Kenya’s Corporate Champions: Celebrating the Powerhouses Driving Growth, Innovation, And Opportunity In Kenya

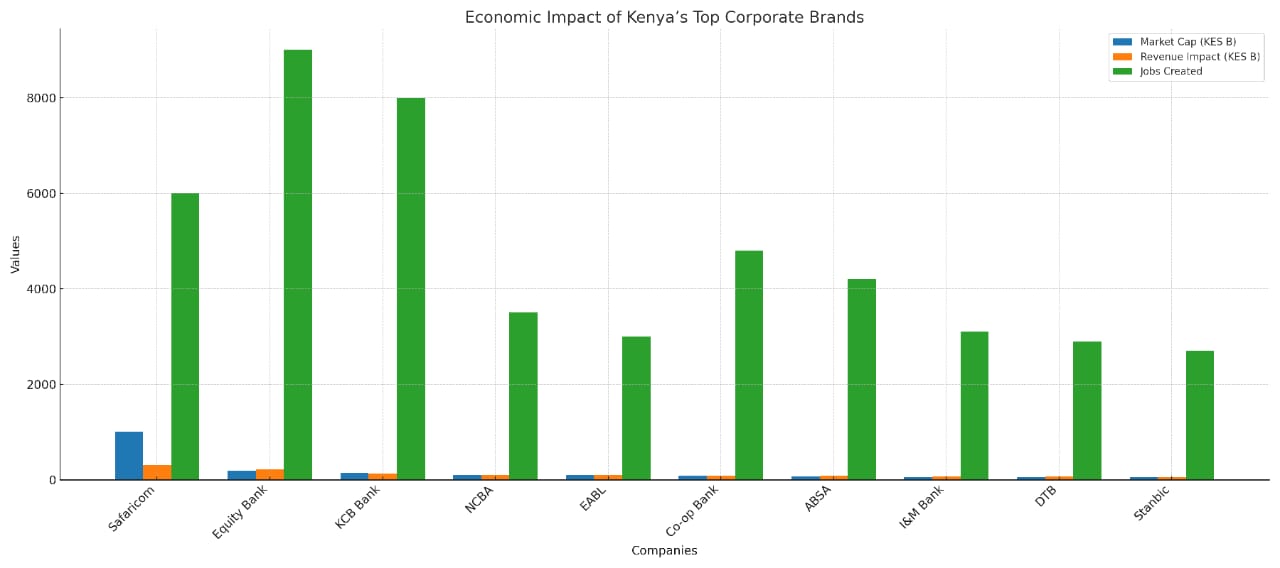

Kenya’s most valuable companies represent the very best of enterprise, innovation, and impact. A recent look at the top corporate brands by market capitalization reveals a powerful lineup shaping the nation’s future: Safaricom, Equity Bank, KCB Bank, NCBA, EABL, Co-operative Bank, ABSA, I&M Bank, Diamond Trust Bank (DTB), and Stanbic Bank. Each of these institutions plays a unique and vital role in transforming lives, supporting jobs, and propelling Kenya’s economic and social growth.

