NSE Turnover Jumps 40% as Safaricom Leads Trading and Co-op Bank Skyrockets After Strong 3Q25 Results

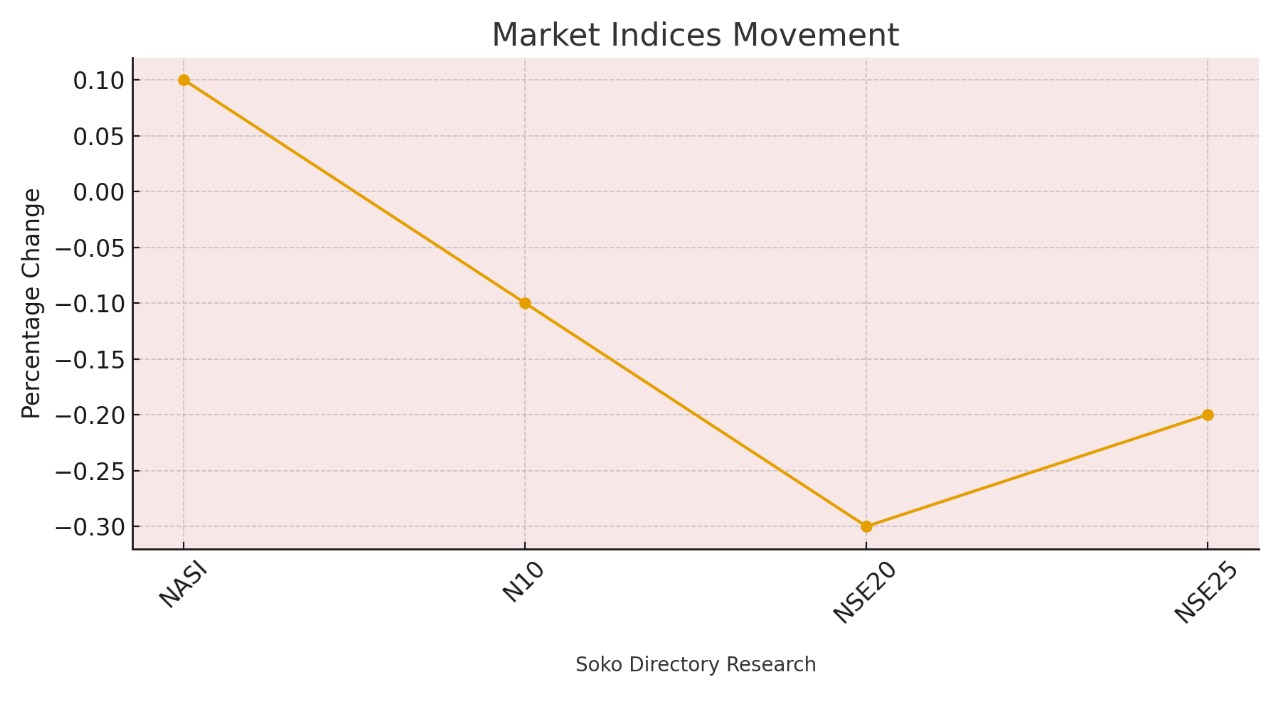

The Nairobi Securities Exchange closed today’s session in a delicate balance of gains and losses, reflecting a market that is active, emotional, and increasingly sensitive to earnings momentum, foreign flows, and dividend declarations. The broader market posted a slight lift through the NASI, which edged up by 0.1 percent, signaling a mild uptick in overall market capitalization. At the same time, the N10, NSE 20, and NSE 25 indices collectively softened, slipping by between 0.1 and 0.3 percent, a reminder that while optimism is present, caution still dominates investor positioning. This mixed close underscores the competing forces at play—local investors driving volume, corporates releasing earnings, and foreign investors persistently rebalancing away from frontier markets.

Liquidity surged strongly across the session, with turnover expanding by 40.5 percent to hit USD 6.6 million. This marked one of the most active sessions of the month. Local investors once again anchored trading, commanding 75.9 percent of all activity despite easing from yesterday’s dominance of over 89 percent. Their participation continues to provide the stability the market needs, especially at a time when global investors maintain a conservative stance toward emerging and frontier markets. The robust turnover also reflects renewed interest in large-cap counters, particularly among retail and domestic institutional players who continue to find value opportunities in banking and telecommunications stocks.

