Diaspora Remittances To Kenya Drop By 5.1 Percent

KEY POINTS

Remittance inflows to Kenya increased by ten times in the last 15 years reaching an all-time record of USD 3,718 million in 2021.

KEY TAKEAWAYS

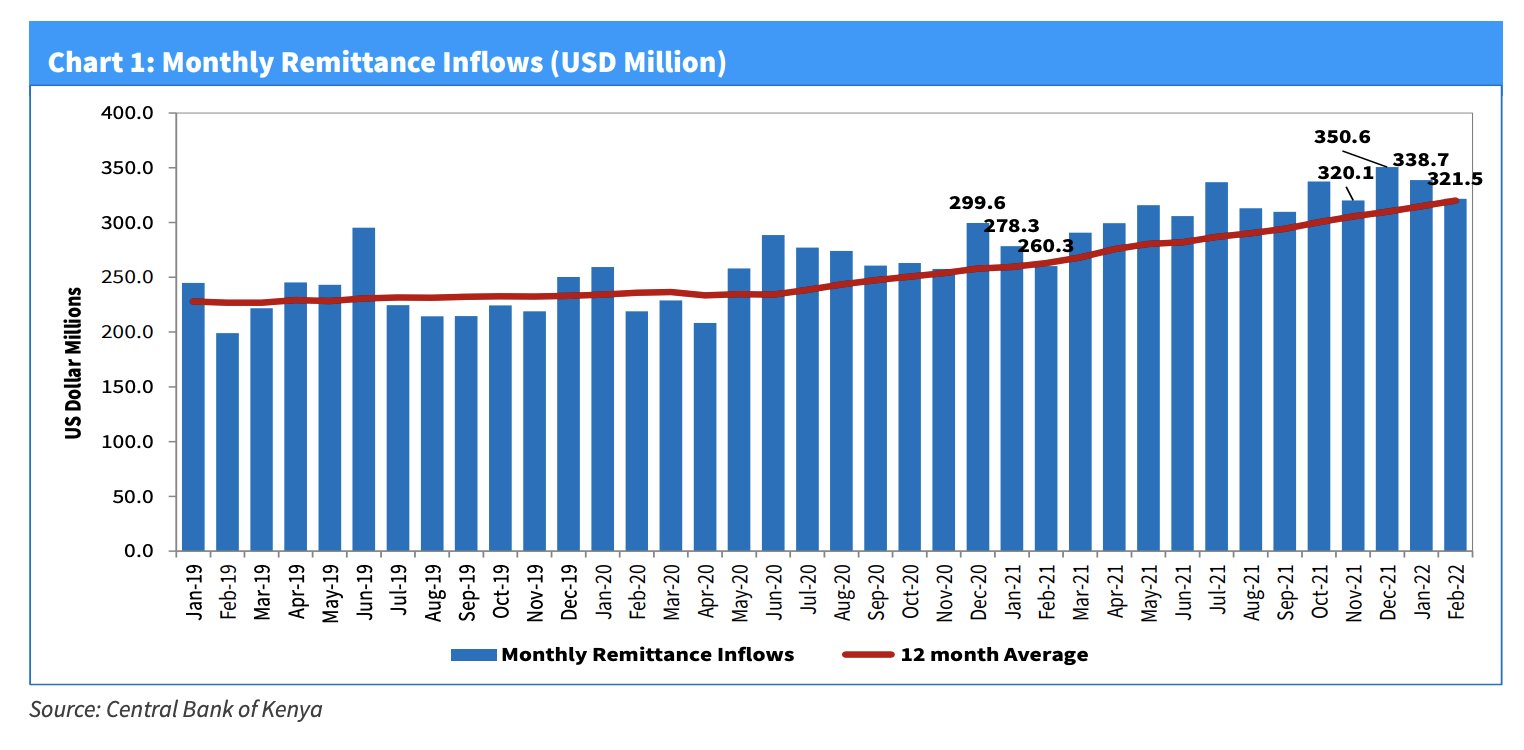

Remittances to Kenya dropped by 5.1 percent from USD 338.72 million to USD 321.53 million in the month of February 2022.

Diaspora remittances are an important contributor to the country’s growth and development. Remittances are Kenya’s largest source of foreign exchange ahead of horticulture, tea, coffee, and tourism.

The US remains the largest source of remittances to Kenya accounting for over 60 percent every month. Other significant contributors are European Countries like UK, Germany, and London.

According to the Central Bank of Kenya Report, Remittances to Kenya dropped by 5.1 percent from USD 338.72 million to USD 321.53 million in the month of February 2022.

The February remittances are equivalent to Kshs 36.6 billion. This is 23 percent more than the remittances made in February 2021. Over the same period last year, Kenyans remitted back home USD 260.29 million .which is equivalent to 29.67 billion shillings.

The total remittances sent into Kenya in the month of January were USD 321.53 million in the month of January which was a decline from the total remittances of 350.26 for the month of December 2021. During the festive season, last year diaspora remittances hit an all-time high in a single month.

Remittance inflows to Kenya increased by ten times in the last 15 years reaching an all-time record of USD 3,718 million in 2021. This phenomenal growth points to the importance of remittances as a source of foreign exchange to the country, equivalent to more than 3 percent of Kenya’s GDP.

Remittance flows also provide livelihoods to vulnerable households by contributing to basic needs such as food, education, healthcare, and housing. In this context, there is a need to better understand diaspora remittances and mainstream them into the country’s development process

The Central Bank of Kenya conducts a survey on remittance inflows every month through formal channels that include commercial banks and other authorized international remittances service providers in Kenya.

“Despite the significant role of remittance flows, its data has previously not been fully captured. Currently, the Central Bank of Kenya (CBK) collects data every month on remittance inflows through formal channels that include commercial banks and other authorized international remittance service providers in Kenya. The reported amount excludes remittances through informal channels and in-kind remittances. The Diaspora Remittances Survey, therefore, represents an additional step in the CBK’s initiatives to improve statistics on remittances and understanding the landscape for remittances more generally, “said CBK Governor Patrick Njoroge.

Remittance flows to Kenya are remitted monthly to family members and largely cater to basic household needs such as food, household goods, medicine, and payment of education expenses. The majority of recipients are self-employed, unemployed, or students, suggesting a relatively high dependency ratio of Kenyans on the diaspora. Slightly over half of the remittance amounts were allocated to investment in real estate for recipients, mortgage payment for senders, and purchase of food and household goods.

The advancement in Digital service providers is a key driver to growth in diaspora remittances into Kenya due to convenience, efficiency in terms of speed or prompt service, and being easily accessible. Recipients currently receive the money sent on the same day as a result of the high efficiency of these Digital channels.

About Soko Directory Team

Soko Directory is a Financial and Markets digital portal that tracks brands, listed firms on the NSE, SMEs and trend setters in the markets eco-system.Find us on Facebook: facebook.com/SokoDirectory and on Twitter: twitter.com/SokoDirectory

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (226)

- August 2025 (211)

- September 2025 (270)

- October 2025 (248)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)