Kenya’s Debt Sustainability: Is Country on the Right Track?

There has been a lot of discussion on whether Kenya as a country is able to sustain the current debt levels and as to whether the economy has the capacity to service the outstanding government debt. Is Kenya on the right way in case of debt sustainability?

Over the years, the national budget continues to grow with the total expenditures growing at an average of 15.4 percent to 2 trillion shillings in 2015/16 from 977.0 billion shillings in 2010/11, while revenue growth (KRA Tax collections) has increased by 14.2 percent to 1.3 trillion shillings in 2015/16 from 670.0 billion shillings in 2010/11 meaning that the difference has been funded through borrowing.

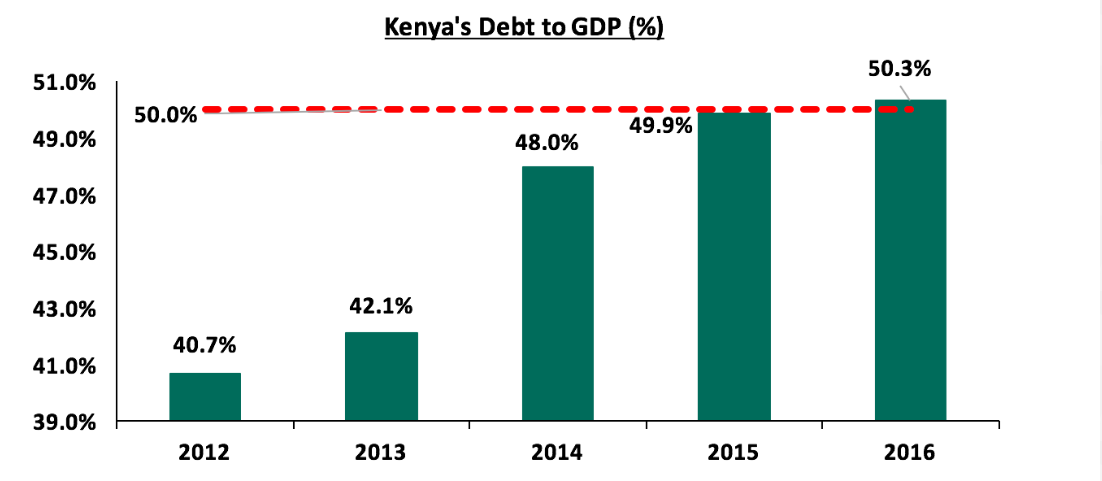

This has led to an increase in the debt level from 40.7 percent debt to GDP in 2011 to the current level of 50.3 percent. According to the International Monetary Fund, the target debt to GDP for developing countries should be at or below 50 percent, meaning that the current debt level in the country has surpassed the standard set by the global lender, and this may pose fiscal challenges if mechanisms are not put in place to improve on Kenya’s fiscal and public finance management framework.

There are two avenues that the government can use for borrowing, either from the domestic markets through issuance of treasury bills and bonds, or can seek to borrow from the international markets through direct government-to-government negotiations or from the international capital markets through the issuance of sovereign bonds/Eurobonds.

Raising funds from the domestic market is much easier and faster and there is already a defined time table for this i.e. weekly through treasury bills and monthly through treasury bonds and for this, the Central Bank acts as the borrowing agent of the Treasury.

Local borrowing is also advantageous as it is faster and simple to administrate, but the main issue is that government competes with the private sector for funds from banks which leads to crowding out of private sector and slowdown in economic growth as the contribution by the private sector to economic growth reduces.

On the foreign borrowing, though it gives the government another borrowing avenue apart from the domestic market, the challenge is that it opens up the country to trends in the global market, which may destabilize the economy in times of global crisis.

According to the Central Bank of Kenya, the country debt mix currently stands at 50:50 for external and domestic debt at 1.8 trillion shillings each, bringing the total debt to 3.6 trillion.

The bulk of the government’s foreign borrowings is through bilateral agreements as only 270.0 billion shillings was issued in the 5 and 10 year Eurobonds. From the last budget, the split in the local and foreign borrowing was at 42.6 and 56.9 percent, respectively and this has now been revised as per the Budget outlook paper to 49.4 and 50.6 percent, respectively.

The ability to service debt is key and is usually measured by revenue collection to total outstanding payments required, both in principal and interest payment. The government at times borrows to pay off their debt but usually ability to pay off the debt with revenue collections would be ideal.

For the current fiscal year, the total allocation to debt servicing was 250.0 billion shillings and has increased from 173.3 billion in 2011, a growth rate of 44.3 percent over the last five years.

According to a report on Division of Revenue Bill by the Treasury, the government is expected to utilize 40.0 percent of tax revenue collection for debt repayments in 2017, up from 32.0 percent in the current fiscal year 2016/17.

Looking at the current debt levels, the main issue is that if the current trend continues, the economy is likely to face fiscal challenges which may further affect negatively Kenya’s credit ratings in the international market.

In order to address this, Kenya need first to look at the factors that has led to the acceleration in government borrowing over the last three years;

- Slow growth in revenue collection compared to the budget growth: The revenue growth has averaged 14.2% over the last five years while budget growth has been at 15.4% over the same period resulting into more borrowings to fund the budget deficit,

- Significant investment in infrastructure projects: Though investment in infrastructure will eventually result in an increase in economic activity, it will take time for the economy to start benefitting from such investments,

- Misalignment of Fiscal and Monetary Policy decisions: The government continues to borrow money from the market at high rates despite the initiatives being in place to achieve a low interest rate environment.

(99 Percent of the material in this Text were extracted directly from Cytonn Investments Report of 11th December 2016)

About Juma

Juma is an enthusiastic journalist who believes that journalism has power to change the world either negatively or positively depending on how one uses it.(020) 528 0222 or Email: info@sokodirectory.com

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (146)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)