How Does Kenya Compare To Other African Countries In Terms Of Taxation?

KEY POINTS

The average tax-to-GDP ratio for 30 African countries was 16.5% in 2018, compared to the OECD average of 34.3% and the Latin American and Caribbean (LAC) average of 23.1%.

The report covers the years 1990 to 2018 and shows that between 2010 and 2018, the average African tax-to-GDP ratio increased by 1.4 percentage points, mainly due to revenue increases from VAT and individual income taxes.

KEY TAKEAWAYS

According to World Bank data, the tax rates on income, profits, and capital gains in African countries range from 3% to 48%. On average, African countries have a higher tax rate on income, profits, and capital gains, compared to other countries, even those at similar income levels.

The Kenyan government has recently proposed new tax measures that have sparked public outrage and criticism. The proposals include a 16% value-added tax (VAT) on bread, a 10% excise duty on motorcycles, and a 1.5% digital service tax on online transactions, 15% on content generation among many others targeting the hustlers while the rich get protection to import helicopters for almost for nothing.

These taxes are expected to increase the cost of living and affect the livelihoods of many Kenyans, especially the poor and the informal sector workers.

But how does Kenya fare in comparison to other African countries when it comes to taxation? Is Kenya the most taxed country in Africa? What are the main sources of tax revenue for African governments? And how do they affect economic growth and development?

Tax-to-GDP ratio

One way to measure the level of taxation in a country is to look at the tax-to-GDP ratio, which is the total amount of taxes collected by the government as a percentage of the gross domestic product (GDP) of the country. This ratio indicates how much of the national income is used to finance public services and goods.

According to the latest report by the Organisation for Economic Co-operation and Development (OECD) on tax revenue statistics in Africa, the average tax-to-GDP ratio for 30 African countries was 16.5% in 2018, compared to the OECD average of 34.3% and the Latin American and Caribbean (LAC) average of 23.1%.

The report covers the years 1990 to 2018 and shows that between 2010 and 2018, the average African tax-to-GDP ratio increased by 1.4 percentage points, mainly due to revenue increases from VAT and individual income taxes.

However, there is a wide variation among African countries in terms of their tax-to-GDP ratios. In 2018, Seychelles (32.4%), Tunisia (32.1%), and South Africa (29.1%) had the highest tax-to-GDP ratios of the 30 countries covered. Nigeria (6.3%), Equatorial Guinea (6.3%), Chad (7.1%), and the Democratic Republic of the Congo (7.5%) had the lowest.

Kenya had a tax-to-GDP ratio of 18% in 2018, which was slightly above the African average but below the LAC average. Kenya’s tax-to-GDP ratio has increased by 2 percentage points since 2010, mainly due to higher VAT revenues.

Related Content: Taxation Systems In East African Countries: A Comparative Analysis Shows Kenya Is The Most Taxed Country In EAC

The table below shows the tax-to-GDP ratios of some selected African countries in 2018:

Sources of tax revenue

Another way to compare taxation across countries is to look at the sources of tax revenue, which indicate how different types of taxes contribute to the total tax collection.

According to the OECD report, taxes on goods and services were on average the greatest source of tax revenue for African countries, at 51.9% of total tax revenues in 2018. VAT contributed on average 29.7%, making it the most important tax on goods and services.

Corporate taxes accounted on average for 19.2% of all tax revenues, and individual taxes accounted for 17.5%. Social insurance taxes and property taxes played less significant roles, at 7.2% and 1.6%, respectively.

On average, African countries’ tax structure is relatively similar to that of LAC countries. Notable differences are Africa’s relatively higher reliance on individual taxes and lower reliance on social insurance taxes.

The average OECD tax structure differs quite substantially from that of the African average, as African countries tend to rely less on individual taxes, social insurance taxes, and property taxes, and more on corporate taxes and consumption taxes.

