SACCOs vs Banks: The Coming War That Will Redefine Who Owns Kenya’s Shilling

In Kenya today, more than 43 commercial banks, 175 SACCOs, 13 MFIs, and several telcos with financial licenses compete fiercely for a core base of about 25 million financially active adults. That means every institution is chasing essentially the same customer pool. And yet paradoxically, 8+ million Kenyans remain financially excluded— a signal that the battle is being waged poorly.

Let’s anchor this in hard data: as of December 2024, total deposits in the Kenyan banking sector stood at KES 5,739.6 billion, up 1.0 % from the prior quarter. The system’s asset base was KES 7,645.8 billion in the same period. Meanwhile, the gross non-performing loan (NPL) ratio was 16.4 %, slightly improving from 16.5 % in September 2024.

On a broader scale, in September 2024, gross NPLs (in absolute terms) amounted to KES 669.5 billion, up from KES 657.6 billion in June 2024. That is a sharp reminder: default risk is not theoretical—it is a real, heavy drag on balance sheets.

Meanwhile, average lending rates among commercial banks in 2025 hover around 15.24 % (July) down slightly from earlier months. Deposit rates, by contrast, average ~8.07 % in July 2025. Overdraft rates hover closer to ~13.6–14.0 %.

On interest spreads: weighted-average lending minus deposit yields remain steep, sustaining margins for banks but also indicating cost to end borrowers.

In the micro and SME segment, banks have committed to lending KES 153 billion to MSMEs in 2025—exceeding their target of KES 150 billion by ~2 %.

Moreover, in April 2025, gross NPLs across the sector reportedly reached KES 724.2 billion, pushing the NPL ratio to 17.6 % in some analyses. These are not incidental numbers—they point to structural stress.

The most powerful institutions in this battlefield control deposits. Tier-1 banks (the largest) still hold the lion’s share—estimates put their share of deposits at 64 % of the total system. (This estimate echoes the original narrative, though official breakdowns are less frequently published.)

Yet, despite that dominance, these large banks serve only about 12 % of the population directly in everyday financial lives. The rest exist in fragmented relationships: many Kenyans maintain 3+ financial relationships.

If we accept that 67 % of banked Kenyans juggle 3 or more financial providers, we see the cost of fragmentation: overlapping credit, cross-institution liabilities, and a dangerous overextension of risk by providers.

In short, large banks dominate deposits and capital but fail to reach. Smaller providers respond by patchwork approaches—but the outcome is over-competition, margin compression, risk overlaps, and exclusion pockets.

Read Also: NCBA Highlights Strategies For Better Governance Of Kenya’s SACCO Sector