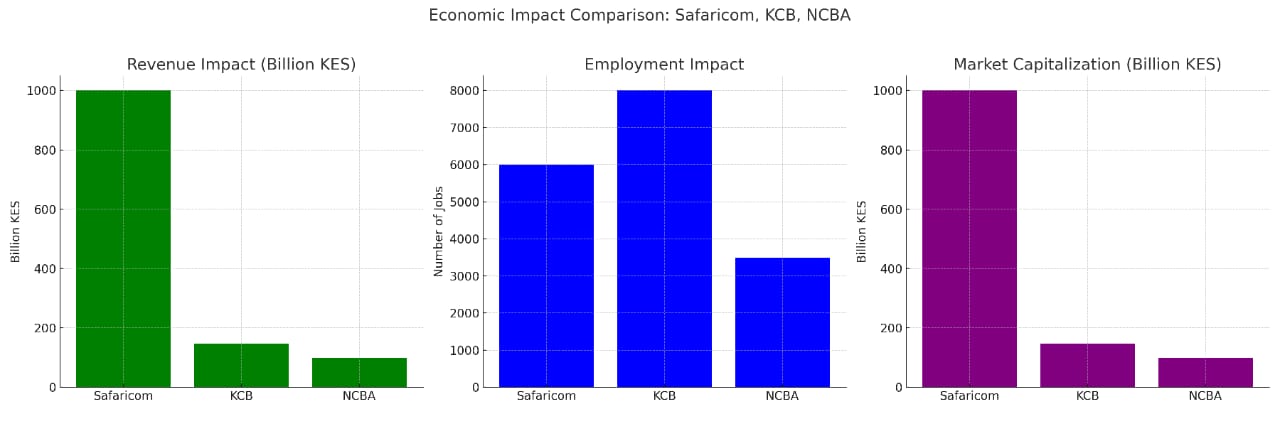

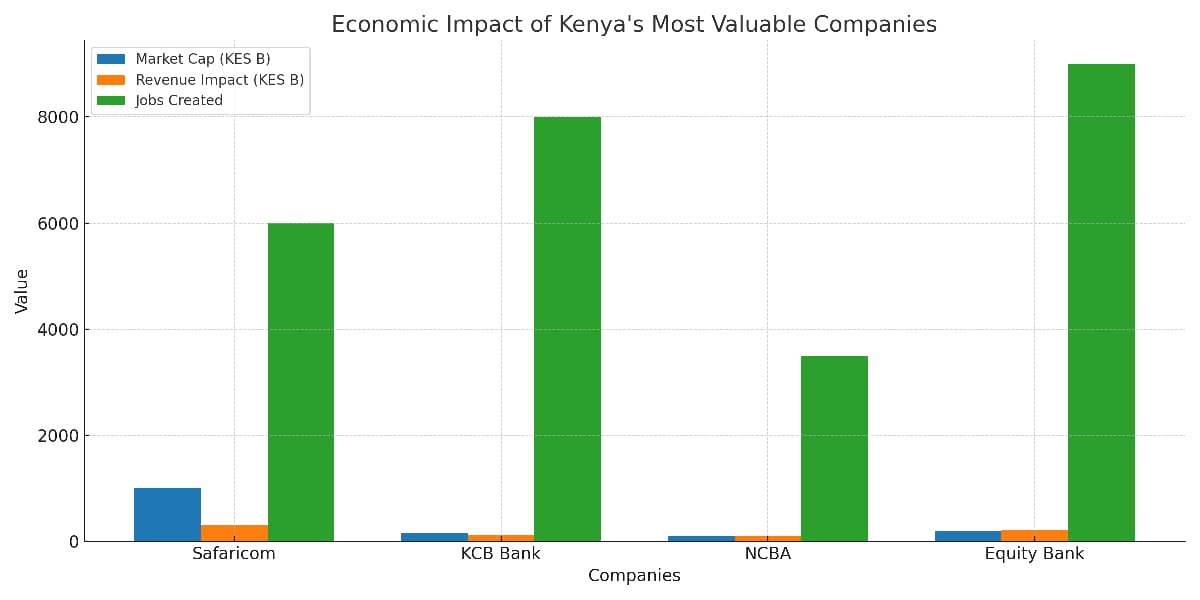

Safaricom, Kenya’s most valuable company, is the bedrock of digital transformation in the country. With a market capitalization of over KES 1 trillion, Safaricom has gone beyond being a telco to becoming a lifestyle enabler. Its mobile money platform, M-PESA, processes over KES 35 billion daily, driving financial inclusion and powering micro-businesses across the country. Safaricom also leads in connectivity, health-tech, agritech, and civic technology, serving millions while supporting a vast network of agents, distributors, and digital partners.

Equity Bank is a true story of transformation and empowerment. With a market cap of KES 188 billion, Equity’s core mission of financial inclusion has been instrumental in uplifting individuals and enterprises. Through inclusive banking, the Equity Leaders Program, and youth-focused initiatives like Young Africa Works, the bank empowers millions. Equity’s innovative agency and mobile banking platforms have opened financial access to the remotest regions, while its Pan-African expansion continues to position it as a continental financial leader.

Read Also: Ahead Of Holiday Shopping Season, Consumer Trust Falls, Brands Lean Into AI

KCB Bank, with a market cap of KES 148 billion, has established itself as a leader in infrastructure financing, digital transformation, and regional banking. With operations in seven countries and assets above KES 1.5 trillion, KCB’s growth story is defined by stability, innovation, and customer-centricity. Its support for SMEs, partnerships in climate finance, and scalable digital platforms like Vooma show a commitment to inclusive growth. KCB’s strategic mergers and acquisitions continue to expand its reach and impact across East Africa.

