If You Have Money and You’re Not in Mansa X, You’re Actively Choosing Financial Stress

Money rarely disappears loudly. Most of the time, it leaks quietly through indecision, fear, and badly chosen “safe” options. People believe money is protected because it sits in a bank account, a savings product, or a familiar institution. In truth, money that is not compounding is being punished by time. Inflation does not ask permission, and opportunity cost does not send reminders. This is where Mansa X exposes a painful truth: disciplined growth beats emotional comfort every single time.

Most people fail to build wealth not because returns are unavailable, but because they lack a structure that works without constant supervision. The modern investor is tired. They have businesses to run, families to raise, crises to manage, and reputations to protect. An investment that requires daily attention, emotional resilience, or technical sophistication is already unsuitable for the majority. Mansa X is built for real life, not theory. It assumes you will be busy—and designs around that reality.

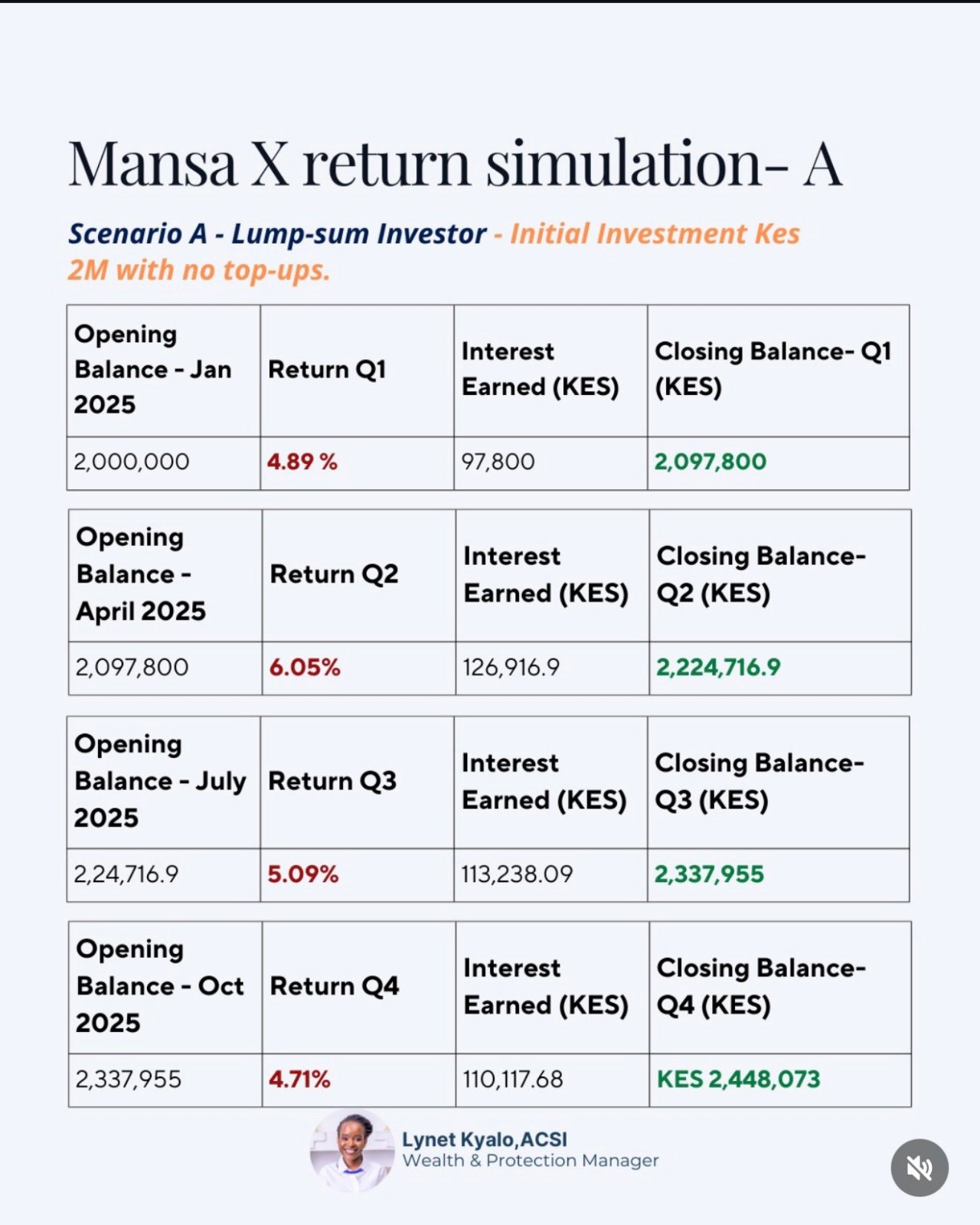

