NCBA: The Bank That Builds Kenya’s Entrepreneurs From the Ground Up

In the heart of Nyeri, a quiet revolution is taking place—one that is being led not by politicians or big corporations, but by transporters, small traders, and enterprising men and women who have found a reliable partner in NCBA Bank. At a recent workshop attended by over 200 transporters in Nyeri and Karatina, the message was clear: NCBA is not just another bank—it is a builder of dreams, a mentor to hustlers, and a powerful engine for the region’s economic growth.

With a laser focus on SMEs, NCBA is proving that access to credit does not have to be a frustrating process riddled with bureaucratic hurdles and high interest rates. Instead, through tailor-made solutions like Asset Financing, Insurance Premium Financing, stock loans, and smart cash management services, the bank is actively breaking down financial barriers and enabling Nyeri’s business community to scale sustainably.

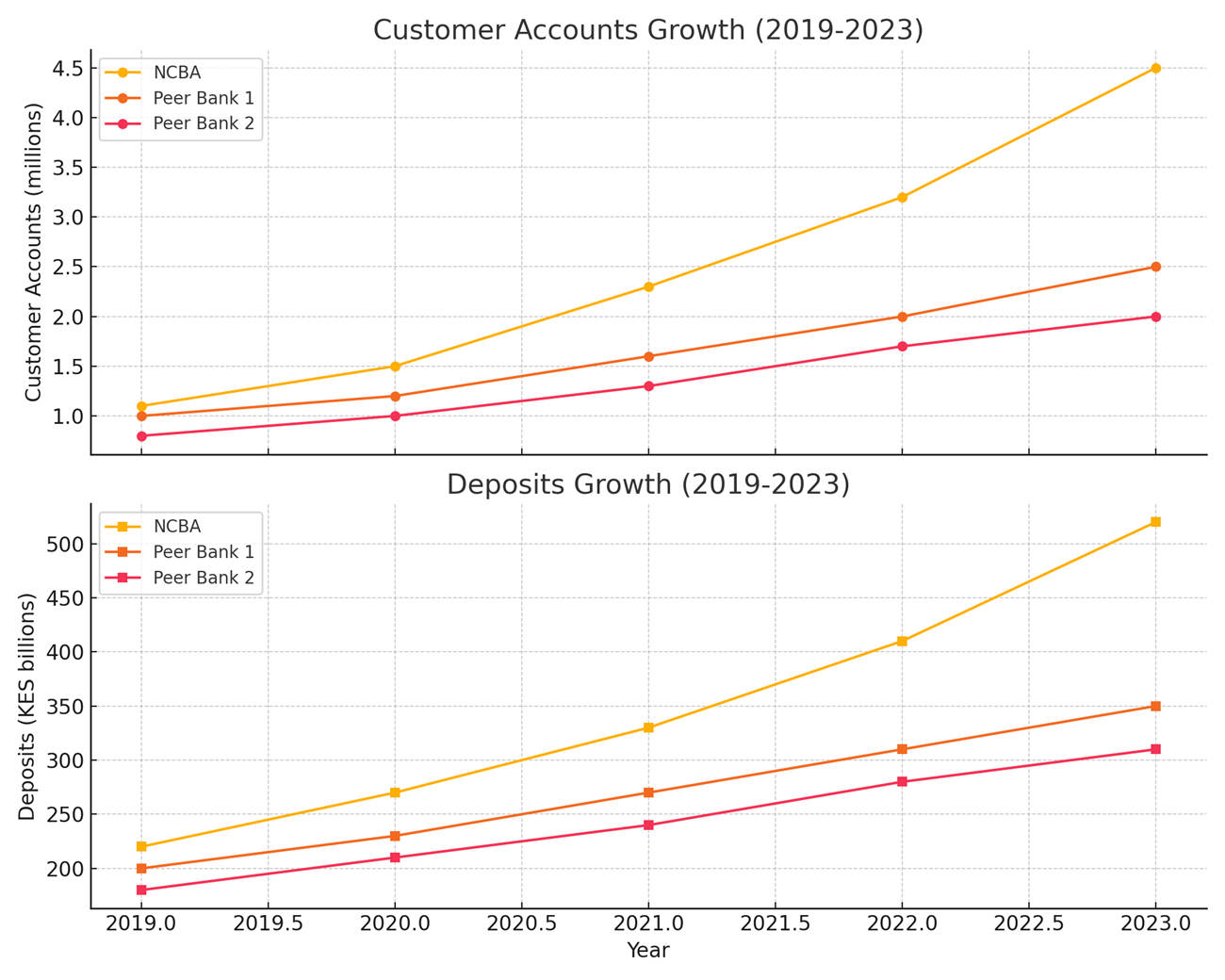

The numbers speak volumes. Over the past five years, NCBA has witnessed a consistent upward trajectory in both customer accounts and deposits. While its peers in the banking sector have grown modestly, NCBA’s customer accounts have surged from 1.1 million in 2019 to a commanding 4.5 million in 2023. Deposits have followed suit, swelling from KES 220 billion to an impressive KES 520 billion. This growth is not accidental—it is the result of intentional customer enchantment strategies that center mentorship, accessibility, and innovation.

No wonder NCBA is now the leading bank in Kenya in terms of customer accounts. The secret? The bank knows how to enchant customers. Whether it is through capacity-building workshops, one-on-one business advisory sessions, or digital tools that empower entrepreneurs to manage their cash flow efficiently, NCBA positions itself not as a service provider but as a growth partner. In a business climate fraught with economic uncertainty, this kind of commitment is nothing short of revolutionary.

In regions like Nyeri—often overlooked by mainstream banking giants—NCBA is filling a critical gap by acknowledging the potential of local enterprise. Its regional leaders have praised the county’s role in Kenya’s economy and committed to building customized financial products that speak directly to the needs of traders, farmers, and transporters. This bottom-up approach resonates deeply with business owners who have long struggled to find financial institutions that truly understand them.

Even more compelling is NCBA’s role in financial literacy. At the transporter event, attendees walked away not just with brochures but with real financial education—learning about insurance, fleet expansion strategies, and how to leverage working capital facilities without falling into debt traps. This is the kind of banking that transforms lives, families, and entire communities.

In an era where many financial institutions are digitizing at the expense of human connection, NCBA is proving that the future of banking lies in relationships. From Nyeri’s matatu owners to Karatina’s fresh produce suppliers, the message is echoing across the slopes of Mt. Kenya: with NCBA, you don’t just bank—you grow, you scale, and you thrive.

Read Also: Teeing Off Entrepreneurship: How NCBA Is Mentoring Entrepreneurs, One Swing at a Time

About Steve Biko Wafula

Steve Biko is the CEO OF Soko Directory and the founder of Hidalgo Group of Companies. Steve is currently developing his career in law, finance, entrepreneurship and digital consultancy; and has been implementing consultancy assignments for client organizations comprising of trainings besides capacity building in entrepreneurial matters.He can be reached on: +254 20 510 1124 or Email: info@sokodirectory.com

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (228)

- December 2025 (59)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)