Squeezed Pockets: The Chicken Are Back Home For A Roost

The savings rate within a nation is shaped by a rather complex interplay of economic, social, and policy factors.

Typically, developing economies aspire to achieve higher savings rates as a means of buffing up capital for vital investments in areas such as infrastructure, education, and overall economic advancement while advanced economies may have lower savings rates due to higher consumption levels.

Read Also: Dear Entrepreneur, Here Are 10 Money Habits Of The Rich

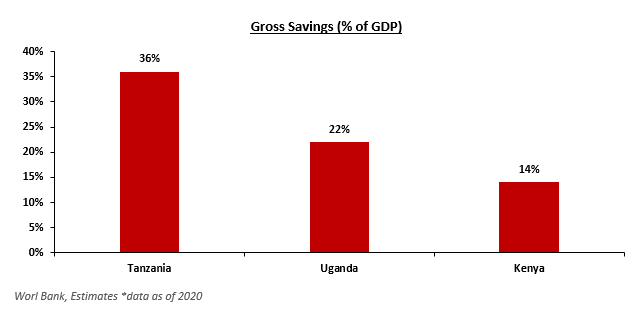

In the context of Kenya, we note that the country’s savings-to-GDP ratio has consistently trailed those of neighboring nations like Uganda and Tanzania for an extended period spanning over a decade as shown below:

In 2021, Kenya’s savings rate rose to 16% of GDP primarily due to the resumption of most economic activities and the reinstatement of most employees’ salaries following the COVID-19 slowdown – we note that pension contributions account for the larger part of the savings.

That said, we suspect that the lower ratio (as compared to the recommended ratio for lower-middle-income countries – 26%) is likely due to a higher rate of unemployment coupled with lower disposable income.

Read Also: Dear Entrepreneur, Become Successful By Dropping The Following Behavior

See below a chart comparing the rates of unemployment in the three countries;

Some of the factors affecting disposable income in Kenya include;

- Tax Policies – The level and structure of taxes, particularly income and consumption taxes such as VAT, can have a considerable impact on disposable income. Controversy specifically arises when taxation is concentrated on one group of the population e.g employees in the formal sector,

- Social Security & Pension Contributions – Mandatory contributions to social security, pension plans, and other similar programs such as the housing levy reduce disposable income, and

- Wages & Employment – Wage levels and employment opportunities influence the income earned by individuals. A lower minimum wage and a weak job market potentially reduce disposable income.

Read Also: Top 10 Business Opportunities For You In Eldoret

Below we look at the take-home salary and recurrent expenditures for two breadwinners; one earns KES 100,000 and the other earns KES 50,000.

Our assumptions are; i.) Both have 3 children, ii.) Both have no personal vehicles, iii.) Both work in the same area and iv.) Both contribute to a personal pension scheme.

Read Also: Dear Entrepreneur, Here Are Six Steps To Become A Millionaire By 30

We observe that the two individuals hardly meet their basic recurrent needs, let alone leisure and other one-off expenditures such as clothing. As a result of the squeezed pockets, many are forced to depend on loans from saccos, chamas, or digital apps such as Tala and Branch.

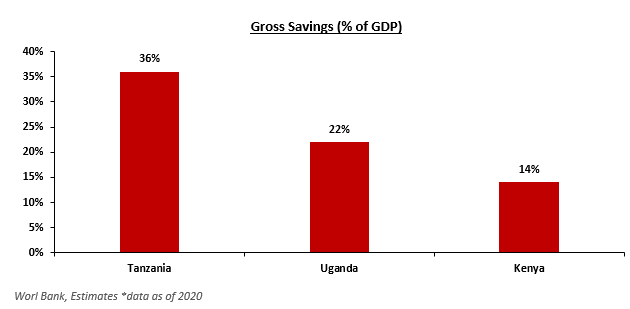

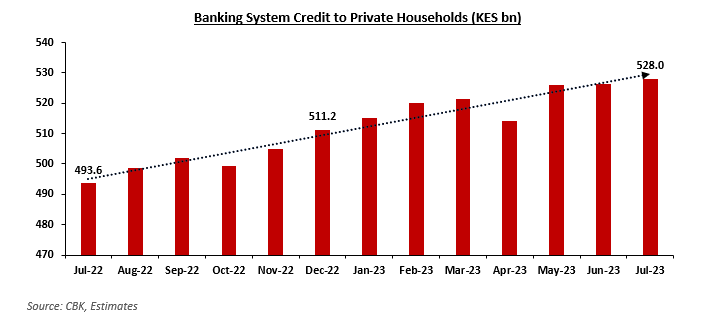

Consequently, the volume of loans disbursed to private households has been steadily increasing, as many individuals resort to borrowing from one lending app to settle obligations with another which has given rise to a cyclic pattern of indebtedness.

See below a chart showing the growth of credit advanced to private households since July 2023;

Read Also: 6 Strategies Employee Retention To Help Improve Your Business

It is worth noting that taxation policies and proposals for mandatory contributions continue to increase but the minimum wage and most employees’ salaries remain the same – with the real earnings adjusted to inflationary pressures dwindling over time.

As the government persists in raising the mandatory medical fund contributions to 2.75%, it is the employees in the formal sector who are most acutely affected. Furthermore, the National Social Security Fund (NSSF) contributions are slated to increase annually for the next four years, potentially placing additional strain on individuals’ financial resources.

Read More:

- The Devastating Impact of Delayed Payments: A Looming Threat to SMEs In Kenya

- Dear Entrepreneur, 10 Tips For Unlocking The Power Of Compounding To Become Rich

- Why Kenyans Should Start Saving The Little They Have While Young

This leaves formal sector employees with only two viable alternatives:

- Either accept a reduced standard of living, or

- Rely on loans for their survival.

Read Also: Six Pillars Of Entrepreneurial Success: Unveiling The Key Ingredients For Achievement And Success

- January 2026 (217)

- February 2026 (112)

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (230)

- December 2025 (219)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)