When a lump-sum investor places capital into Mansa X and does absolutely nothing else, something rare happens: progress without anxiety. Quarter after quarter, returns accrue within a disciplined range that signals control rather than recklessness. There are no sharp spikes that hint at excessive risk, and no dead periods that suggest idle capital. The money simply grows. That boring consistency is not accidental; it is the signature of professional asset management done correctly.

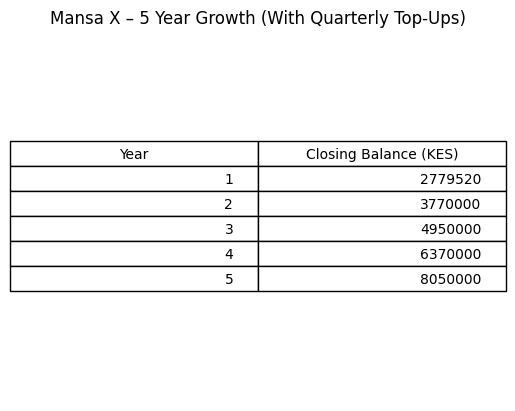

What becomes even more revealing is time. One year is informative, but five years is unforgiving. Over extended periods, weak strategies collapse under their own weight, while disciplined systems reveal their true character. When the same quarterly return behaviour is allowed to repeat over five years, the results stop being theoretical and start becoming uncomfortable for anyone who chose “safe” stagnation instead.

Below is a five-year projection image for a lump-sum investor who starts with KES 2 million and makes no additional contributions, relying purely on disciplined compounding:

This image tells a quiet but brutal story. Without adding effort, leverage, or stress, the capital more than doubles over five years. No meetings. No panic. No dependency on market timing. Just time doing its job. This is what happens when money is placed inside a system that respects mathematics instead of emotions.

