NASI and NSE 20 At The NSE Rally Even as Market Turnover Drops Sharply

Wednesday’s market is moving with a steady but confident upward rhythm, signalling renewed investor appetite across Kenya’s equities landscape. The session is closing on a bullish note, and every number on the board is telling a story — a story of shifting sentiment, shifting liquidity, and shifting investor psychology.

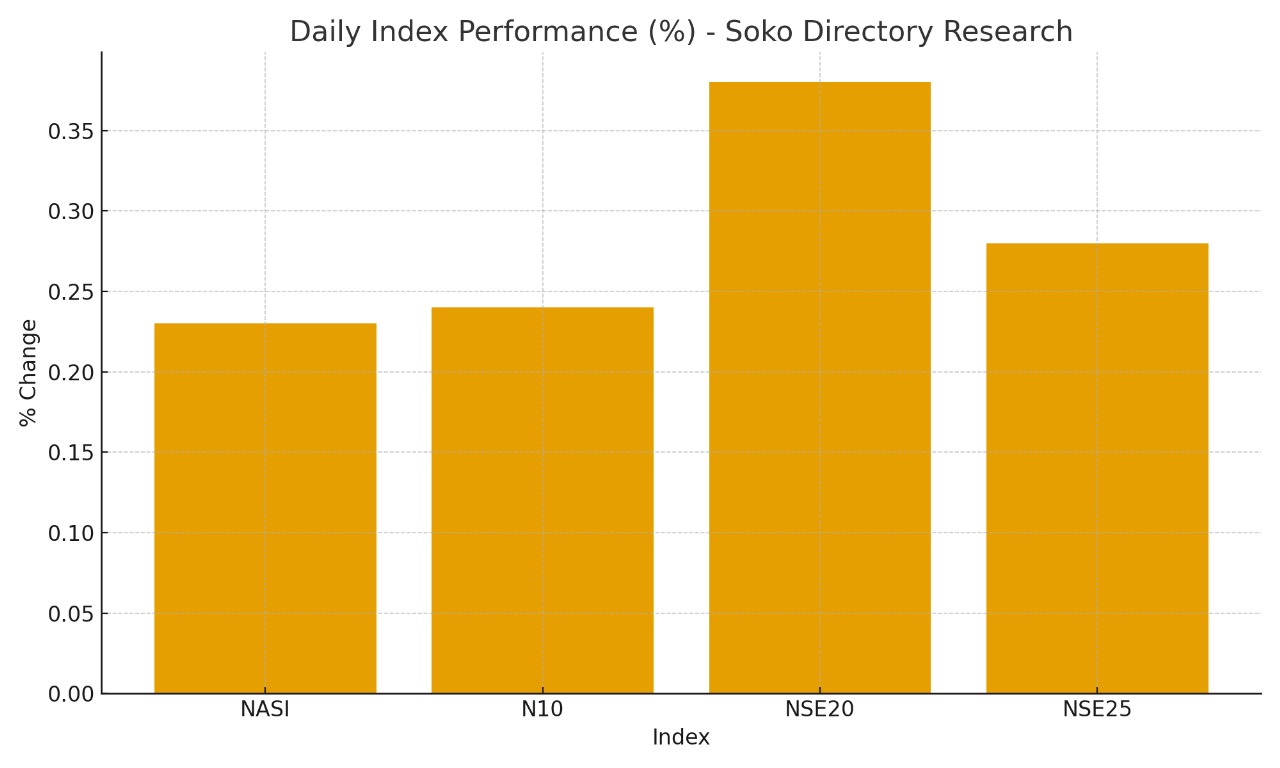

The NASI is rising by 0.2%, meaning that the general market value across all listed counters is climbing as investors are willing to pay slightly more for broad Kenyan equities. The N10 is matching this energy with another 0.2%, showing that the most liquid blue-chip companies are experiencing similar buy-side momentum. At the same time, the NSE 20 Index is advancing by 0.4%, a significant move because this index is price-weighted and reacts strongly when heavyweight counters tick upwards. The NSE 25 is adding 0.3%, demonstrating that the mid-to-large cap segment is pulling in stable demand.

Equity turnover is easing to USD 3.0 million, down by 18.2%, showing that while the market is rising, traders are transacting with more caution — fewer shares changing hands, but at firmer prices. This tells us today’s buyers are deliberate and value-driven rather than speculative. Local investors are controlling 76.0% of all market activity, down from 91.8% the previous Friday, showing that foreign investors are slowly creeping back into the market, though still selectively.

Equity Group is commanding the stage, contributing 26.1% of all turnover. Its price is rising by 1.2% to KES 64.75, signalling confidence ahead of year-end banking sector disclosures. StanChart is inching up by 1.1% to KES 305.75, driven by quiet accumulation from institutional desks. Co-op Bank is rising by 0.4% to KES 24.90, mirroring sustained retail and pension-fund interest.

KCB and Safaricom are sitting in positions of calm stability — unchanged at KES 65.00 and KES 29.00 — a sign that the market is holding its breath for upcoming catalysts. Kenya-Re is slipping by 0.6% to KES 3.15, the lone top mover losing ground as investors trim exposure ahead of sector-specific events.

ABSA Gold is exploding upward by 8.7% to KES 5,180.00, making it the day’s stand-out gainer as hard-asset ETFs continue benefiting from global uncertainties. On the other hand, Flame Tree is shedding 6.5% to KES 1.45, becoming the day’s harshest loser as supply overwhelms demand.

Foreign investors are turning net sellers with an outflow of USD 505.7K, signalling profit-taking behaviour. KCB is attracting foreign buys while Safaricom is attracting foreign sells — a familiar pattern reflecting valuation and dividend dynamics.

The market is now positioning ahead of ABSA’s 3Q25 earnings release tomorrow, a catalyst expected to shape banking-sector flows for the rest of the month.

About Steve Biko Wafula

Steve Biko is the CEO OF Soko Directory and the founder of Hidalgo Group of Companies. Steve is currently developing his career in law, finance, entrepreneurship and digital consultancy; and has been implementing consultancy assignments for client organizations comprising of trainings besides capacity building in entrepreneurial matters.He can be reached on: +254 20 510 1124 or Email: info@sokodirectory.com

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (226)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (156)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)