Safaricom remained the heartbeat of the market, driving more than a third of the day’s total turnover. The counter gained 0.9 percent to close at KES 29.00, maintaining its role as the NSE’s liquidity king even as foreign investors extended their selling streak for the third consecutive session. Safaricom’s ability to attract local buying interest despite persistent foreign exits illustrates how deeply entrenched the stock is in domestic portfolios. The day also saw notable activity among tier-one banks, where reactions to earnings releases played out sharply on the boards. KCB Group shed 1.1 percent to KES 65.00, while Equity Group slipped 0.8 percent to KES 64.50, as both counters navigated a blend of foreign profit-taking and subdued demand. Co-op Bank, however, broke away from the banking pack, rallying an impressive 9.5 percent to KES 24.90. This surge came on the strength of its newly released 3Q25 results and its historic declaration of a maiden interim dividend of KES 1.00. Co-op Bank’s rally was a clear signal that the market rewarded resilience, balance sheet strength, and shareholder returns.

Read Also: Total Value Of Transactions Through Instant Payment Systems Across Africa Hits $1.98 Trillion

The performance in the consumer and manufacturing counters painted a similarly nuanced picture. EABL eased by 2.1 percent to settle at KES 235.00, extending its recent bearish run as regional inflation, excise taxes, and muted consumption patterns continue to challenge its margins. Meanwhile, BAT held its ground at KES 450.00, reflecting stability in the face of regulatory headwinds and low trading volumes. Among the small-cap battlegrounds, Uchumi emerged as the day’s top gainer, jumping 10 percent to KES 0.44, fuelled largely by speculative positioning from opportunistic traders. ABSA Bank Kenya, on the other hand, suffered a heavy blow, sliding 6.4 percent to KES 24.20 as the market reacted negatively to shifting sentiment and possible portfolio switches among investors seeking stronger dividend plays.

Foreign investors once again ended the day as net sellers, registering outflows of USD 850.7K. Safaricom led the sell-side activity for the third day in a row, underscoring foreign investors’ strategic profit-taking and offloading of high-weight positions. Interestingly, KCB Group attracted the highest foreign buy interest, signaling that while foreign participation is shrinking, selective confidence persists in high-value banking counters. These outflows continue to pressure market depth, but the strength of local investors has blunted the potential downside.

Co-operative Bank’s 3Q25 results were the day’s most significant corporate highlight. The lender reported a 12.3 percent year-on-year increase in earnings per share to KES 3.68, with attributable income rising to KES 21.6 billion. Pre-tax profit climbed 12.1 percent to KES 30.0 billion, driven largely by a robust 22.8 percent expansion in net interest income to KES 45.3 billion. Despite this strength, non-interest revenue dipped slightly by 0.8 percent due to weaker forex trading income. The Group grappled with rising credit impairments, with loan loss provisions surging 31.9 percent year-on-year as gross non-performing loans hit KES 78.9 billion, reflecting the broader macroeconomic pressures felt across households and SMEs. Its main subsidiary posted a 10.1 percent rise in profit after tax to KES 19.3 billion, demonstrating strong operational efficiency. The announcement of the Group’s first-ever interim dividend of KES 1.00 amplified investor excitement, with book closure scheduled for November 26, 2025.

Today’s trading session demonstrated a market alive with activity, competing sentiments, and pockets of strong conviction. The surge in turnover, dominance of local investors, and outsized movements in specific counters all point toward a market adjusting to the realities of higher interest rates, shifting risk appetites, and an evolving earnings landscape. As investors digest Co-op Bank’s results and anticipate more corporate announcements, the NSE seems poised for continued volatility—tempered by strong local participation and selective foreign interest.

Read Also: Co-op Bank 3Q25 Group EPS Jumps By 12.3%y/y; Surprise Interim Dividend

About Soko Directory Team

Soko Directory is a Financial and Markets digital portal that tracks brands, listed firms on the NSE, SMEs and trend setters in the markets eco-system.Find us on Facebook: facebook.com/SokoDirectory and on Twitter: twitter.com/SokoDirectory

- January 2026 (220)

- February 2026 (243)

- March 2026 (62)

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (230)

- December 2025 (219)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)