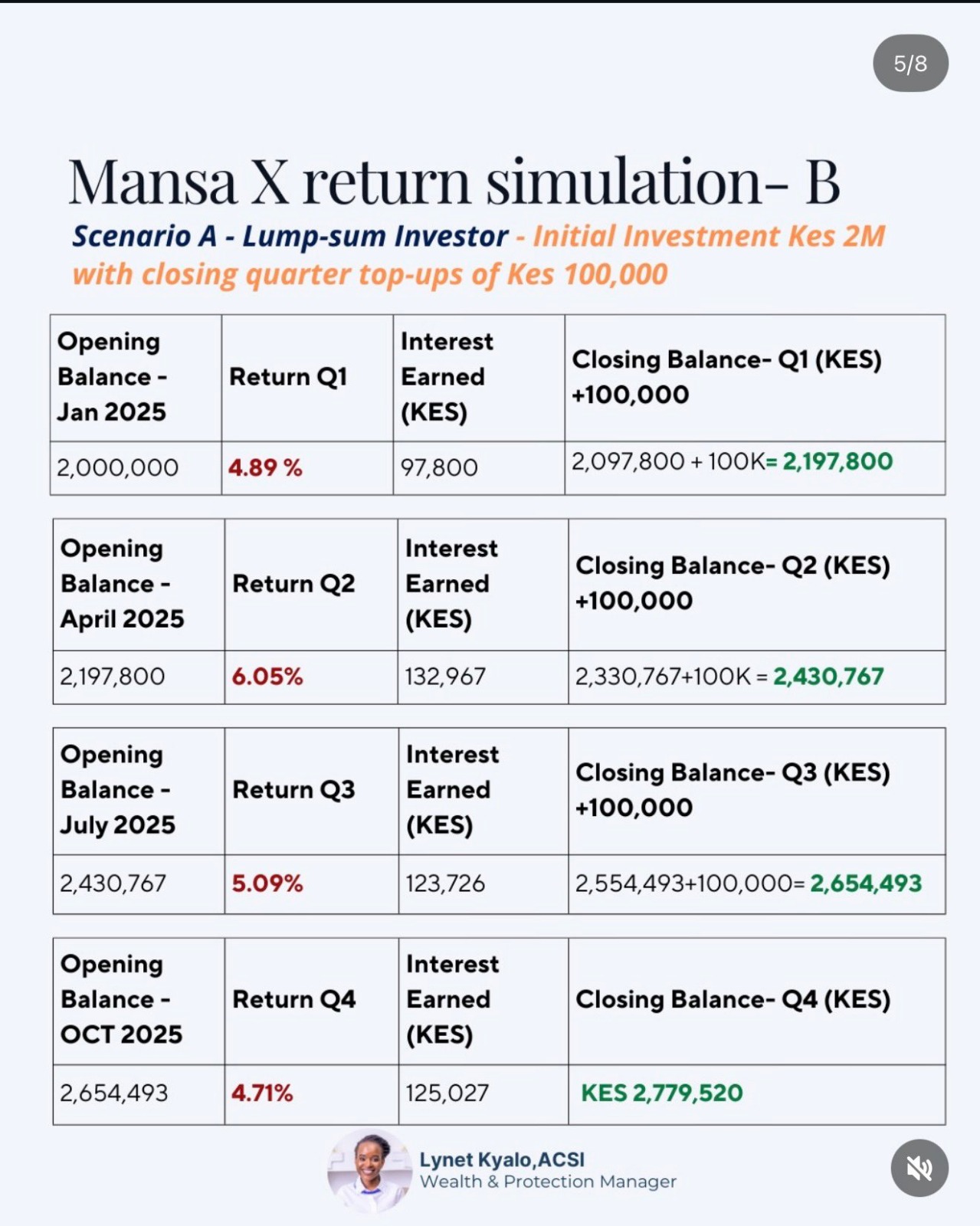

Now introduce a second investor—not smarter, not luckier, just more consistent. This investor adds a modest KES 100,000 at the end of each quarter. Nothing dramatic. Nothing painful. Just disciplined reinforcement. The effect of this behaviour over time is not linear in effort, but exponential in outcome. Compounding does not reward intensity; it rewards consistency.

Below is the five-year projection image for the same initial capital, this time with quarterly top-ups added into the same disciplined structure:

The difference between the two investors is not intelligence. It is respect for momentum. Over five years, the gap between passive saving and structured investing becomes irreversible. This is why wealth quietly concentrates among people who understand systems, not among those who chase excitement.

To remove any remaining doubt, the linear growth paths tell the final story. Straight lines without chaos are rare in investing, because chaos usually means emotion has entered the process. These graphs show steady upward motion—proof of controlled risk and repeatable execution.

What Mansa X offers is not magic; it is relief. Relief from decision fatigue. Relief from second-guessing. Relief from waking up to bad news and wondering what it means for your money. Your capital works while you live. That is the definition of financial maturity.

Many people talk about diversification as if it means scattering money everywhere. In reality, diversification begins with a stable core—one engine that compounds predictably while everything else remains optional. Mansa X is that core. It is where money should sit before risk is taken elsewhere, not after losses have occurred.

The most uncomfortable truth is this: refusing disciplined compounding is not caution—it is procrastination disguised as wisdom. Time will move forward regardless. The only question is whether your money will be moving with it or decaying quietly in place.

Mansa X does not promise miracles. It delivers something far rarer: consistency backed by history, structure backed by discipline, and returns that do not demand your sanity as payment. For anyone serious about building wealth without stress, the conclusion is not emotional—it is inevitable.

