NCBA Champions Holistic Wealth Advisory as Demand Grows Among Kenya’s Affluent

Recent global studies by McKinsey and Bloomberg have highlighted a significant shift in the financial needs of high-net-worth individuals. A striking 60% of these clients are now prioritising holistic financial advisory services—ranging from estate planning to legal counsel—beyond traditional investment offerings. This growing trend is reshaping the future of financial services worldwide, and NCBA Bank is positioning itself at the forefront of this evolution.

“We recognise that our customers are seeking comprehensive financial advice—not just on investments, but also on legal and estate matters,” said Mr. Dennis Njau, Acting Group Director of Retail Banking at NCBA. “This forum is part of our ongoing commitment to walk alongside our clients on their journey to economic freedom, equipping them with the right tools to protect and grow their legacy.”

Against the backdrop of Kenya’s economic rebound, projected by the World Bank to grow by 5.2% in 2025—with non-resource-rich countries like Kenya potentially reaching 5.7%—the importance of wealth protection is gaining prominence. This optimistic outlook is largely driven by increased private sector investments and reduced government domestic borrowing.

However, a disconnect remains in wealth transfer preparedness. According to Knight Frank’s Africa Wealth Report, more than 70% of Kenya’s affluent individuals plan to pass on their wealth within the next decade, yet only 30% have formal succession plans in place. This gap underscores the urgent need for structured succession planning and legal clarity.

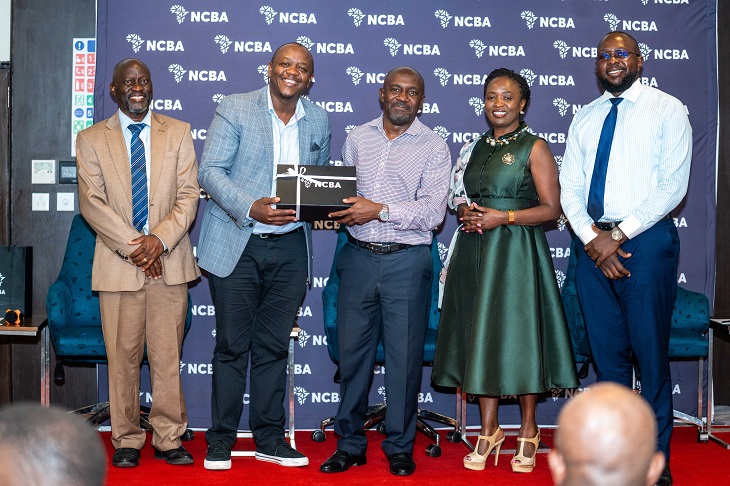

In response, NCBA recently held a specialized forum in partnership with Owiti, Otieno & Ragot Advocates and the NCBA Bancassurance Life team. The session focused on key pillars of estate planning, including Wills, Trusts, and taxation. Experts from NCBA Insurance also offered strategic insights into the benefits of early planning and how to navigate the legal intricacies of wealth succession.

This initiative forms a critical part of NCBA’s enhanced Platinum Customer Value Proposition (CVP), which is now evolving to offer value-added, structured advisory services. With increasing demand for integrated wealth management solutions, NCBA is reinforcing its role as more than just a financial institution—it is becoming a trusted adviser, empowering clients to make informed, future-ready decisions.

Read Also: Why NCBA Bank Is The Ally Every Kenyan Entrepreneur Needs Right Now

About Soko Directory Team

Soko Directory is a Financial and Markets digital portal that tracks brands, listed firms on the NSE, SMEs and trend setters in the markets eco-system.Find us on Facebook: facebook.com/SokoDirectory and on Twitter: twitter.com/SokoDirectory

- January 2026 (220)

- February 2026 (241)

- March 2026 (36)

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (230)

- December 2025 (219)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)