Between 2010 and 2018, revenue sources have shifted to VAT (an increase of 2.8 percentage points of total taxes) and individual taxes (an increase of 2.1 percentage points of total taxes). While the share of individual taxes is still lower than the share of corporate taxes, corporate tax revenue has declined by 2.3 percentage points of total tax revenue during the same time frame. Consumption taxes other than VAT have declined by 2.8 percentage points of total revenues. The decline in consumption taxes other than VAT in many African countries is partly due to lower trade tax revenues.

Related Content: Why Safaricom Plc Is The Best Share To Buy At The NSE At The Moment

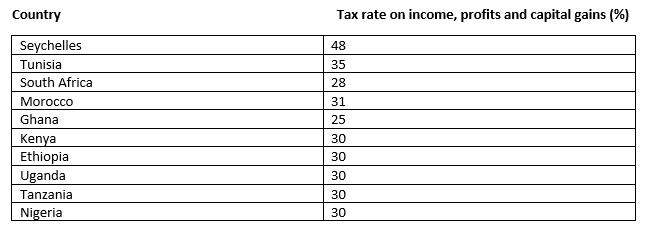

Tax rates on income, profits, and capital gains

Another way to compare taxation across countries is to look at the tax rates on income, profits, and capital gains, which indicate how much of these sources of income are taxed by the government.

According to World Bank data, the tax rates on income, profits, and capital gains in African countries range from 3% to 48%. On average, African countries have a higher tax rate on income, profits, and capital gains, compared to other countries, even those at similar income levels.

The table below shows the tax rates on income, profits, and capital gains of some selected African countries in 2020:

Taxation and economic development

The level and structure of taxation in a country can have significant implications for its economic development. Taxation can affect the incentives for individuals and businesses to work, save, invest, and consume. Taxation can also affect the distribution of income and wealth among different groups of society. Taxation can also provide resources for the government to provide public goods and services that can enhance growth and welfare.

Related Content: Stanbic Bank’s Profits Rise 84% For Q1 To Hit Ksh 3.9 Billion

However, there is no simple or universal relationship between taxation and economic development. The impact of taxation depends on many factors, such as the efficiency and fairness of the tax system, the quality and composition of public spending, the level of corruption and governance, the degree of informality and evasion, and the social and political context.

Some studies have suggested that there is an optimal level of taxation that maximizes economic growth. For example, a study by Scully (1996) estimated that the optimal tax-to-GDP ratio for developing countries is around 21%, while a study by Pessino and Fenochietto (2010) estimated that it is around 26%. However, these estimates are based on historical data and may not be applicable to all countries or situations.

Moreover, some studies have argued that the structure of taxation matters more than the level of taxation for economic development. For example, a study by Easterly and Rebelo (1993) found that taxes on income and profits have a negative effect on growth, while taxes on consumption and international trade have a positive effect. A study by Kneller et al. (1999) found that distortionary taxes (such as income taxes) reduce growth, while non-distortionary taxes (such as property taxes) do not.

Therefore, it is important for each country to design its tax system according to its specific needs and circumstances. A good tax system should be able to raise sufficient revenue for public spending without imposing excessive burdens or distortions on economic activity. A good tax system should also be fair, transparent, simple, and easy to administer and comply with.

In conclusion, this article has compared taxation across African countries with a focus on Kenya. It has shown that Kenya has a moderate level of taxation compared to other African countries but relies heavily on VAT and individual income taxes. We have also discussed some of the factors that affect the relationship between taxation and economic development.

Related Content: Safaricom Revenue Hits Ksh 310.9 Billion As Ethiopia Gives Greenlight For M-Pesa

About Steve Biko Wafula

Steve Biko is the CEO OF Soko Directory and the founder of Hidalgo Group of Companies. Steve is currently developing his career in law, finance, entrepreneurship and digital consultancy; and has been implementing consultancy assignments for client organizations comprising of trainings besides capacity building in entrepreneurial matters.He can be reached on: +254 20 510 1124 or Email: info@sokodirectory.com

- January 2026 (217)

- February 2026 (111)

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (230)

- December 2025 (219)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)