was reclassified as a cross-domain IPS, recognizing its broader interoperability with both banks and non-bank PSPs. These changes illustrate the dynamic adaptation of IPS frameworks to reflect the realities of market participation and technological advancement.

Of the five new systems introduced between July 2024 and June 2025, four are cross-domain platforms, meaning they support participation by both banks and non-bank financial institutions such as mobile money operators and fintechs (see Box 0.3). The four systems—Switch Mobile (Algeria), EPS Fast Payment Module (Eswatini), Salon Pement Swich (Sierra Leone), and SIPS (Somalia)—are designed to promote greater financial inclusion through interoperability. By enabling users across different financial networks to send and receive money seamlessly, these systems are laying the groundwork for a more integrated and efficient digital economy.

The classification of an IPS “type” depends on its interoperability arrangements, which determine the range of PSPs allowed to participate (see Box 0.2). As more countries adopt cross-domain frameworks, Africa is moving closer to achieving universal real-time payment interoperability—one that bridges traditional banking and digital financial services, empowers consumers, and accelerates economic growth through faster and more reliable payment systems.

Read Also: 49 Billion Transactions Were Processed Across The African Continent – SIIPS Report 2024

About Soko Directory Team

Soko Directory is a Financial and Markets digital portal that tracks brands, listed firms on the NSE, SMEs and trend setters in the markets eco-system.Find us on Facebook: facebook.com/SokoDirectory and on Twitter: twitter.com/SokoDirectory

- January 2026 (220)

- February 2026 (243)

- March 2026 (62)

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (230)

- December 2025 (219)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)