Sugar price unlikely to fall, despite 36pc rise in imports

Kenya’s sugar consumption has increased by 3 percent in the last one year due to increased demand in retail, industrial and food service sectors.

However, the growing demand is higher than the local production of sugar.

Kenya produces 600,000 tonnes of sugar annually and relies on imports to meet growing demand that currently stands at 900,000 tonnes an increase from 860,084 tonnes in 2014 according to the Kenya Sugar Directorate.

The growth is supported by an increase in consumer purchasing power, and the

diversification of manufactured sugar-based products.

Local production meets about 60 percent of the total consumption and the resultant shortfall is offset by imports, mainly from the COMESA region.

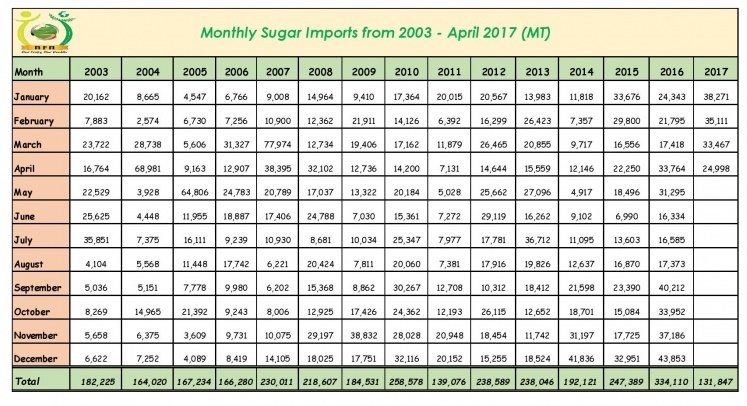

According to Genghis Capital, sugar imports in the first third of the year rose 35.48 percent y/y to 131,846 tonnes from 97,320 tonnes in a similar period last year.

“The imports are geared to meet the shortfall in sugar production, attributed to cane shortage in most growing zones, which has seen a 27.69 percent y/y dip from 238,872 tonnes to 172,722 tonnes,” notes the Analysts.

Imports issued mainly from Madagascar, Mauritius, Uganda, Zimbabwe and Swaziland. Sugar exports dwindled 89.61 percent y/y to 7.9 tonnes in the first third of 2017.

The volume of imported sugar grew from 97,320 tonnes early last year to 131,846 tonnes from January to April this year.

“Sugar imports in April comprised 14,742 tonnes table and 10,256 refined , Comesa gave 1,500 tonnes while EAC provided 2,550 tonnes, non-Comesa countries gave 6,332 tonnes,” says the Sugar Directorate report.

Between January and April 2017, sugar production dropped to 172,722 tonnes compared to 238,872 tonnes compared to the same period last year.

According to the Kenya National Bureau of Statistics (KNBS) first Quarterly Gross Domestic Product Report 2017, the volume of cane deliveries dropped from 2,068.0 thousand Metric Tonnes in the first quarter of 2016 to 1,452.6 thousand Metric Tonnes in the quarter under review.

Since 2004, the government has utilized the import safeguard granted by the COMESA secretariat to limit duty free imports from COMESA countries to a maximum of 350,000 tons per year. The latest two-year extension of the safeguard was granted in 2016 and expires in February 2019.

FAS/Nairobi forecasts Kenya’s sugar production to remain flat in the marketing year 2017/2018 due to continued poor performance of the state-owned sugar milling plants.

The Sugar Directorate projects a shortage of 1.9 million tonnes of sugarcane in 2016/2017 fiscal year, creating a huge production deficit. Millers are already crushing below installed capacity as the shortage takes its toll on production.

Nzoia Sugar Company has suspended operations due to shortage of raw material that will enable the miller to fully function. The company has not been operating in the past two weeks.

The company as of March 2017 was milling less than 2,000 tonnes of cane per day against the installed capacity of 3,000 according to the management.

Mumias sugar had also suspended operations for the same reasons and despite the fact that it has resumed working,.

With the drop in production, prices keep rising and households have to cope up with the high cost. A kilogram of sugar is now retailing at between 175 and 190 shillings up from an average of between 120 and 140 shillings a month before.

A quick check across various shops and supermarkets within Nairobi revealed that 2-kg packet of Kabras sugar is now going for 350 shillings up from 315 shillings while that of Sony Sugar going up to 380 shillings.

About Soko Directory Team

Soko Directory is a Financial and Markets digital portal that tracks brands, listed firms on the NSE, SMEs and trend setters in the markets eco-system.Find us on Facebook: facebook.com/SokoDirectory and on Twitter: twitter.com/SokoDirectory

Trending Stories

Related Articles

Explore Soko Directory

Soko Directory Archives

- January 2026 (48)

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (230)

- December 2025 (219)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)