Read Also: Why Mansa X Is Quietly Becoming Africa’s Smartest Investment

About Steve Biko Wafula

Steve Biko is the CEO OF Soko Directory and the founder of Hidalgo Group of Companies. Steve is currently developing his career in law, finance, entrepreneurship and digital consultancy; and has been implementing consultancy assignments for client organizations comprising of trainings besides capacity building in entrepreneurial matters.He can be reached on: +254 20 510 1124 or Email: info@sokodirectory.com

- January 2026 (216)

- February 2026 (37)

- January 2025 (119)

- February 2025 (191)

- March 2025 (212)

- April 2025 (193)

- May 2025 (161)

- June 2025 (157)

- July 2025 (227)

- August 2025 (211)

- September 2025 (270)

- October 2025 (297)

- November 2025 (230)

- December 2025 (219)

- January 2024 (238)

- February 2024 (227)

- March 2024 (190)

- April 2024 (133)

- May 2024 (157)

- June 2024 (145)

- July 2024 (136)

- August 2024 (154)

- September 2024 (212)

- October 2024 (255)

- November 2024 (196)

- December 2024 (143)

- January 2023 (182)

- February 2023 (203)

- March 2023 (322)

- April 2023 (297)

- May 2023 (267)

- June 2023 (214)

- July 2023 (212)

- August 2023 (257)

- September 2023 (237)

- October 2023 (264)

- November 2023 (286)

- December 2023 (177)

- January 2022 (293)

- February 2022 (329)

- March 2022 (358)

- April 2022 (292)

- May 2022 (271)

- June 2022 (232)

- July 2022 (278)

- August 2022 (253)

- September 2022 (246)

- October 2022 (196)

- November 2022 (232)

- December 2022 (167)

- January 2021 (182)

- February 2021 (227)

- March 2021 (325)

- April 2021 (259)

- May 2021 (285)

- June 2021 (272)

- July 2021 (277)

- August 2021 (232)

- September 2021 (271)

- October 2021 (304)

- November 2021 (364)

- December 2021 (249)

- January 2020 (272)

- February 2020 (310)

- March 2020 (390)

- April 2020 (321)

- May 2020 (335)

- June 2020 (327)

- July 2020 (333)

- August 2020 (276)

- September 2020 (214)

- October 2020 (233)

- November 2020 (242)

- December 2020 (187)

- January 2019 (251)

- February 2019 (215)

- March 2019 (283)

- April 2019 (254)

- May 2019 (269)

- June 2019 (249)

- July 2019 (335)

- August 2019 (293)

- September 2019 (306)

- October 2019 (313)

- November 2019 (362)

- December 2019 (318)

- January 2018 (291)

- February 2018 (213)

- March 2018 (275)

- April 2018 (223)

- May 2018 (235)

- June 2018 (176)

- July 2018 (256)

- August 2018 (247)

- September 2018 (255)

- October 2018 (282)

- November 2018 (282)

- December 2018 (184)

- January 2017 (183)

- February 2017 (194)

- March 2017 (207)

- April 2017 (104)

- May 2017 (169)

- June 2017 (205)

- July 2017 (189)

- August 2017 (195)

- September 2017 (186)

- October 2017 (235)

- November 2017 (253)

- December 2017 (266)

- January 2016 (164)

- February 2016 (165)

- March 2016 (189)

- April 2016 (143)

- May 2016 (245)

- June 2016 (182)

- July 2016 (271)

- August 2016 (247)

- September 2016 (233)

- October 2016 (191)

- November 2016 (243)

- December 2016 (153)

- January 2015 (1)

- February 2015 (4)

- March 2015 (164)

- April 2015 (107)

- May 2015 (116)

- June 2015 (119)

- July 2015 (145)

- August 2015 (157)

- September 2015 (186)

- October 2015 (169)

- November 2015 (173)

- December 2015 (205)

- March 2014 (2)

- March 2013 (10)

- June 2013 (1)

- March 2012 (7)

- April 2012 (15)

- May 2012 (1)

- July 2012 (1)

- August 2012 (4)

- October 2012 (2)

- November 2012 (2)

- December 2012 (1)