Britam Insurance Enters Tanzanian Market

British-American Investments Company (Kenya) Limited (BRITAM) has launched its operations in Tanzania following the successful integration of Real Insurance Company.

Britam made the announcement on its Twitter account.

Bringing 50 years of trusted experience in providing insurance. #BritamTZLaunch pic.twitter.com/Yb56FVdIaK

— Britam Cares (@BritamEA) May 5, 2016

“The new company will leverage on the strong heritage of the Britam Group built over the last 50 years,” said Dr. Benson Wairegi, the Group Managing Director.

Britam acquired Real Insurance in 2014.

The integration creates a stronger general insurance business that will enjoy significant economies of scale as well as a stronger financial, technological and human capital base.

Read: Top Six Challenges Facing the Insurance Sector in Kenya

Britam has increased its market share to rank number two in the East African market on gross premium basis.

In Tanzania, it has seven branches in Dar es Salaam, Arusha, Mwanza, Dodoma, Mbeya, and Mtwara.

During the integration period, Cytonn Investments, the Group registered significant downside growth attributed to high expense growths.

The Tanzanian insurance industry is in a growth phase, and a large proportion of the population is untapped currently at 1 percent of the country’s GDP. By mid-2014, the country had 30 insurance companies and 112 insurance brokers

A

According to Trimetric Report, ‘The Insurance Industry in Tanzania, Key Trends and Opportunities to 2018’, The industry was served by 28 insurance companies, including reinsurers, as well as 79 brokers, 260 agents and 39 loss assessors and loss adjusters as of 2012.

Britam’s entry is due to the implementation of the Insurance Act of 1996 that liberalised the market paving the way for private new entrants to the market, until then a monopoly was held by the government’s National Insurance Corporation.

Ernst & Young (EY) named Tanzania as one of the most attractive markets in Sub Saharan Africa (SSA) in terms of investment opportunities in the insurance industry towards 2018in its report,” Waves of change: revisited Insurance opportunities in Sub-Saharan Africa 2016.”

The report cites Tanzania as one of the world’s strongest growth rates, averaging about 7 per cent annually. In line with overall economic performance, Oxford Economics projects annual growth in insurance premiums of 7.9% through 2018.

Regarding potential growth, Tanzania ranks fourth with 9 percent towards 2018 ahead by 5per cent from Ghana and Nigeria with 4 per cent and only 2 per cent behind Zambia, which tops the list with 11 per cent in the same period.

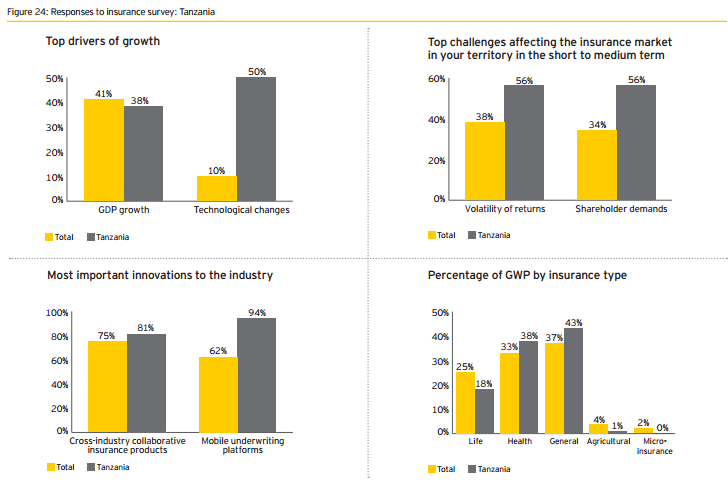

According to EY, GDP potential growth will be the main driver of insurance products’ premiums growth in the short-term since the survey ranks it first with 41 per cent followed by product innovation with 22 percent, regulatory changes with 15per cent, competition 11 percent, and technological changes with 10 percent.

The Company’s core business include: life, health and general insurance, pensions, unit trusts, investment planning, wealth management, off-shore investments, retirement planning, discretionary portfolio management, Property development and private Equity.

About Soko Directory Team

Soko Directory is a Financial and Markets digital portal that tracks brands, listed firms on the NSE, SMEs and trend setters in the markets eco-system.Find us on Facebook: facebook.com/SokoDirectory and on Twitter: twitter.com/SokoDirectory

- January 2026 (97)

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (230)

- December 2025 (219)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)