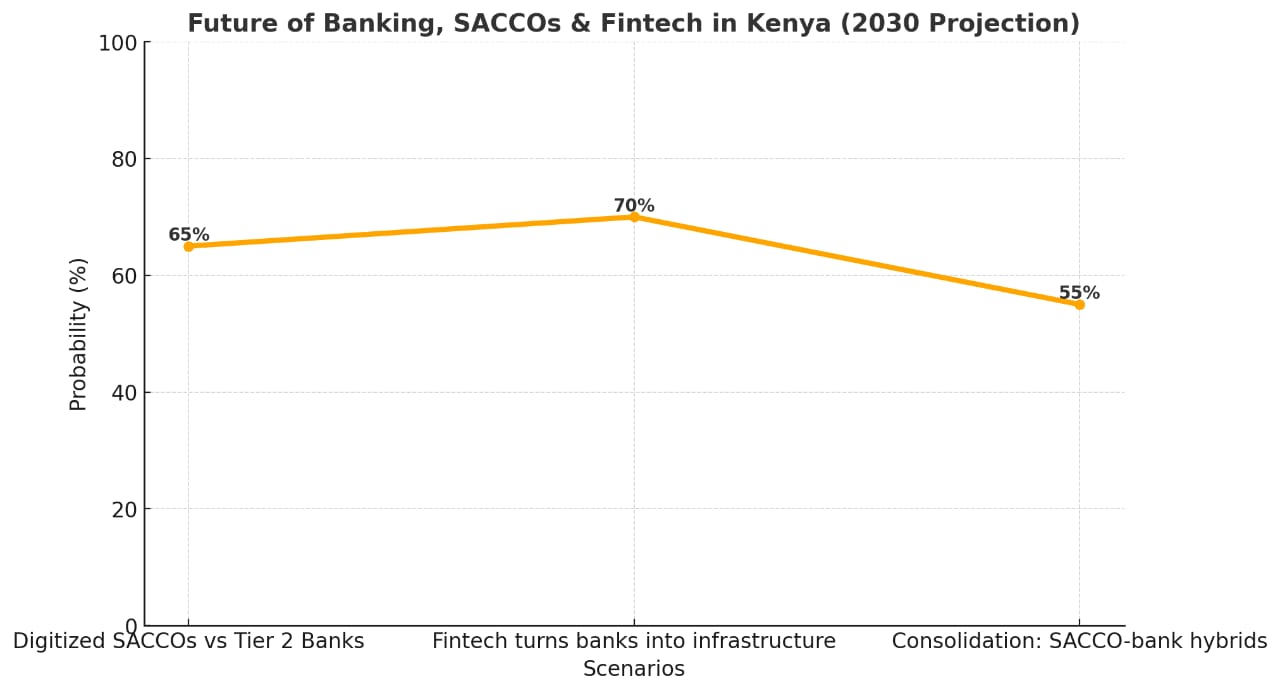

Now let’s forecast forward, with numbers:

65 % chance that digitized SACCOs will rival Tier-2 banks in deposit mobilization, customer base, and loan portfolios

70 % chance that fintech disruption will relegate banks to infrastructure providers—credit, payments, liquidity plumbing 55 % chance that consolidation will produce hybrid SACCO-bank institutions

These percentages, while hypothetical, reflect market sentiment and the scale of structural pressure.

That said, these shifts require financial institutions to move from extraction to creation. The real competition becomes not “which institution gets the same client” but “which institution produces real customer wealth rather than debt dependency.”

Take the NPL dynamic: chasing the same overleveraged clients has already produced a 16–17 % NPL ratio. Any further push without product innovation or customer segmentation is to court collapse.

Likewise, interest rates matter. If lending remains at ~15 % and deposit rates at ~8 %, the 7-point spread can fund operations—but only so long as defaults don’t rise further.

What about auctions and capital constraints? The Business Laws (Amendment) Act, 2024 mandates phased increases in minimum core capital (from KES 1 billion → KES 10 billion by 2029) for banks and mortgage finance companies. This ups the ante on efficiency and scale.

In periods of stress, auctions of distressed assets, collateral sales, and forced write-downs will become more common. Institutions unwilling to evolve will be forced into fire sales.

Even liquidity ratios are under stress: the Deposit-to-Liability Ratio (DLR) rose to 91.0 % in 2024, pointing to heavy reliance on deposit funding to service liabilities.

Additionally, market concentration remains acute: the top 10 banks command ~78.2 % of total industry assets. The Herfindahl-Hirschman Index (HHI) for asset concentration is ~810.5, implying moderate concentration. All these numbers demand an institutional reckoning.

The future archetypes—Community Champions (digitized SACCOs), Ecosystem Orchestrators (platform banks), Invisible Financiers (embedded fintech)—must be anchored in numeric logic. The new SACCOs must reach deposit volumes of KES hundreds of billions, support loan books with NPLs kept <5 %, and scale membership into the millions.

Platform banks must orchestrate flows of KES trillions across value chains while maintaining risk capital ratios above 18–20 %.

Embedded fintech must lend in micro-increments, on real-time data, with default rates under 5 % or else the model fails.

If banks fail to retrofit their models, they risk being relegated to plumbing—settlement, clearing, capital corridors—while others capture customer front-end value.

SACCOs that digitize can convert their social capital into financial capital—if they build robust credit underwriting, risk pooling, and governance.

But here’s the catch: it’s not enough to predict. Institutions must transform now. Those that lag will be forced to auction assets or be acquired. This is not optional—this is survival.

To deliver inclusion, the sector must embed credit, savings, insurance, and payments into everyday life—especially for informal earners.

In 2030, we should stop measuring success by deposit growth alone. We should measure how many low-income customers moved from negative net worth to positive net worth, how many SMEs scaled from micro to small to medium, how many households built real wealth—not just managed debt.

So let me close with a revised, data-anchored proclamation: The Great Banking Battle is not won by size, but by substance. Institutions that embrace data, empathy, and precision will win. The rest will be relics sold at auction rooms.

Read Also: Kenyan MPs Defaulting In Their SACCO is Dragging Kenya’s Cooperative Movement into Financial Ruin

About Steve Biko Wafula

Steve Biko is the CEO OF Soko Directory and the founder of Hidalgo Group of Companies. Steve is currently developing his career in law, finance, entrepreneurship and digital consultancy; and has been implementing consultancy assignments for client organizations comprising of trainings besides capacity building in entrepreneurial matters.He can be reached on: +254 20 510 1124 or Email: info@sokodirectory.com

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (230)

- December 2025 (154)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)