NCBA is a symbol of innovation in mobile and consumer banking. Born from a successful merger, NCBA has become a pioneer in digital credit through M-Shwari and Fuliza, platforms that serve millions daily. With a market value of KES 100 billion, NCBA’s strength lies in its ability to adapt, scale, and provide smart financial solutions for all customer segments, from young entrepreneurs to large corporate entities. Its investments in sustainability and digital banking set a benchmark for the next generation of financial services.

EABL (East African Breweries Limited) is a heritage brand that combines tradition with modern industry. With a market cap of KES 96 billion, EABL plays a vital role in Kenya’s manufacturing sector and value chains. It supports thousands of farmers through sorghum and barley programs and contributes heavily to employment, distribution, tax revenues, and social investments. EABL’s brands and exports are synonymous with quality, consistency, and Kenyan pride across the region.

Co-operative Bank stands out as the bank of the people. With a market capitalization of KES 89 billion, Co-op Bank has maintained a strong cooperative model that supports Saccos, farmers, teachers, and grassroots organizations. Its wide network and excellent financial education programs make it a preferred banking partner for many. Co-op Bank’s focus on ethical banking and sustainability enhances its social footprint while maintaining solid financial performance.

ABSA Kenya, with a market cap of KES 75 billion, brings global excellence with local impact. Known for its high service standards and tech-forward approach, ABSA continues to innovate in retail, SME, and corporate banking. Its investment in digital products, financial literacy, and partnerships in entrepreneurship has made it a dynamic contributor to Kenya’s modern financial ecosystem. ABSA’s commitment to economic empowerment is reflected in its diverse and growing customer base.

I&M Bank, valued at KES 60 billion, has consistently delivered strong financial solutions to SMEs, corporates, and high-net-worth clients. With its strong technological backbone and innovation in digital banking, I&M has become a dependable partner for Kenya’s business community. Its regional presence and prudent risk management have enabled it to offer stability and opportunity for economic growth.

DTB (Diamond Trust Bank), with a KES 55 billion market cap, is a trusted banking brand that supports entrepreneurs, manufacturers, and professionals across East Africa. Known for its digital-first approach and customer-centric solutions, DTB is a key driver of financial services accessibility. The bank’s strategic partnerships and expansion plans highlight its role in regional integration and enterprise support.

Stanbic Bank, at a KES 52 billion valuation, exemplifies corporate excellence and international expertise tailored for local impact. Its leadership in investment banking, infrastructure finance, and innovation makes it a strong pillar of Kenya’s financial sector. Stanbic’s focus on sustainable finance, entrepreneurship, and community development reflects its broader commitment to long-term prosperity.

Together, these ten companies form the backbone of Kenya’s formal economy. They employ tens of thousands of Kenyans directly, support millions more indirectly, and contribute significantly to tax revenues, innovation, financial inclusion, and regional competitiveness. From mobile money and banking to beverages and investments, their operations touch nearly every aspect of Kenyan life.

What makes these brands exceptional is their shared focus on customer experience, innovation, sustainability, and empowerment. Whether it’s Safaricom’s data and fintech leadership, Equity’s commitment to access, KCB’s regional footprint, NCBA’s credit technology, or EABL’s manufacturing excellence—each institution is playing a role in shaping a stronger, more inclusive Kenya.

Their efforts in digital transformation, ESG (environmental, social, governance) practices, and youth engagement are laying the foundation for a future-ready economy. They are not only investing in infrastructure but in people, education, and ecosystems that uplift every Kenyan.

These companies also represent Kenya’s brand to the world. They show investors, tourists, and partners that Kenya is a land of enterprise, growth, and opportunity. Their leadership is a magnet for global capital and confidence.

As we celebrate these corporate champions, we are reminded that national prosperity is built on collaboration, trust, and purpose. With the government, private sector, and citizens working together, these brands will continue to rise—and bring the nation with them.

Their stories are not just about profit—they are about progress. They are not just corporations—they are Kenya’s partners in transformation. And in them, we see the promise of a brighter, more prosperous future for all.

Read Also: Here Is What Today’s Audiences Want From Brands

About Steve Biko Wafula

Steve Biko is the CEO OF Soko Directory and the founder of Hidalgo Group of Companies. Steve is currently developing his career in law, finance, entrepreneurship and digital consultancy; and has been implementing consultancy assignments for client organizations comprising of trainings besides capacity building in entrepreneurial matters.He can be reached on: +254 20 510 1124 or Email: info@sokodirectory.com

- January 2026 (220)

- February 2026 (243)

- March 2026 (54)

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (230)

- December 2025 (219)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)